CAD Analysis & NewsCanadian Retail Sales BeatsOil and European Lockdown Concerns the Main DriverDATA OVERVIEW: Better than expected Canadian r

CAD Analysis & News

- Canadian Retail Sales Beats

- Oil and European Lockdown Concerns the Main Driver

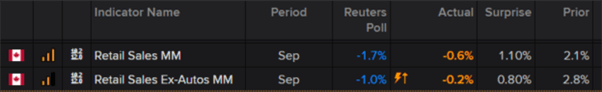

DATA OVERVIEW: Better than expected Canadian retail sales figures with the headline at -0.6% (exp. -1.7%), alongside the core reading at -0.2% (exp. -1%). However, given the current backdrop of oil prices falling amid a combination of renewed lockdown fears across Europe and the US attempting to create a coordinated release of strateigc petroleum reserves with the likes of China, India and Japan. The economic data is largely playing second fiddle to dictating price action for the Canadian Dollar.

Canadian Retail Sales Beat Consensus

Source: Refinitiv

EUR/USD Slides Germany Cannot Rule Out Possible Lockdown on Covid Surge

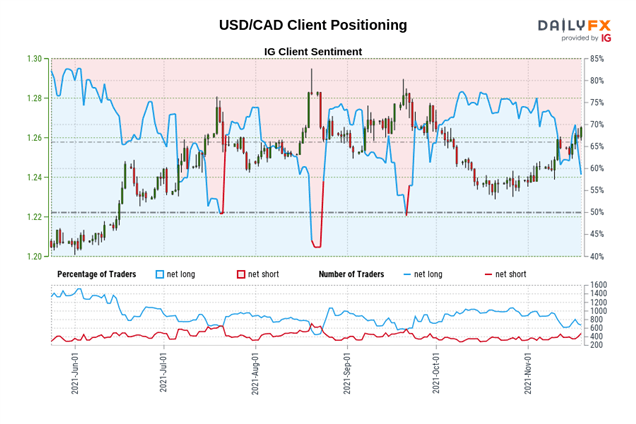

IG Client Sentiment Warns of Higher USD/CAD

Data shows 57.10% of traders are net-long with the ratio of traders long to short at 1.33 to 1. The number of traders net-long is 9.13% lower than yesterday and 7.25% lower from last week, while the number of traders net-short is 3.06% higher than yesterday and 2.39% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/CAD price trend may soon reverse higher despite the fact traders remain net-long.

Source: IG

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com