Japanese Yen Technical Outlook: Cyclical Downturn within the Offing for JPYThe technical outlook for the haven-associated Japanese Yen stays overt

Japanese Yen Technical Outlook: Cyclical Downturn within the Offing for JPY

The technical outlook for the haven-associated Japanese Yen stays overtly bearish, after the funding forex toppled over 5.5% on common in opposition to its main counterparts within the first quarter of 2021. A continuation of this draw back transfer appears within the playing cards by means of the approaching months, as cycle evaluation suggests a cyclical downturn is afoot for JPY.

Advisable by Daniel Moss

Obtain the total JPY 2Q forecast!

Cyclical Downturn at Hand for the Japanese Yen

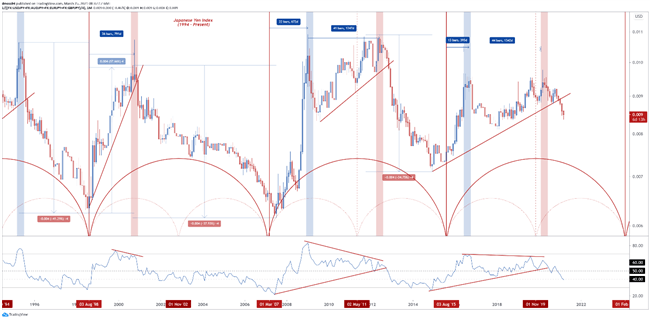

Majors-Based mostly JPY Index Month-to-month Chart

Chart ready by Daniel Moss, Supply: TradingView

The chart above highlights the cyclical sample displayed by the Japanese Yen over the previous 37 years, with the forex largely adhering to what seems to be an 8-and-a-half 12 months rotation. JPY set important bottoms in opposition to its main counterparts in late 1998, early 2007 and late 2015.

After bottoming out, the haven-associated forex then appears to outperform early within the cycle, with key highs posted roughly two years after the 1998 and 2007 lows.

Though the Yen soared to its preliminary cyclical excessive simply 13 months after the beginning of the interval, the event of worth during the last 5 years seems strikingly just like the earlier bullish cycle.

With that in thoughts, the convincing break beneath uptrend assist extending from the December 2014 low – mixed with the RSI snapping its 73-month uptrend and sliding to its lowest ranges in six years – could foreshadow prolonged losses for JPY within the coming months.

Cycle evaluation means that the forex might fall a further 25% from present ranges earlier than bottoming out in early 2024.

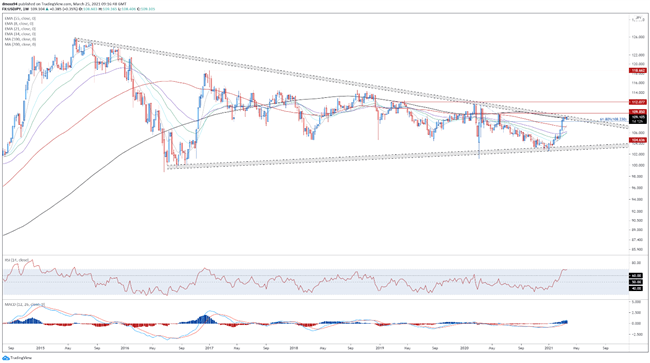

USD/JPY Weekly Chart – Ascending Triangle Resistance Beneath Stress

Chart ready by Daniel Moss, Supply: TradingView*Index averages USD/JPY, EUR/JPY, GBP/JPY, AUD/JPY

The USD/JPY alternate fee seems to be gearing up for an prolonged transfer larger, as worth surges by means of the 61.8% Fibonacci retracement of the March 2020 to January 2021 downtrend, and careens in the direction of confluent resistance on the sentiment-defining 200-MA (108.97) and Symmetrical Triangle downtrend.

With the RSI eyeing a push into overbought circumstances for the primary time since 2017, and the MACD registering its highest diploma of optimistic divergence in 4 years, the trail of least resistance appears skewed to the topside.

A weekly shut above psychological resistance at 110.00 is required to validate a bullish break of Symmetrical Triangle consolidation and would most likely open the door for the alternate fee to speed up in the direction of the 2019 excessive (112.40).

Hurdling that would pave the way in which for USD/JPY to start probing the 114.00 deal with. Nonetheless, if triangle resistance stays intact, and costs slide again beneath the 61.8% Fibonacci (108.23), a pullback in the direction of the trend-defining 55-EMA (106.26) may very well be on the playing cards.

aspect contained in the

aspect. That is most likely not what you meant to do!nn Load your utility’s JavaScript bundle contained in the aspect as a substitute.www.dailyfx.com