Secure-havens are rapidly turning into the principle monetary story of summer season 2020. Steep July rallies in GOLD and the Swiss franc have bee

Secure-havens are rapidly turning into the principle monetary story of summer season 2020. Steep July rallies in GOLD and the Swiss franc have been the important thing highlights. Nonetheless, the Japanese yen has made an enormous transfer vs the Dollar right now, gaining greater than 1%. In the interim, foreign exchange merchants are ignoring this morning’s robust U.S. New Properties Gross sales (June) report.

It has been an lively Friday on the financial calendar. Right here’s a fast have a look at the exhausting information:

Occasion Precise Projected Earlier

New Dwelling Gross sales (MoM, June) 0.776M 0.700M 0.682M

New Dwelling Gross sales Change (MoM, June) 13.8% 4.0% 19.4%

Baker-Hughes U.S. Rig Rely 181 NA 180

Maybe the largest eyebrow-raiser of this group is the uptick within the U.S. rig rely. For the primary time since March 13, the Baker-Hughes Rig Rely has posted a acquire. So, is that this the tip of the U.S. shale downturn? Unlikely, however we could also be discovering a backside.

For the second straight month, New Dwelling Gross sales have grown by double-digits. At this level, it appears like mortgage lenders and debtors are having fun with ultra-low rates of interest and the supply of funds. I count on this determine to carry nicely above 10% for July.

New Dwelling Gross sales Stay Robust, Secure-Havens Spike

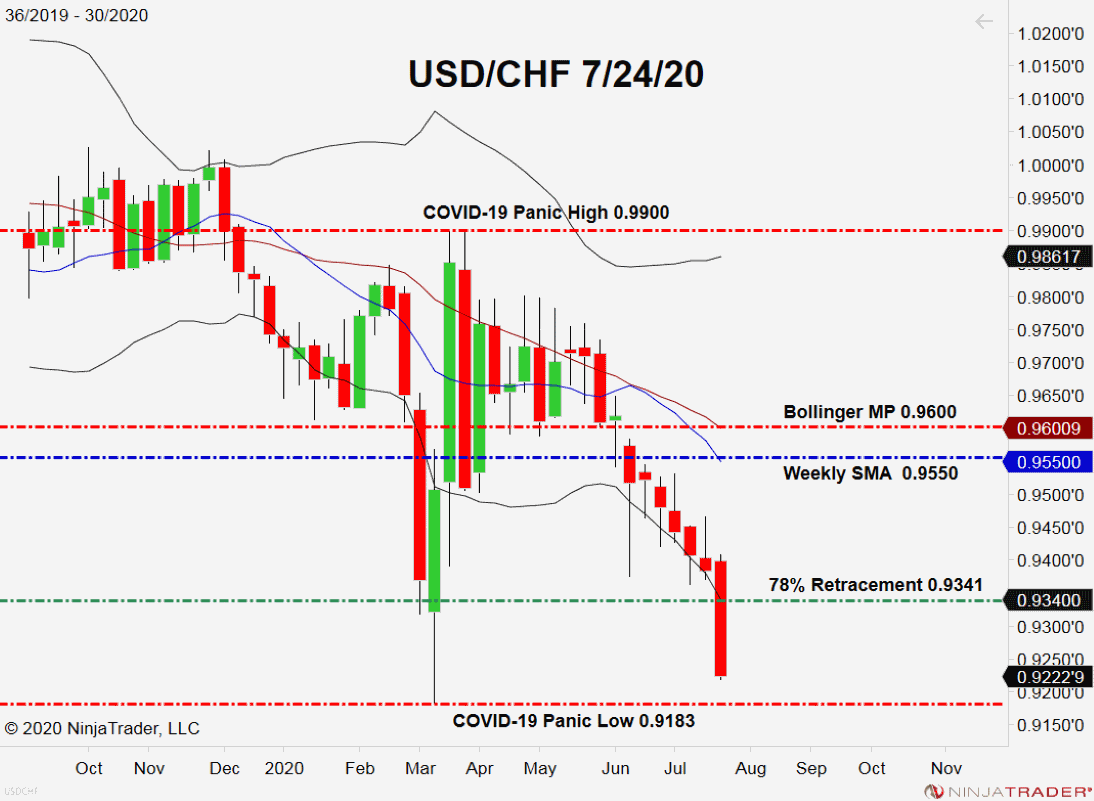

The USD/CHF is poised to shut within the purple for the seventh-consecutive week. This has been fairly the bearish run, with charges falling greater than 350 pips. As we roll towards August commerce, it appears like a check of the COVID-19 panic low is imminent.

+2020_30+(11_15_07+AM).png)

Going into subsequent week, there’s one stage on my radar for the Swissy:

- Help(1): COVID-19 Panic Low, 0.9183

Backside Line: Until the FED decides to get hawkish in a rush, the USD/CHF will very doubtless proceed to fall. If nothing else, right now’s robust New Dwelling Gross sales figures make the case for optimistic shopper sentiment. However, if the Swissy continues its descent, a shopping for alternative from the COVID-19 panic low could come to go.

Till elected, I’ll have purchase orders queued up from 0.9187. With an preliminary cease loss at 0.9169, this commerce produces 25 pips on a better-than-1:1 threat vs reward ratio.