NATURAL GAS (HENRY HUB) ANALYSISClimate, provide and logistical constraints aiding strengthening LNG costsFocus for the week: Wee

NATURAL GAS (HENRY HUB) ANALYSIS

- Climate, provide and logistical constraints aiding strengthening LNG costs

- Focus for the week: Weekly storage report scheduled tomorrow

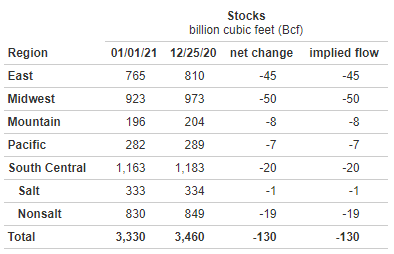

2021 has been a constructive yr for LNG spot costs with a number of elements contributing to it’s upward trajectory. Demand for the commodity has risen notably in Asia and Europe as a result of cooler than anticipated climate situations. Coupled with the final EIA storage report (see beneath) which reveals a marked discount (-130) in LNG shares from December. These elements offered further LNG value stimulus for January nevertheless, tomorrows storage information (10:30 EST) ought to give an perception into the elevated demand on present shares.

Weekly Pure Fuel storage report:

Supply: EIA – U.S. Vitality Data Administration

Really helpful by Warren Venketas

Buying and selling Foreign exchange Information: The Technique

This enhance in demand has put added stress on provide in addition to logistical capabilities. A scarcity of LNG tankers has resulted in exorbitant transportation prices which naturally interprets to the ultimate value of the commodity. This interruption within the provide chain doesn’t cease at tanker shortages however congestion current within the Panama Canal has pressured tankers to seek out alternate routes to Asia. These routes are longer which will increase journey time and in the end doesn’t meet demand wants.

Improve your data on Pure Fuel with my Prime Buying and selling Methods and Ideas!

NATURAL GAS TECHNICAL ANALYSIS

Pure Fuel daily chart:

Chart ready by Warren Venketas, IG

From the top of December up till now, Pure Fuel costs have moved roughly 20%. Value motion suggests a short-term uptrend within the midst of a medium-term downward pattern. The June 2020 low marks the start of a diagonal help trendline (black) which serves as a key space within the occasion of additional draw back.

2.7805 (blue) highlights the latest swing excessive in December. This horizontal stage has not been totally breached with yesterdays lengthy higher wick candle formation indicating value rejection above 2.7805. Tomorrow’s storage report my give bulls the impetus to push above resistance and look towards the long-term space of confluence at 2.9225.

Ought to resistance maintain, additional draw back could also be evident with Monday’s swing low supplying preliminary help at 2.5765.

Begins in:

Stay now:

Jan 13

( 16:01 GMT )

Maintain updated with value motion setups!

Weekly Inventory Market Outlook

Key factors to contemplate:

- Asian and European demand

- Weekly storage information

- Key resistance stage breaks

— Written by Warren Venketas for DailyFX.com

Contact and comply with Warren on Twitter: @WVenketas