Here's what it's essential to know on Wednesday, November 11: Markets stabilized on Tuesday with the buck giving up some floo

Here’s what it’s essential to know on Wednesday, November 11:

Markets stabilized on Tuesday with the buck giving up some floor, however holding close to weekly highs in opposition to most of its main rivals. The EUR was the weakest, amid dismal German knowledge, whereas the Pound was the stronger, underpinned by UK employment figures.

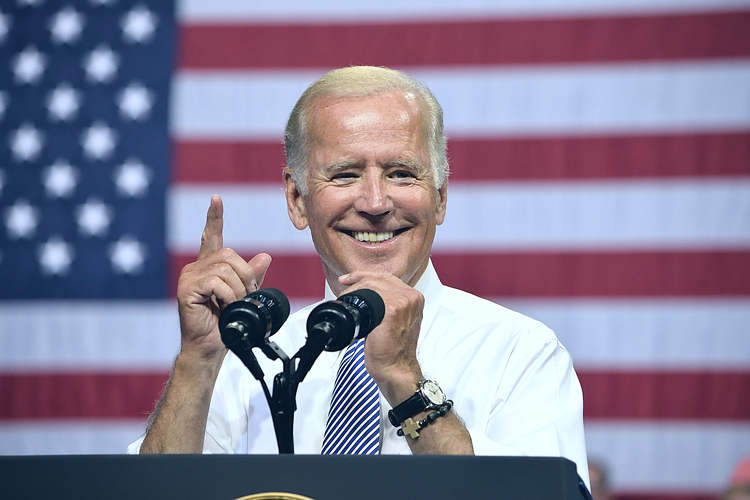

The US post-election euphoria pale, though tensions stay. President-elect Joe Biden outlined plans for his authorities, whereas present President Trump stays assured he’ll keep within the White Home, continuing with authorized actions in some states. Information businesses reported that the Biden transition group is contemplating authorized motion as a federal company refuses to acknowledge the outcomes of the election and grant full entry to different businesses and funding.

Enthusiasm for a coronavirus vaccine additionally pale, as regardless of hopes persist, the world retains reporting roughly 500Ok new COVID-19 circumstances per day, with over one-fifth of these circumstances coming from the US. Europe figures are additionally worrisome, not solely due to the rise in contagions but in addition as a result of the dying toll in Italy, Spain, and the UK has reached ranges not seen because the first months of the pandemic. In the meantime, checks of the Chinese language SINVOVAC vaccine in Brazil had been suspended, after one participant died.

Asian and European indexes closed with positive factors, however Wall Road ended combined, with the DJIA up however the Nasdaq down over 1%. US Treasury yields edged marginally decrease however held at ranges that have been final seen in March.

Gold recovered some floor, however stay close to the decrease finish of its Monday’s vary. It’s ending the day at round $1,878 a troy ounce. WTI, however, saved recovering and surged above $41.00 a barrel.

Cryptocurrencies Worth Prediction: Bitcoin, Cardano & Compound – American Wrap 10 November