Oil Worth Speaking FactorsThe worth of oil consolidates following the string of failed makes an attempt to check the February 202

Oil Worth Speaking Factors

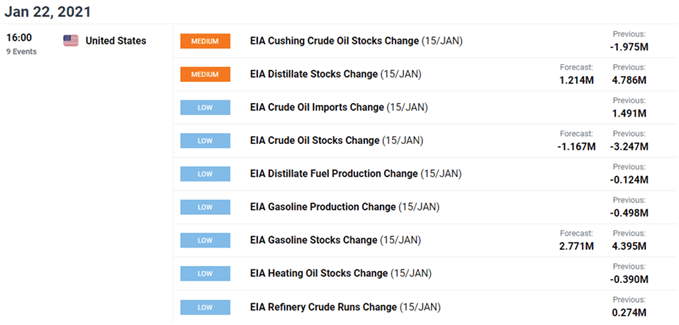

The worth of oil consolidates following the string of failed makes an attempt to check the February 2020 excessive ($54.66), however recent knowledge prints popping out of the US could affect vitality costs as crude inventories are projected to contract for the sixth consecutive week.

Oil Worth Outlook Supported by Forecasts for Decrease US Crude Stock

The worth of oil seems to be caught in a slender vary although US President Joe Biden unveils a $1.9 trillion stimulus package deal known as the American Rescue Plan, however pullback from the month-to-month excessive ($53.93) could turn into an exhaustion within the bullish worth motion reasonably than a change in pattern because the Group of the Petroleum Exporting International locations (OPEC) seem like on observe to control the vitality market all through 2021.

On the similar time, recent figures from the Vitality Info Administration (EIA) is anticipated to point out crude inventories falling 1.167M within the week ending January 15 following the three.247M contraction the week prior, and the recent figures could assist to maintain the value of oil afloat so long as US manufacturing sits at its lowest degree since 2018.

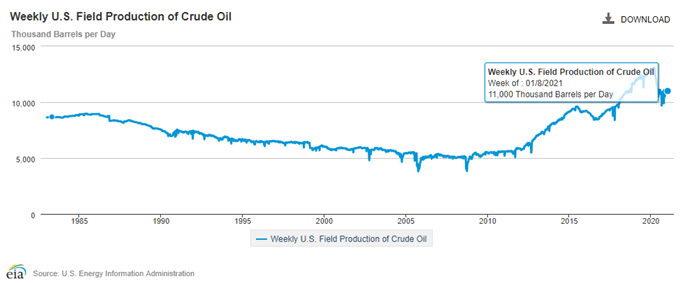

In actual fact, the earlier replace from the EIA revealed discipline manufacturing holding regular at 11,000K for the fifth consecutive week, and the continued weak point in US output could prop up oil costs forward of the subsequent OPEC Joint Ministerial Monitoring Committee (JMMC) Assembly on February 3 as Saudi Arabia plans to cut back provide by 1 million b/d till April 2021.

In flip, the value of oil could exhibit a bullish pattern all through the primary quarter of 2021 so long as crude output stays subdued, and recent knowledge prints popping out of the US could result in larger oil costs because the contraction in crude inventories instills an improved outlook for demand.

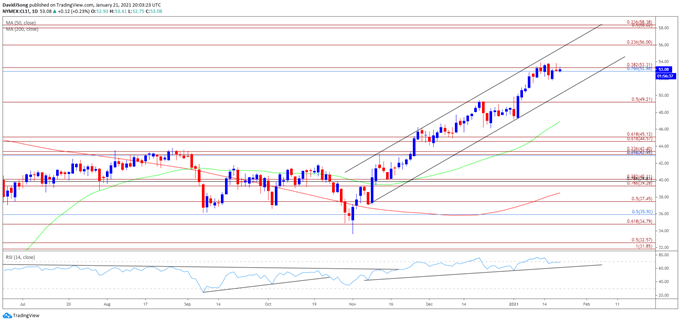

With that stated, the technical outlook stays constructive as the value of oil trades above pre-pandemic ranges, and crude could try to interrupt out of the vary certain worth motion from earlier this week because the Relative Power Index (RSI) flirts with overbought territory.

Really useful by David Track

Be taught Extra Concerning the IG Consumer Sentiment Report

Oil Worth Each day Chart

Supply: Buying and selling View

- Consider, crude broke out of the vary certain worth motion from the third quarter of 2020 following the failed try to shut beneath the Fibonacci overlap round $34.80 (61.8% growth) to $35.90 (50% retracement), and the value of oil could proceed to retrace the decline from the beginning of 2020 as each the 50-Day SMA ($46.97) and 200-Day SMA( $38.48) set up a observe a constructive slope.

- Crude seems to be caught in a slender vary following the string of failed makes an attempt to check the February 2020 excessive ($54.66), however the RSI could provide a bullish sign because the oscillator flirts with overbought territory.

- A break above 70 within the RSI is more likely to be accompanied by larger oil costs just like the conduct seen earlier this month, with the transfer above the Fibonacci overlap round $52.90 (78.6% retracement) to $53.30 (38.2% growth) retaining the February 2020 excessive ($54.66) on the radar.

- The $56.00 (23.6% growth) deal with sits subsequent on the radar adopted by the $58.00 (50% growth) to $58.40 (23.6% growth) area.

Really useful by David Track

Traits of Profitable Merchants

— Written by David Track, Forex Strategist

Observe me on Twitter at @DavidJSong