Inventory Market Outlook:Inventory Market Forecast for the Week ForwardUS fairness markets have had a tur

Inventory Market Outlook:

Inventory Market Forecast for the Week Forward

US fairness markets have had a turbulent week up to now, gyrating between document ranges and appreciable losses as US Treasury yields creep greater and work to shift the chance panorama. Towards the backdrop of an ever-improving US economic system, nevertheless, the Nasdaq 100, Dow Jones and S&P 500 might proceed greater within the longer-term regardless of latest weak point. That being stated, not all indices are created equal and the high-flying Nasdaq 100, which has dragged markets greater since March 2020, could also be falling out of favor.

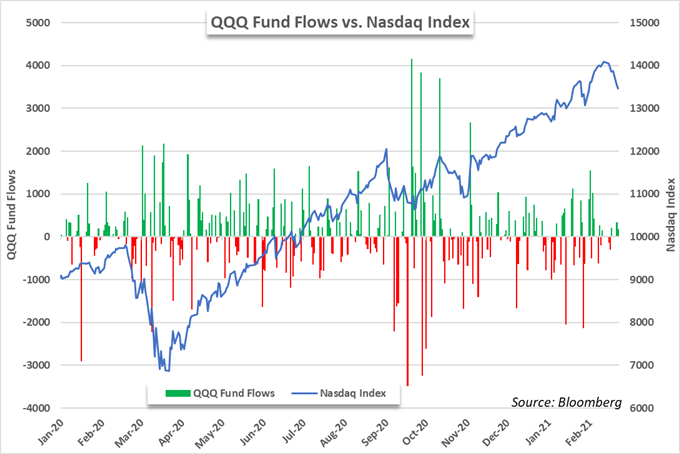

Nasdaq 100 Value Alongside QQQ Fund Flows

To that finish, alternate traded fund circulate information reveals a sequence of withdrawals from the Nasdaq-tracking QQQ ETF since January 2021. Within the year-to-date, QQQ has seen -$780 million go away its coffers regardless of a simultaneous 4.80% achieve in worth for the index.

Inventory Sectors: The Fundamentals You Have to Know

Dominated by shares like Apple, Microsoft, Amazon, Google and Tesla, the Nasdaq 100 has lengthy been the chief in speculative danger urge for food, leaving it particularly weak as traders look to reposition their portfolios amid rising risk-free charges. In consequence, the shares which have captivated the market’s consideration for months seem like among the most weak within the present local weather and merchants have voiced concern by withdrawing publicity from QQQ.

Merchants Flock to Shares With Extra Affordable Worth

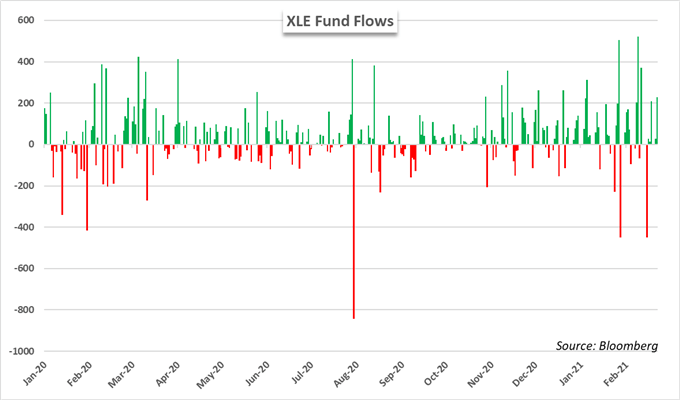

Then again, beleaguered sectors like vitality have had a exceptional begin to the yr as shares like Exxon Mobil (XOM) handily outperform new-age excessive flyers like Tesla (TSLA) within the year-to-date. Elevated financial forecasts have opened the door to greater crude oil costs which has helped propel the XLE vitality ETF greater as traders count on improved earnings from most of the beforehand downtrodden shares within the sector. Additional nonetheless, the vitality sector was one of many largest losers on the onset of the covid pandemic and plenty of traders might have shied away from publicity consequently.

Buyers Pile into Vitality-Monitoring XLE ETF

Now that crude has recovered and traders start to chop publicity to shares with lofty valuations as Treasury yields tick greater, the vitality sector has been a giant beneficiary. Within the year-to-date, the XLE fund has recorded $2.6 billion in web inflows amidst a 32.50% achieve in worth throughout the identical interval. Whereas vitality is only one sector that has outperformed the Nasdaq 100, it’s indicative of the gradual uptick in demand for worth shares.

Really helpful by Peter Hanks

Get Your Free Equities Forecast

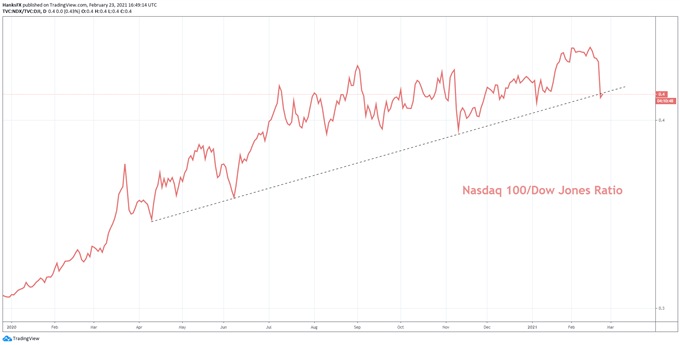

Suffice it to say, worth motion and fund circulate information recommend merchants have been engaged within the sectoral rotation for months, a theme highlighted clearly by the latest breakdown within the Nasdaq 100 to Dow Jones ratio.

Nasdaq 100 to Dow Jones Ratio Posts Abrupt Downturn

Chart created in TradingView. Ratio used asproxy forgrowth to value stocks

Along with the abrupt downturn within the Nasdaq to Dow Jones ratio, the latest technical breakdown within the Nasdaq 100may trace the development will proceed within the days forward. Both manner, know-how shares might proceed to face stress as Treasury yields rise and cash managers take into account the tradeoffs of tech publicity as risk-free charges climb. Within the meantime, observe @PeterHanksFX on Twitter for updates and evaluation.

Really helpful by Peter Hanks

Get Your Free Prime Buying and selling Alternatives Forecast

–Written by Peter Hanks, Strategist for DailyFX.com

Contact and observe Peter on Twitter @PeterHanksFX

factor contained in the

factor. That is in all probability not what you meant to do!nnLoad your utility’s JavaScript bundle contained in the factor as a substitute.www.dailyfx.com