Overseas trade buying and selling volumes throughout Refinitiv Matching and FXall platforms decreased barely in December 2020 from the earlier mont

Overseas trade buying and selling volumes throughout Refinitiv Matching and FXall platforms decreased barely in December 2020 from the earlier month, the corporate mentioned on Friday.

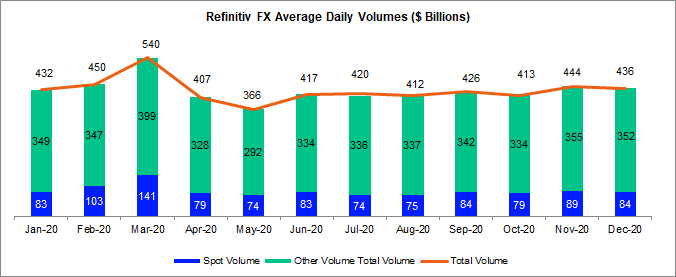

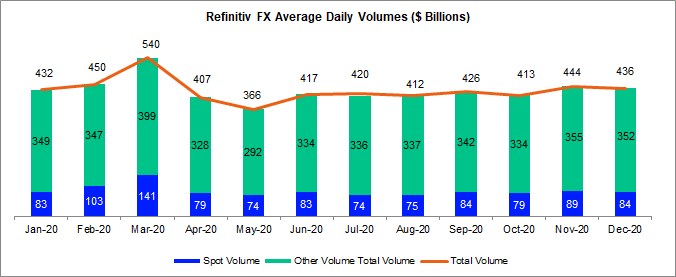

Turnover in all merchandise together with money, forwards, swaps, choices and non-deliverable forwards had been reported at $436 billion in December 2020. This determine was down 1.eight p.c from $444 billion in November 2020, however displays a 10 p.c enhance from $395 billion in December 2019.

The previous Monetary and Threat enterprise of Thomson Reuters reported in November its greatest metrics since March, when turnover hit a median every day $540 billion, the best in its volumes knowledge going again to February 2013.

Of the December’s $436 billion determine, $84 billion was FX spot, representing a -6 p.c fall over the month-to-month interval when in comparison with $89 billion in November 2020. Over a yearly foundation, the spot turnover additionally outpaced its counterpart in December 2019, which got here at $79 billion.

Prompt articles

FBS CopyTrade Launches a New Card Scanning Function!Go to article >>

London Inventory Change to Shut Refinitiv Acquisition

Exercise in different transaction sorts, together with forwards, swaps, choices and non-deliverable forwards (NDFs), averaged $352 billion every day, -0.eight p.c decrease from $355 billion the earlier month.

Refinitiv’s figures mirror the development noticed within the month-to-month figures from lots of the main buying and selling platforms which have seen record-breaking volumes within the first half earlier than turning to undergo lackluster exercise. Nevertheless, given its place as a serious buying and selling hub for the wholesale market, the monetary knowledge vendor supplies one of the crucial complete snapshots of exercise.

London Inventory Change mentioned earlier this week it expects to shut its proposed $27 billion acquisition of Refinitiv on 29 January 2021. The information comes after the European Fee, which oversees competitors coverage within the 27-nation bloc, permitted the all-stock deal again in December.

Underneath the phrases of the deal, the Blackstone-led Refinitiv will personal 37 p.c of the mixed group, whereas its former proprietor, Thomson Reuters, might be holding a 15 p.c stake. It might grow to be the largest shareholder within the London trade, with the proper to call three administrators.