WTI – US Crude Oil Worth Setup: WTI – US Crude Oil reached a contemporary yearly excessive after catalyzing off of a mixture of a

WTI – US Crude Oil Worth Setup:

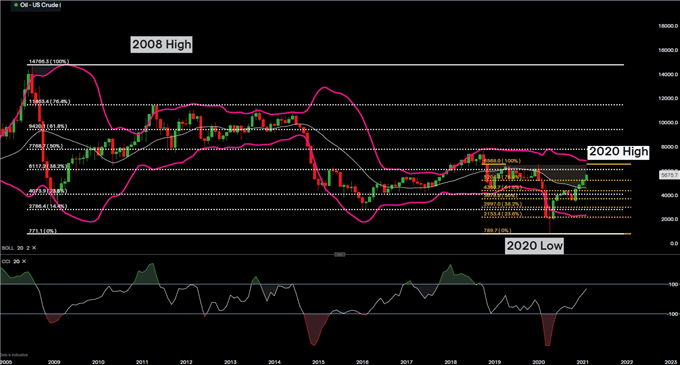

WTI – US Crude Oil reached a contemporary yearly excessive after catalyzing off of a mixture of a discount in US Crude inventories and the approval of the bigger US Fiscal Stimulus bundle. A rise in demand for the main commodity supplied bulls with renewed optimism, permitting them to push via the crucial degree at 5204.3, fashioned by the 76.4% Fibonacci retracement degree of the 2020 transfer.

Really useful by Tammy Da Costa

Get Your Free Oil Forecast

WTI – US Crude Oil Month-to-month Chart

Chart ready by Tammy Da Costa, IG

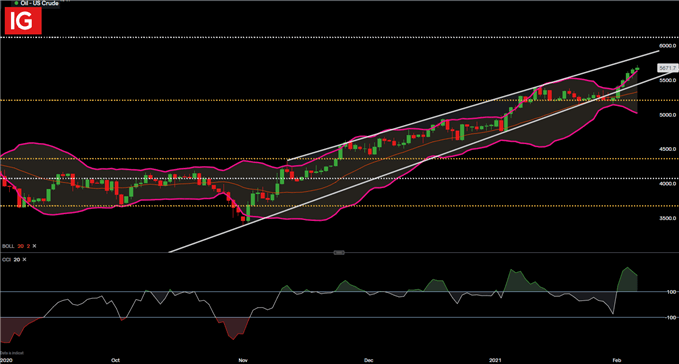

In the meantime, short-term worth motion stays throughout the confines of a bullish channel, after bears failed to interrupt beneath present help, permitting consumers to run with the pattern. A break above the higher Bollinger Band, mixed with a Commodity Channel Index (CCI) studying of 227, signifies that though the bullish pattern has prevailed, costs stay in oversold territory, probably hindering additional features.

WTI – US Crude Oil Day by day Chart

Chart ready by Tammy Da Costa, IG

Really useful by Tammy Da Costa

Be taught the Core Fundamentals of Oil Buying and selling

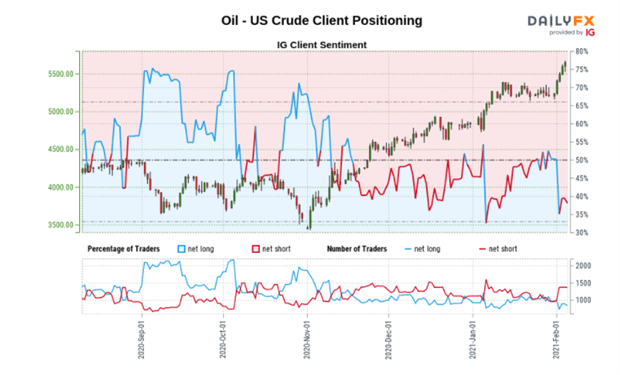

WTI – US Crude Oil Sentiment

| Change in | Longs | Shorts | OI |

| Day by day | -3% | -3% | -3% |

| Weekly | -11% | 36% | 13% |

On the time of writing, retail dealer information reveals 38.10% of merchants are net-long with the ratio of merchants brief to lengthy at 1.62 to 1. The variety of merchants net-long is 7.44% decrease than yesterday and eight.33% decrease from final week, whereas the variety of merchants net-short is 6.00% decrease than yesterday and 28.60% greater from final week.

We usually take a contrarian view to crowd sentiment, and the very fact merchants are net-short suggests Oil – US Crude costs might proceed to rise.

Merchants are additional net-short than yesterday and final week, and the mix of present sentiment and up to date adjustments provides us a stronger Oil – US Crude-bullish contrarian buying and selling bias.

— Written by Tammy Da Costa, Market Author for DailyFX.com

Contact and comply with Tammy on Twitter: @Tams707