FOMC Curiosity Charge Choice, US Greenback, Financial Coverage, Federal Reserve Steadiness Sheet – Speaking Factors:The upcoming

FOMC Curiosity Charge Choice, US Greenback, Financial Coverage, Federal Reserve Steadiness Sheet – Speaking Factors:

- The upcoming FOMC rate of interest resolution might exacerbate the US Greenback’s latest decline

- USD seems to be set to increase its losses in opposition to its main counterparts after snapping via long-term pattern assist.

Asia-Pacific Recap

A blended day of commerce in the course of the Asia-Pacific session noticed the ASX 200 nudged greater, regardless of the Australian shopper value index falling 1.9% within the three months via June.

The Nikkei 225 dropped 0.72% after Fitch Rankings downgraded Japan’s outlook from steady to adverse. Gold pulled again from its file excessive, while silver stalled above the $24/ozmark.

The US Greenback continued to slip in opposition to its main counterparts because the risk-sensitive Australian Greenback climbed 0.27%.

Wanting forward, the upcoming FOMC charge resolution headlines the financial docket with Chairman Jerome Powell and the committee anticipated to retain their dovish ahead steering for financial coverage.

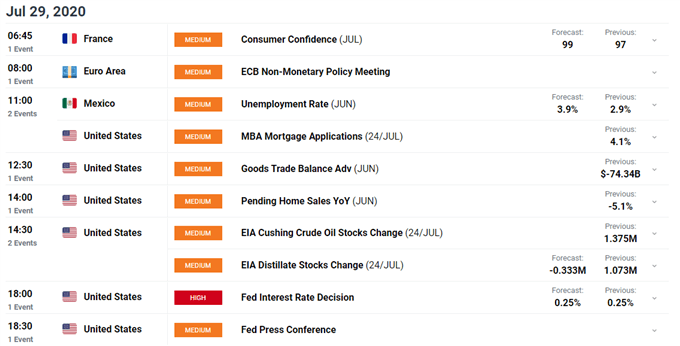

DailyFX Financial Calendar

US Greenback Hangs on Upcoming FOMC Assembly

The US Greenback might prolong declines in opposition to its main counterparts because the Federal Reserve seems to be set to proceed supporting “the move of credit score to households and companies” after saying, “an extension via December 31 of its lending amenities that have been scheduled to run out on or round September 30”.

This extension comes forward of the Federal Open Market Committee’s (FOMC) rate of interest resolution, suggesting that the board might proceed to lean on lending amenities and its asset buying program to “assist the financial system get well from the COVID-19 pandemic”, because the central financial institution’s steadiness sheet seems to be set to balloon again above $7 trillion.

Supply – Federal Reserve

With the central financial institution monitoring “the implications of incoming data associated to public well being”, accommodative financial coverage seems to be set to remain for the foreseeable future as circumstances of the novel coronavirus climb previous 4.Four million.

To that finish, intent focus will likely be given to Federal Reserve Chairman Jerome Powell’s press convention, with an overtly dovish tone probably exacerbating the Buck’s decline in opposition to its main counterparts.

Really helpful by Daniel Moss

Get Your Free USD Forecast

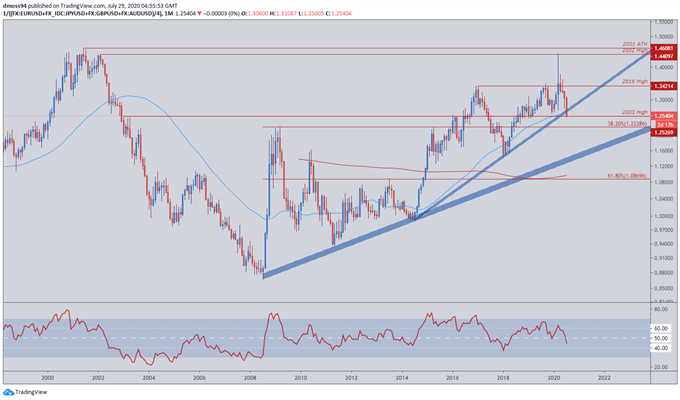

US Greenback Index** Month-to-month Chart – Break of 2014 Uptrend Suggests Additional Declines

US Greenback Index month-to-month chart created utilizing TradingView

**USD Index averages EUR/USD, GBP/USD, AUD/USD, JPY/USD

Zooming out to a month-to-month timeframe highlights the magnitude of the US Greenback’s decline in latest weeks, as value takes out the uptrend extending from the 2014 low (0.9884) and begins to check assist on the 2003 excessive (1.2527).

The Buck seems to be set to increase its declines because the RSI dives under 50 into bearish territory and value breaks under the trend-defining 50-month shifting common (1.2644).

A sustained slide in the direction of the 38.2% Fibonacci might be on the desk ought to value efficiently shut under the 2003 excessive (1.2527) and validate the break of 6-year pattern assist.

US Greenback Index** Weekly Chart – Break of 200-WMA Might Speed up Losses

US Greenback Index month-to-month chart created utilizing TradingView

**USD Index averages EUR/USD, GBP/USD, AUD/USD, JPY/USD

Leaping right into a weekly timeframe reinforces the bearish outlook for the liquidity-rich forex, as value simply slices via supportive confluence on the 200-WMA (1.2690) and 2014 uptrend.

Promoting stress might intensify because the RSI dives under 40 for the primary time since early 2018, probably driving value under the 2003 excessive (1.2527) and carving a path for value to check the 38.2% Fibonacci (1.2289).

Entry of the oscillator into oversold situations in all probability coincides with a break under the 1.22 degree.

Nevertheless, sellers nonetheless want a weekly shut under 1.25 to validate bearish potential.

US Greenback Index** Every day Chart – RSI Hints at Quick-Time period Restoration

US Greenback Index month-to-month chart created utilizing TradingView

**USD Index averages EUR/USD, GBP/USD, AUD/USD, JPY/USD

Lastly, the every day chart might present USD bulls with some encouragement because the RSI simply exceeds the extremes of early June, regardless of the haven-associated forex collapsing over 5% in opposition to its main counterparts in July.

This divergence between the oscillator and value suggests underlying exhaustion within the latest surge to the draw back, as sellers fail to breach pivotal assist on the 2019 low (1.2476).

With that in thoughts, a short-term restoration may see value retest the January low every day shut (1.2666) and downtrend resistance extending from the yearly excessive (1.4428).

— Written by Daniel Moss, Analyst for DailyFX

Observe me on Twitter @DanielGMoss

Really helpful by Daniel Moss

Constructing Confidence in Buying and selling