All through the COVID-19 pandemic, Fridays have been tough for equities bulls. Extra occasions than not, merchants have minimize danger publicity

All through the COVID-19 pandemic, Fridays have been tough for equities bulls. Extra occasions than not, merchants have minimize danger publicity forward of the weekend information cycle ― right now has been no totally different. On the midway level of the Wall Road session, the DJIA DOW (-525), S&P 500 SPX (-52), and NASDAQ (-163) are all destructive. It seems to be just like the U.S. resurgence of COVID-19 is enjoying hell on sentiment.

The important thing information driving right now’s bearish motion are studies that Florida and Texas are rolling again their COVID-19 reopenings attributable to a spike in new circumstances. Each states are displaying an enormous uptick within the virus, with every setting data prior to now 48-hours. For now, it seems to be like extra shutdowns are on the best way for hard-hit areas within the U.S.

On the financial information entrance, right now was comparatively mute. Private Consumption Expenditures (Might) grew month-over-month, however the UM Sentiment Index (June) got here in decrease than anticipated. The determine threw a curveball to merchants, hitting 78.1, beneath expectations (79.0) and the earlier launch (78.9). Most analysts, together with this one, anticipated the COVID-19 reopen to spice up client morale ― this assertion proved categorically false.

Merchants Bail On Shares, Lean Towards Secure-Havens

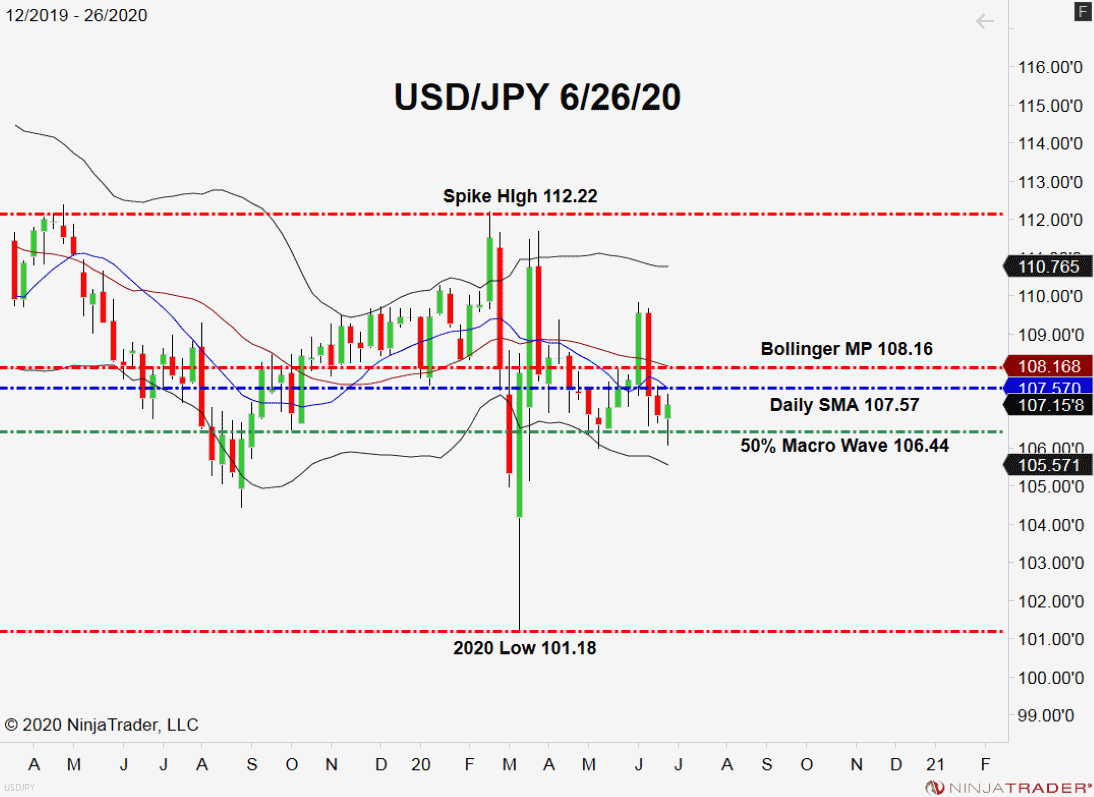

Following final evening’s ho-hum Tokyo CPI (June) report, the USD/JPY has fallen barely. Nonetheless, given the exodus from danger property, the USD/JPY might lengthen session losses earlier than the shut.

+2020_26+(11_01_09+AM).png)

Overview: At this level, the important thing stage merchants are watching within the USD/JPY is the 50% COVID-19 Retracement (106.44). So long as charges maintain above this space, a slight bullish bias is warranted. Nonetheless, given the market’s sudden “risk-off” angle, this pair could also be positioned for a plunge as June attracts to an in depth.