Canadian Greenback Technical Value Outlook: Close to-term Commerce RangesCanadian Greenback up to date technical commerce ranges

Canadian Greenback Technical Value Outlook: Close to-term Commerce Ranges

- Canadian Greenback up to date technical commerce ranges – Day by day & Intraday Charts

- USD/CAD breakdown testing key assist zone into month-to-month open

- Quick focus is on 1.36 assist zone – threat is slower sub-1.3855

The US Greenback is down greater than 7% because the March highs in opposition to the Canadian Greenback with USD/CAD now probing key near-term assist into the beginning of June commerce. These are the up to date targets and invalidation ranges that matter on the USD/CAD worth charts heading into the month-to-month open. Overview my newest Weekly Technique Webinar for an in-depth breakdown of this Loonie commerce setup and extra.

Begins in:

Reside now:

Jun 08

( 12:06 GMT )

Reside Weekly Technique Webinars on Mondays at 12:30GMT

Weekly Scalping Webinar

Canadian Greenback Value Chart – USD/CAD Day by day

Chart Ready by Michael Boutros, Technical Strategist; USD/CAD on Tradingview

Technical Outlook: In my final Canadian Greenback Value Outlook we observe to be looking out for, “topside exhaustion forward of the late-March trendline IF worth is certainly heading decrease with a break under the target Could opening-range wanted to gasoline the subsequent leg decrease in worth.” USD/CAD broke under the month-to-month opening-range on Could 26th with the decline now testing a essential assist zone at 1.3602/10 – a area outlined by the 61.8% Fibonacci retracement of the yearly vary and the 100% extension of the decline off the March excessive.

The main focus is on this threshold at this time with a break / shut under wanted to maintain the short-bias viable with subsequent assist aims on the Mary 2019 high-day shut at 1.3515 and the March / 2017 opens at 1.3433/35. Day by day resistance at 1.3855 with broader bearish invalidation on the April low-day shut / Could open at 1.3945.

Canadian Greenback Value Chart – USD/CAD 120min

Notes: A better take a look at Loonie worth motion exhibits USD/CAD buying and selling throughout the confines of a near-term descending pitchfork formation with a break under the median-line at this time difficult the 1.3602/10 assist zone- search for a response right here. Preliminary resistance again at 1.3708 backed by the 1.3793-1.3812. Recoveries needs to be capped by the April opening-range lows at 1.3855 IF worth is certainly heading decrease.

Really useful by Michael Boutros

New to Foreign exchange Buying and selling? Get began with this Newcomers Information

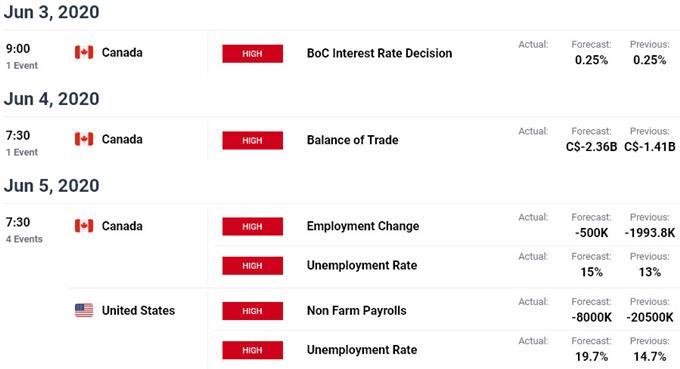

Backside line: The Canadian Greenback rally has taken USD/CAD right into a key near-term assist zone and we’re in search of a response down right here at this time. From at buying and selling standpoint, area to scale back short-exposure / decrease protecting stops – be looking out for topside exhaustion whereas under 1.38 with a break protecting the give attention to assist aims into the decrease parallels. Consider we’ve got the BoC on faucet this week alongside US non-farm payroll (NFP) and Canada employment on Friday- keep nimble. Overview my newest Canadian Greenback Weekly Value Outlook for a more in-depth take a look at the longer-term USD/CAD technical commerce ranges.

For a whole breakdown of Michael’s buying and selling technique, assessment his Foundations of Technical Evaluation sequence on Building a Trading Strategy

Canadian Greenback Dealer Sentiment – USD/CAD Value Chart

- A abstract of IG Consumer Sentiment exhibits merchants are net-short USD/CAD – the ratio stands at –1.04 (48.91% of merchants are lengthy) – impartial studying

- Lengthy positions are2.00% decrease than yesterday and 5.28% greater from final week

- Quick positions are44.10% greater than yesterday and 18.82% greater from final week

- We usually take a contrarian view to crowd sentiment, and the very fact merchants are net-short suggests USD/CAD costs could proceed to rise. Merchants are additional net-short than yesterday and final week, and the mixture of present positioning and up to date adjustments offers us a stronger USD/CAD-bullish contrarian buying and selling bias from a sentiment standpoint.

| Change in | Longs | Shorts | OI |

| Day by day | 4% | 19% | 10% |

| Weekly | 7% | -10% | -1% |

—

Key US / Canada Information Releases

Financial Calendar – newest financial developments and upcoming occasion threat.

Lively Commerce Setups

– Written by Michael Boutros, Forex Strategist with DailyFX

Observe Michael on Twitter @MBForex