Chart created with TradingView Japanese Yen Basic Forecast: BullishAnti-risk Japanese Yen rose as US progress outlook deteriorate

Chart created with TradingView

Japanese Yen Basic Forecast: Bullish

- Anti-risk Japanese Yen rose as US progress outlook deteriorated

- Covid circumstances, lockdowns, fiscal woes could preserve USD/JPY decrease

- Nikkei 225 could also be in danger, Thanksgiving liquidity drain forward

Japanese Yen, USD/JPY Recap

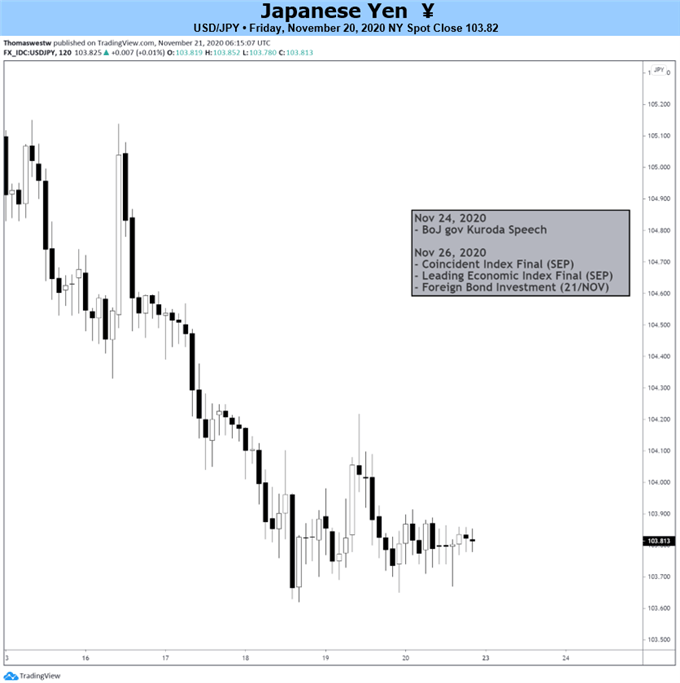

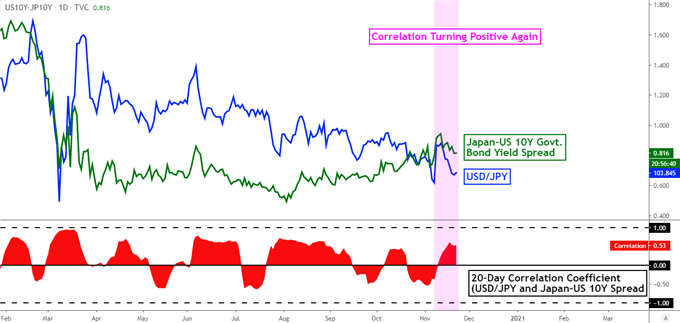

The Japanese Yen spent most of this previous week buying and selling increased towards its main counterparts, together with the US Greenback. USD/JPY aimed decrease as Treasury yields weakened, making authorities bonds in Japan comparatively extra enticing to buyers. Actually, following some divergence forward of the US presidential election, USD/JPY now appears to be monitoring bond yield spreads between the US and Japan once more – see chart beneath.

The US yield curve flattened as longer-dated authorities bond returns declined, signaling fading confidence within the medium-term outlook. Traders look like specializing in the document tempo in native Covid-19 case progress relatively than on optimistic vaccine information. Because the nation reached hospitalization highs, California imposed a late curfew for about 94% of its residents. Texas noticed 12,293 circumstances, beating a earlier document from the summer time.

Advisable by Daniel Dubrovsky

Don’t give into despair, make a recreation plan

Week Forward

Going ahead, the anti-risk Japanese Yen seems to be in an optimum place. A scarcity of expediency in fiscal help from the US poses a risk for each native and exterior equities. That is underscored if extra states take measures to impose lockdowns to assist comprise the unfold of the illness. The Worldwide Financial Fund (IMF) warned final week that the worldwide restoration seems to be shedding momentum.

In the meantime in Japan, circumstances have been additionally setting data. This brought about Tokyo to boost its Covid-19 alert standing to its highest degree. Whereas policymakers shunned imposing lockdowns, they urged residents to be extra cautious. The Nikkei 225, Japan’s benchmark inventory index, halted its spectacular profitable streak from earlier this month after closing at its highest since 1991.

For updates on developments within the Japanese Yen and threat developments, make sure that to comply with me on Twitter @ddubrovskyFX

Finance Minister Taro Aso talked about that they ‘should stimulate sentiment with fiscal coverage’. His tone echoes what the Federal Reserve has been stressing within the US. FOMC minutes could proceed to reiterate this message with client sentiment additionally on faucet. The latter might disappoint given rising coronavirus circumstances. It can even be a shortened buying and selling week because of the Thanksgiving vacation, opening the door to decrease ranges of liquidity.

Advisable by Daniel Dubrovsky

How can central banks impression markets?

USD/JPY and Authorities Bond Unfold Relationship

Chart Created in TradingView

— Written by Daniel Dubrovsky, Foreign money Analyst for DailyFX.com

To contact Daniel, use the feedback part beneath or @ddubrovskyFX on Twitter