RAND ANALYSISZAR FUNDAMENTAL BACKDROPThe South African rand has had an unimaginable final two weeks because the native forex ra

RAND ANALYSIS

ZAR FUNDAMENTAL BACKDROP

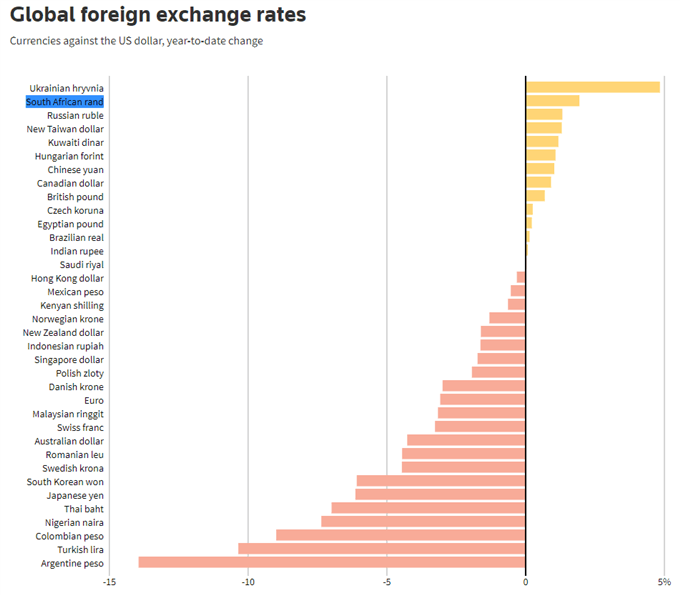

The South African rand has had an unimaginable final two weeks because the native forex rallied roughly 6.5% in opposition to the U.S. greenback. This brings the rand to a well-recognized spot on the year-to-date (YTD) rankings in opposition to the buck (see graphic beneath).

Supply: Reuters

GET YOUR Q3 RAND FORECAST HERE!

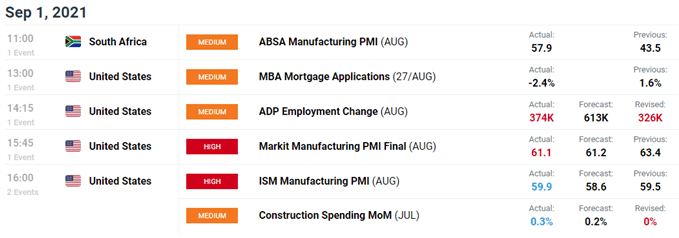

There was a broad-based uptick in Rising Market (EM) currencies primarily resulting from greenback weak point as rand linked commodities (gold, platinum and iron ore) have been comparatively subdued throughout the identical interval. This comes after the dovish slant given by Fed Chair Jerome Powell on the current Jackson Gap Symposium together with unsupportive financial knowledge comparable to yesterdays ADP and uninspiring PMI prints (see calendar beneath). South African PMI knowledge considerably improved on earlier figures with the measure coming in nicely above the 50 stage which suggests an increasing manufacturing economic system – the best since October 2020.

Supply: DailyFX financial calendar

SPOTLIGHT ON NFP TOMORROW

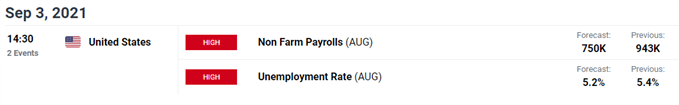

All eyes firmly give attention to tomorrows NFP and unemployment knowledge which might presumably change the current trajectory of rand energy ought to precise figures exceed estimates. Anticipate pre and post-announcement volatility on USD/ZAR.

Supply: DailyFX financial calendar

TECHNICAL ANALYSIS

USD/ZAR DAILY CHART

Chart ready by Warren Venketas, IG

Whereas markets keenly await the NFP report, the technicals mirror the potential for a bullish reversal on the pair. Worth motion reveals hesitancy across the current trendline help (black). Costs have moreover deviated fairly extensively from the EMA’s and at present sits comparatively removed from the 20-day EMA (purple). This might result in a rebound from USD/ZAR bulls because the potential for imply reversion is excessive. The Relative Energy Index (RSI), additional helps this notion with the oscillator approaching oversold ranges. This doesn’t take away from the truth that the pair is in a robust near-term downtrend, however I don’t foresee rand energy for for much longer.

Resistance ranges:

Assist ranges:

- Trendline (black)

- 14.2238

- 14.0000

— Written by Warren Venketas for DailyFX.com

Contact and comply with Warren on Twitter: @WVenketas

factor contained in the

factor. That is most likely not what you meant to do!Load your utility’s JavaScript bundle contained in the factor as a substitute.

www.dailyfx.com