Inventory Market Forecast: Bearish Inventory Market Forecast for the Week Forward: Will the Mania Proceed?The investing world was

Inventory Market Forecast: Bearish

Inventory Market Forecast for the Week Forward: Will the Mania Proceed?

The investing world was thrown into disarray final week when a band of Reddit-based retail merchants ignited an obvious quick squeeze in GameStop’s inventory. Crammed with FOMO and keen to hitch in on the trouble, extra retail merchants then started piling into different shares with excessive quick curiosity – hoping to spark the same squeeze. The surge in a number of choose names dominated monetary information media and is prevalent in discourse outdoors conventional market-related mediums.

Video Explainer – GameStop Quick Squeeze and Different Reddit Favorites

Public outrage ensued when brokerages started limiting entry to the shares in query which expanded the phenomenon, drawing the eye of regulators and public officers throughout the nation. The quick squeeze has since ballooned right into a exceptional second in standard tradition. These particular person buyers have created an extremely advanced state of affairs, nonetheless, and the concept that “shares solely go up” – a rallying cry of some newly minted GameStop shareholders – is a harmful falsehood.

It’s underneath these circumstances that market contributors ought to look to previous bubbles, manias and monetary crises for perception as many have resulted in catastrophe. Additional nonetheless, you will need to perceive one’s publicity when investing and to apply correct danger administration. There is no such thing as a telling how lengthy the occasion will final and losses can mount when regular market situations prevail and it’s time to exit the commerce.

Dow Jones, Nasdaq 100, S&P 500 Forecasts

Outlook: Bearish

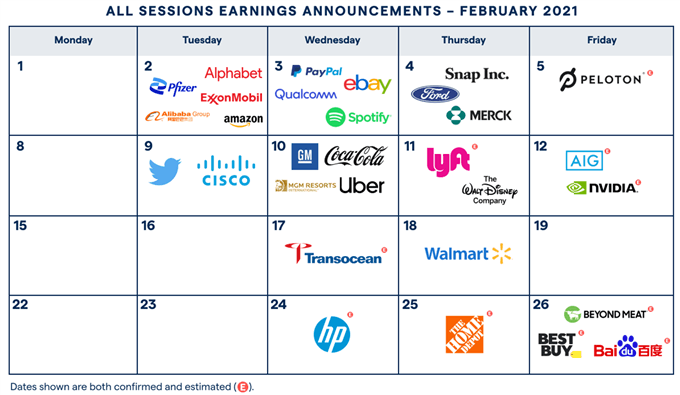

The continued phenomenon has undoubtedly disrupted the regularly-scheduled programming of the market, as earnings from Fb, Apple and Tesla – along with a FOMC price choice – went comparatively unnoticed final week. Quarterly experiences are set to proceed within the week forward with large names like Alphabet, Amazon, Alibaba and Exxon.

Supply: IG

Friday will see the discharge of non-farm payroll information for January which is able to present an important replace on the state of employment on the earth’s largest economic system. Current NFP prints have disillusioned, revealing a slowing financial restoration within the wake of coronavirus. Echoed by the Federal Reserve’s findings final week, one other disappointing print may derail market sentiment additional.

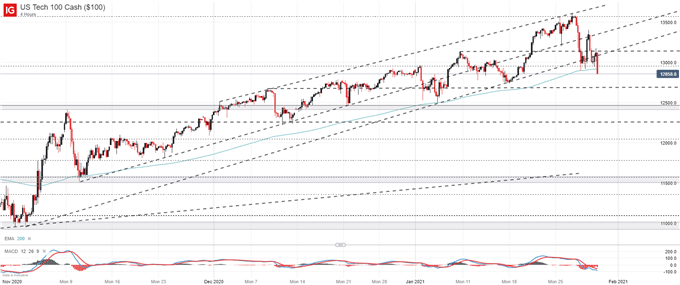

Nasdaq 100 Worth Chart: 4 – Hour Time Body (November 2020 – January 2021)

Nasdaq Buying and selling Fundamentals: Find out how to Commerce Nasdaq 100

That stated, the broader indices could proceed to battle as bullish sentiment dissipates and a few giant institutional gamers rush to reposition capital amid the continuing rally in single-stock names with excessive quick curiosity. Because the longer-term outlook stays encouraging in my opinion, a pullback within the coming weeks may present intriguing set-ups for bullish publicity.

Begins in:

Reside now:

Feb 03

( 16:02 GMT )

Really helpful by Peter Hanks

Weekly Inventory Market Outlook

DAX 30 & FTSE 100 Forecasts

Outlook: Impartial

Throughout the Atlantic, the DAX 30 and FTSE 100 will look to Euro Space GDP information and a Financial institution of England price choice. With US equities within the driver’s seat by way of sentiment, volatility and value motion, the European indices could proceed to loosely observe their American counterparts. Within the meantime, observe @PeterHanksFXon Twitter for updates and evaluation.

Really helpful by Peter Hanks

Get Your Free Equities Forecast

–Written by Peter Hanks, Strategist for DailyFX.com