In U.S. politics, the time period “October Shock” is synonymous with late-election uncertainty. Principally, the October Shock is a blockbuster in

In U.S. politics, the time period “October Shock” is synonymous with late-election uncertainty. Principally, the October Shock is a blockbuster information merchandise meant to sway voters forward of Election Day. To restrict threat publicity to such occasions, many merchants and traders select to go lengthy the safe-havens for safety. To date in October 2020, this has been the case.

By the primary 4 buying and selling periods of the month, each gold and the Swiss franc have gained floor on the USD. And, why not? With the POTUS being hospitalized with COVID-19 and a second spherical of U.S. authorities stimulus in query, it isn’t a foul concept to restrict publicity to threat belongings. In any case, something can occur within the month forward of a U.S. Common Election.

In all probability essentially the most notable monetary October Shock was the market crash of 2008. With jobless charges at multi-decade highs and the inventory markets plunging, Republican presidential candidate John McCain famously forgot what number of homes he owned in an interview with Politico. The consequence was a dismal loss to Democratic nominee Barack Obama and a return to the Senate for McCain.

Wall Avenue volatility throughout October of an election yr is not any secret amongst energetic merchants. Consequently, shifting liquidities to safe-haven belongings is a go-to technique for a lot of within the markets.

Foreign exchange Gamers Bid The Swiss Franc To Open October

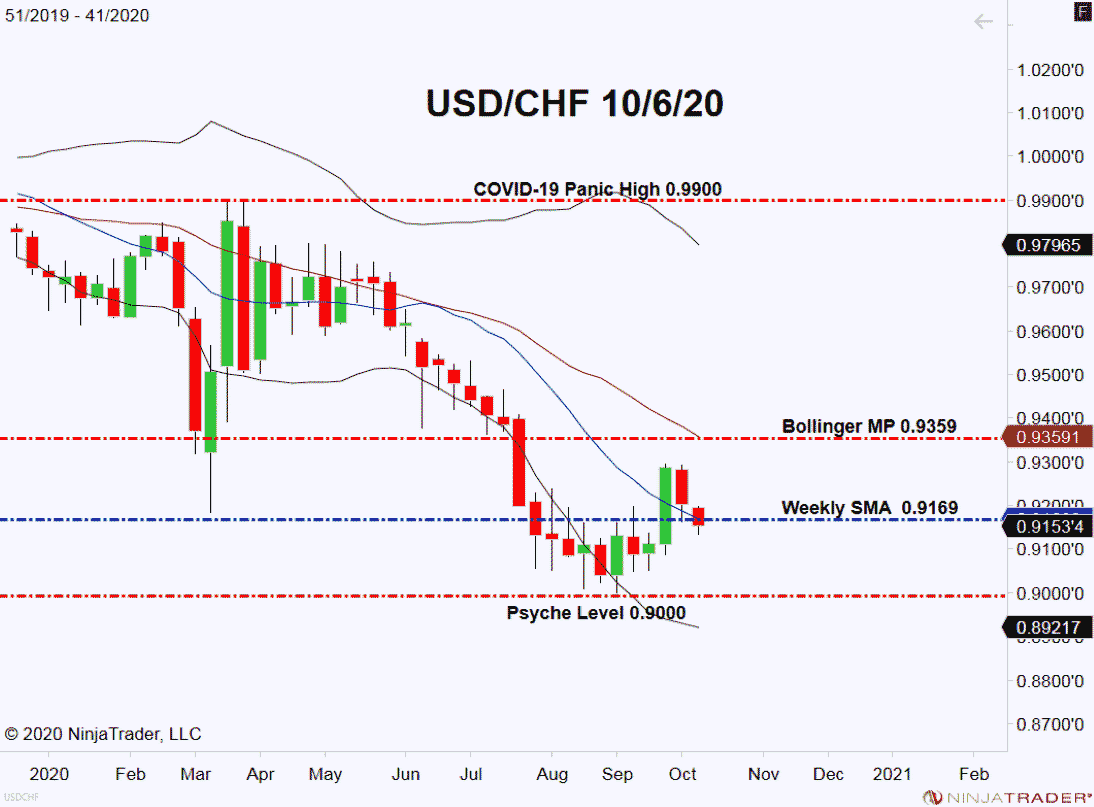

Over the previous 4 periods, merchants have bought off the USD/CHF. The consequence has been a return to sub-0.9200 pricing.

+2020_41+(11_23_16+AM).png)

Backside Line: As October wears on, it is extremely possible that the USD/CHF will publish one other take a look at of the 0.9000 deal with. In that case, a shopping for alternative will come into play.

Till elected, I’ll have purchase orders queued up from 0.9011. With an preliminary cease loss at 0.8941, this commerce produces 70 pips on a regular 1:1 threat vs reward administration plan.