One other bounce in Eurozone PMIs may additional gas euro rally – Foreign exchange Information Preview Pos

One other bounce in Eurozone PMIs may additional gas euro rally – Foreign exchange Information Preview

Posted on Might 19, 2021 at 3:01 pm GMTRaffi Boyadjian, XM Funding Analysis Desk

After lengthy winter shutdowns, virus-stricken Eurozone international locations are lastly rising out of lockdown and the vaccination drive is accelerating. The additional lifting of virus restrictions in Might doubtless boosted financial exercise throughout the area and that is anticipated to be mirrored within the flash PMIs due on Friday (08:00 GMT). The euro is driving excessive on the again of the rosier financial outlook. However that’s not the one factor giving the one forex a leg up. The European Central Financial institution’s half-hearted dedication to protecting yields low and eagerness to scale down a few of the emergency stimulus is amplifying the bullish case for the euro.

Eurozone restoration again on observe

For the reason that autumn, the manufacturing sector has been the primary driving pressure of the Eurozone financial system however that now appears to be altering because the rebound in companies is quickening, with slightly assist from hotter climate and vaccines. After a bungled begin, Europe’s vaccination marketing campaign is lastly gathering tempo and though it’s nonetheless behind the present vaccine leaders, the US and UK, traders are hopeful that after the present spherical of virus restrictions have been lifted, there received’t be one other return to lockdowns.

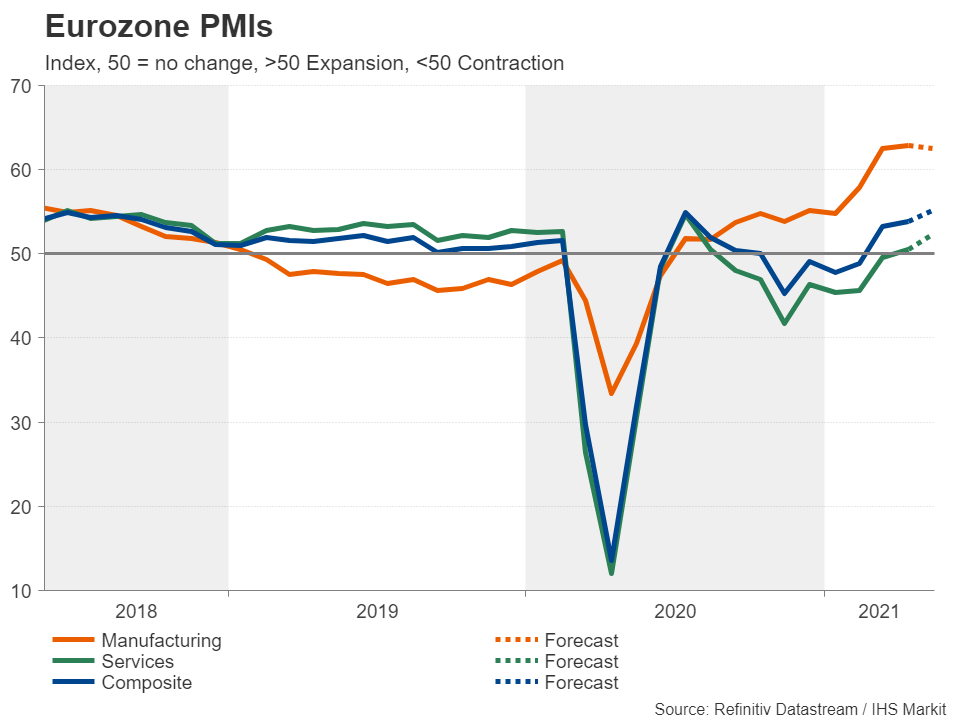

Exercise within the companies sector had already proven indicators of life in April and the PMI is anticipated to have jumped from 50.5 to 52.Three in Might’s flash studying. Nevertheless, after surging to a file excessive in April, the manufacturing PMI is forecast to average barely to 62.5 in Might. The composite PMI, which measures general exercise, is anticipated to rise to a post-pandemic excessive of 55.1.

Extra upside in retailer for the euro?

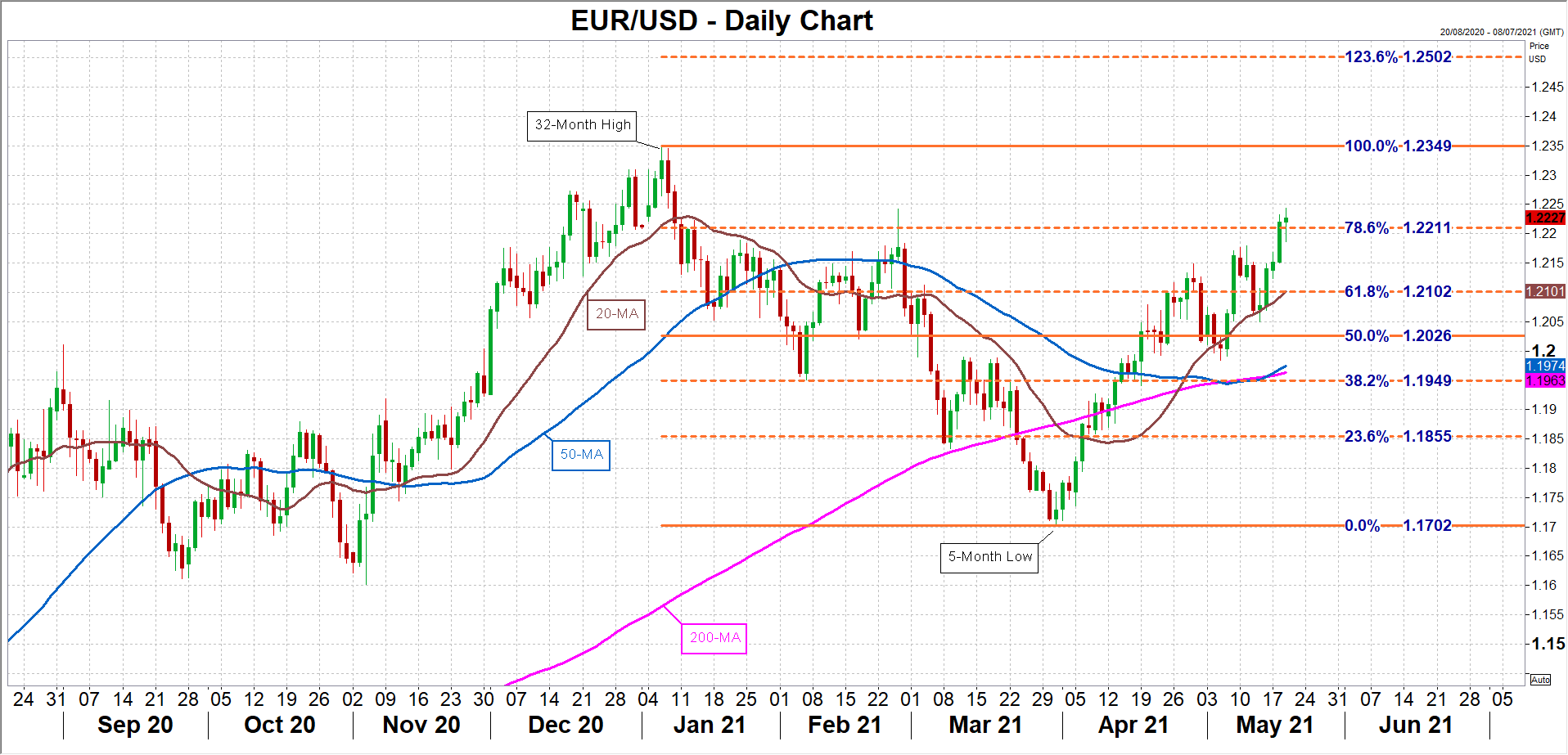

The quick turnaround within the Eurozone’s financial fortunes has re-energized euro bulls after a dreadful first quarter. Euro/greenback has hit 4½-month highs this week, skyrocketing above the $1.22 deal with. Having efficiently damaged above the 78.6% Fibonacci retracement of the January-March downleg, the following goal for the bulls is the January peak of $1.2349, after which level, the 123.6% Fibonacci extension of $1.2502 would come into focus.

To the draw back, the 61.8% Fibonacci of $1.21 is a serious help to observe in case of any correction, adopted by the 50% Fibonacci of $1.2026.

A robust set of PMIs on Friday may simply add extra constructive momentum for the euro and there’s a very good likelihood this pattern will proceed within the coming weeks. Nevertheless, June might be a trickier time for euro/greenback as each the European Central Financial institution and Federal Reserve may present some clues as as to if their respective bond shopping for plans will proceed at their present tempo.

Yields are hovering, ECB’s subsequent transfer can be essential

Expectations that the ECB may sign some type of winding down of its Pandemic Emergency Buy Programme (PEPP) on the June assembly has despatched Eurozone authorities bond yields hovering. The 10-year German bund yield has shot as much as two-year highs and is on observe to show constructive. In distinction, the 10-year Treasury yield has stored to its sideways vary even after the most recent shockingly sturdy US CPI knowledge.

Except ECB policymakers reaffirm their pledge to entrance load bond purchases to fend off an additional explosion larger in Eurozone yields, the euro is more likely to stay on the entrance foot in opposition to the US greenback, particularly if the Fed maintains its ultra-dovish stance via the summer season.

EURUSD