NvidiaSkerdian Meta•Tuesday, January 28, 2025•2 min read

Add an article to your Reading ListRegister now to be able to add articles to your reading

Nvidia

Skerdian Meta•Tuesday, January 28, 2025•2 min read

Add an article to your

Reading List

Register now to be able to add articles to your reading list.

”

aria-hidden=”true”>

Share in Facebook

“>

US stock markets staged an impressive rebound following yesterday’s sharp declines, with the Nasdaq showing the strongest recovery at 2.0%, fueled by optimism in tech-heavy sectors.

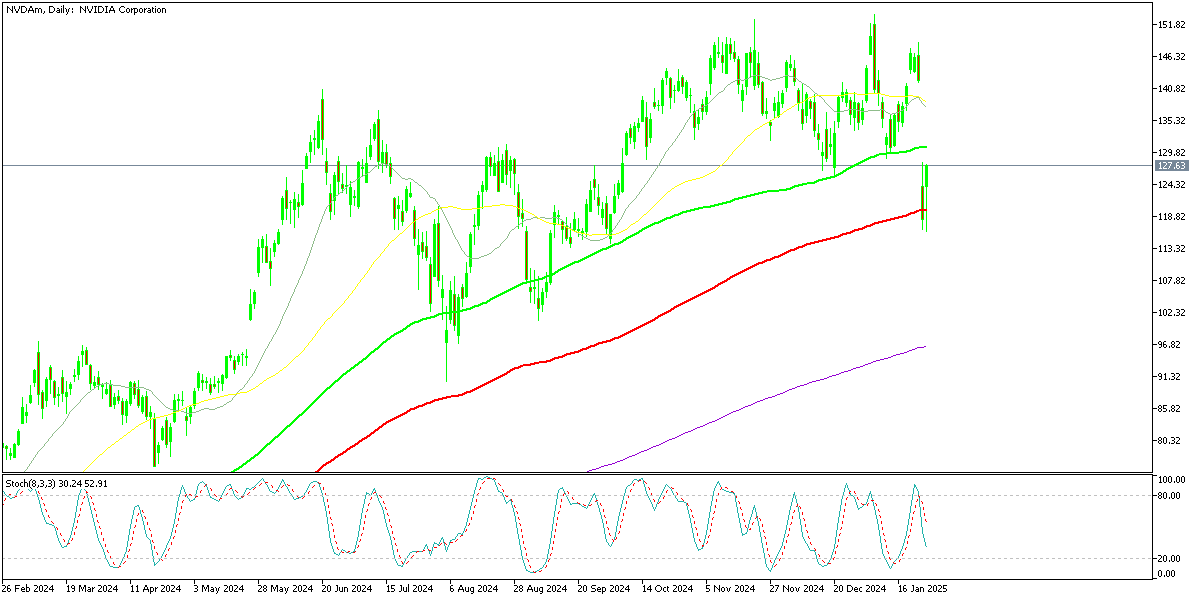

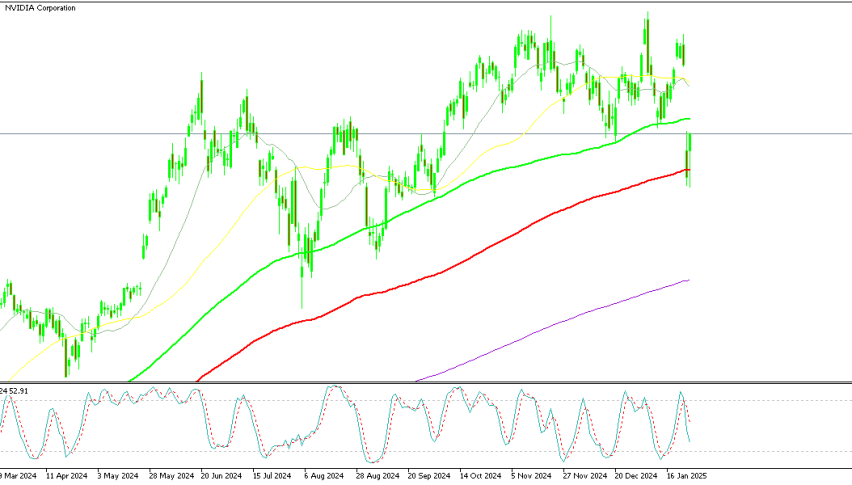

The S&P500 also posted solid gains of 1%, reflecting broad market strength despite ongoing uncertainties, while the Dow Jones and Russell 2000 made some minor gains. Nvidia stock dipped below the 100 SMA (red) on the daily chart early at the opening but climbed above $120 again and formed a bullish daily candlestick, so the trend remains upward. Yesterday $600 billion were wiped out of Nvidia’s value as a company, falling to $2.9 trillion, today the market cap increased to $3.16 trillion.

After-hours earnings results further lifted sentiment, as Starbucks and Stryker exceeded expectations, boosting their shares in extended trading. The positive momentum in these key earnings reports suggests resilience in consumer spending and corporate performance, despite the challenging economic backdrop. However, volatility remains a factor, as markets continue to react to broader economic data and central bank policies. This rebound highlights a mix of cautious optimism and selective sector strength driving market performance.

US Stock Indices Rebound Strongly:

-

- Dow Jones Industrial Average: Gained 138.77 points (+0.3%) to close at 44,850.35, maintaining momentum after yesterday’s 0.65% rise.

- S&P 500: Recovered 55.42 points (+1%) to 6,067.70, reversing some of yesterday’s -1.46% decline.

- Nasdaq: Led the charge, jumping 391.75 points (+2%) to 19,733.59, rebounding sharply from yesterday’s -3.07% drop.

- Russell 2000: Marginally up by 4.83 points (+0.2%) to close at 2,288.86, showing limited recovery.

- Earnings Reports (After-Hours):

- Starbucks:

- EPS: $0.69 (vs. $0.67 expected).

- Revenue: $9.4 billion (vs. $9.31 billion forecast).

- Shares are up $3.21 (+3.20%) in after-hours trading.

- Stryker:

- EPS: $4.01 (vs. $3.87 expected).

- Revenue: $6.44 billion (vs. $6.36 billion forecast).

- Shares rose $3.85 (+0.97%) after hours.

US stock markets rebounded after yesterday’s declines, with the Nasdaq leading the recovery, driven by optimism in tech-heavy sectors. After-hours earnings provided an additional boost, with Starbucks and Stryker beating expectations and their shares seeing gains. The overall sentiment suggests cautious optimism, though broader market volatility persists.

Nasdaq Live Chart

NAS100

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank’s local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

14 mins ago

Add an article to your

Reading List

Register now to be able to add articles to your reading list.

”

aria-hidden=”true”> Save

Save

12 hours ago

Add an article to your

Reading List

Register now to be able to add articles to your reading list.

”

aria-hidden=”true”> Save

Save

16 hours ago

Add an article to your

Reading List

Register now to be able to add articles to your reading list.

”

aria-hidden=”true”> Save

Save

www.fxleaders.com

Save

Save

Save