Indian Rupee, USD/INR, Nifty 50, Reserve Financial institution of India, RBI - Speaking FactorsIndian Rupee flat, Nifty 50 benefi

Indian Rupee, USD/INR, Nifty 50, Reserve Financial institution of India, RBI – Speaking Factors

- Indian Rupee flat, Nifty 50 beneficial properties after shock RBI charge maintain

- Governor Das highlighted the potential for close to time period inflation

- USD/INR ranging, Nifty 50 might invalidate a reversal sign

The Indian Rupee was unable to search out a lot of a raise regardless of the Reserve Financial institution of India (RBI) unexpectedly leaving benchmark lending charges unchanged in August. The native 2-year authorities bond yield traded increased, touching its highest because the center of June. In the meantime, India’s benchmark Nifty 50 inventory index traded increased forward of a rosy Wall Road session.

Advisable by Daniel Dubrovsky

Why do rates of interest matter for currencies?

The RBI repurchase and reverse repo charges held regular at 4.00% and three.35% respectively. Economists’ have been pretty break up over whether or not or not the central financial institution may ship additional 25-basis level cuts. The opportunity of close to time period inflation expectations might have been why the RBI hesitated to scale back borrowing prices. Governor Shaktikanta Das famous that there are inflation pressures evident throughout sub-groups.

Further Feedback from RBI Governor Shaktikanta Das:

- The MPC voted to proceed an accommodative stance

- International financial exercise stays fragile

- Portfolio flows into rising markets have resumed

- Indian financial exercise has began to recuperate

- Provide chain disruptions are nonetheless there

- Extra favorable meals inflation might emerge

- Client confidence turned pessimistic in July

- House for additional coverage motion is offered

- Shadow lenders have entry to funding at cheap value

- The purpose is to enhance stream of credit score

Inflation is anticipated to remain elevated till September earlier than easing, and hopes for additional stimulus down the highway might have saved the Nifty afloat. As well as, the RBI gave the inexperienced gentle for banks to restructure debt for sure debtors. It permits them to increase moratoriums on mortgage repayments for as much as two years. An extra particular liquidity facility of INR100 billion was deliberate for NABARD and NHB, key banks.

In comparison with a few of its counterparts, the Indian Rupee hasn’t been capable of finding as a lot significant upside progress in opposition to the US Greenback as of late. That is as Asia’s third-largest economic system stays the third most-impacted nation by the coronavirus outbreak. Indian fiscal-2021 actual GDP progress is anticipated to be damaging for the primary time in over 40 years. From right here, USD/INR is eyeing native industrial manufacturing and CPI information subsequent week whereas additionally protecting a tab on exterior dangers that will affect market temper.

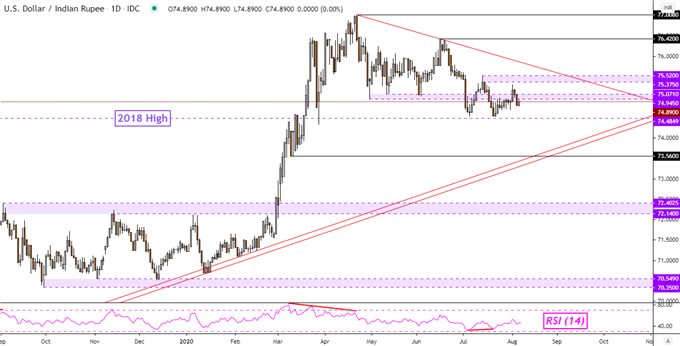

Indian Rupee Technical Evaluation

USD/INR stays in range-bound commerce since costs discovered a low in June. That time additionally very intently aligns with the 2018 excessive at 74.48. Key resistance sits above as a variety between 75.37 and 75.52. Within the center, there’s the 74.94 – 75.07 inflection vary which has its beginnings from April. A each day shut underneath the 2018 excessive may open the door to resuming the highest from April.

Advisable by Daniel Dubrovsky

Don’t give into despair, make a recreation plan

USD/INR Every day Chart

USD/INR Chart Created in TradingView

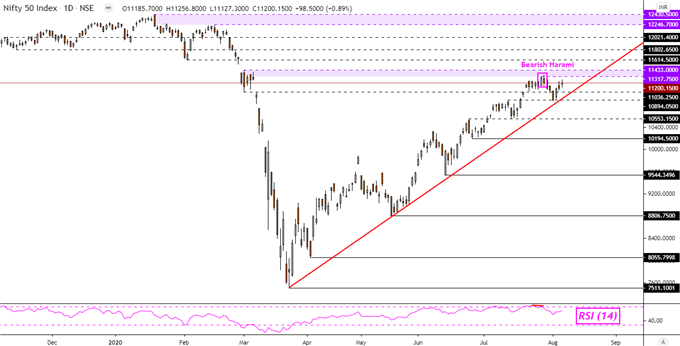

Nifty 50 Technical Evaluation

The Nifty 50 stays in an uptrend after costs have been unable to push underneath rising assist from March’s backside. In truth, the index could also be on the verge of retesting a key resistance zone between 11317 and 11433 which may invalidate the Bearish Harami candlestick sample. In any other case, a each day shut underneath the rising development line may open the door to a reversal, exposing assist at 10553.

Nifty 50 Every day Chart

Nifty 50 Chart Created in TradingView

— Written by Daniel Dubrovsky, Foreign money Analyst for DailyFX.com

To contact Daniel, use the feedback part under or @ddubrovskyFX on Twitter

https://www.tradingview.com/symbols/NIFTY/?change=FX_IDC