December has began with a thud for the Dollar, with values falling throughout the foreign exchange majors. The large story has been the EUR/USD br

December has began with a thud for the Dollar, with values falling throughout the foreign exchange majors. The large story has been the EUR/USD breaking out above 1.2000 as Fed Chairman Jerome Powell testified earlier than Congress. Each Powell and Treasury Secretary Stephen Mnuchin are being questioned this week as mandated by final spring’s Cares Act.

Right now’s engagement between Powell, Mnuchin, and Congress was fascinating. Final month, Mnuchin rescinded $455 billion price of funds directed towards the Fed. The transfer was ill-received by the central financial institution, which claimed the added liquidity can be essential transferring ahead. Listed below are just a few of this morning’s remarks from Powell and Mnuchin:

Powell:

- “[Cares Act] applications function a backstop to key credit score markets and have helped the movement of credit score from personal lenders by regular channels.”

- “The outlook for the financial system is very unsure and can rely, largely, on the success of efforts to maintain the virus in examine.”

- “The rise in new COVID-19 circumstances, each right here and overseas, is regarding and will show difficult for the subsequent few months.”

Mnuchin:

- “I proceed to consider {that a} focused fiscal bundle is essentially the most acceptable federal response.”

- “I strongly encourage Congress to make use of the $455 billion in unused Cares Act funds to move an extra invoice with bipartisan assist.”

- “The Administration is standing able to assist Congress on this effort to assist American staff and small companies.”

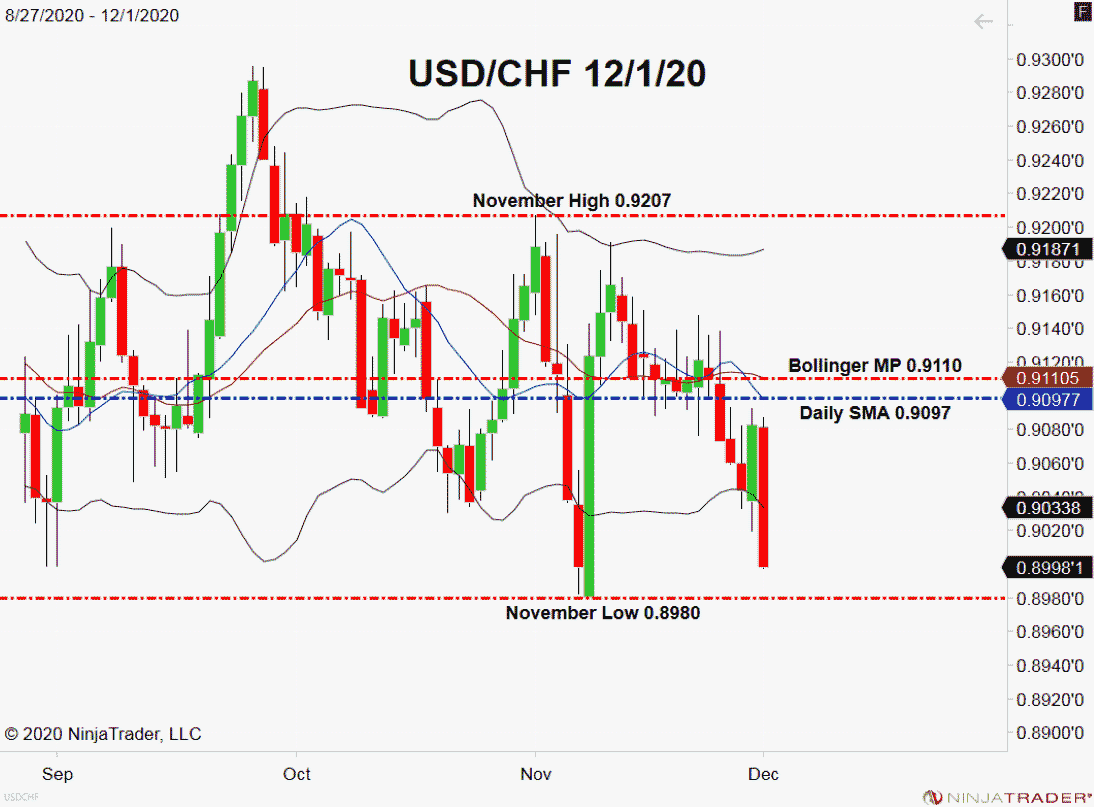

The potential of huge stimulus packages being handed by mid-February 2021 is sending the USD south towards the foreign exchange majors. Let’s check out how the USD/CHF has fared throughout this morning’s testimony.

The USD Is On The Ropes Versus The Foreign exchange Majors

For the USD/CHF, the psychological barrier of 0.9000 is again in play. Charges are at present difficult this stage.

+2020_12_01+(10_38_36+AM).png)

Backside Line: The USD/CHF has been an enormous mover for immediately’s foreign exchange majors. If we see a check of November’s Low (0.8980), a shopping for alternative could come into play very shortly.

Till elected, I’ll have purchase orders within the queue from 0.8989. With an preliminary cease loss at 0.8964, this commerce produces 25 pips on a 1:1 danger vs reward ratio.