Sterling Fundamental Forecast: Slightly BullishUK Prime Minister releases sanctions on Russian banks and Russian billionairesUK consumers under press

Sterling Fundamental Forecast: Slightly Bullish

- UK Prime Minister releases sanctions on Russian banks and Russian billionaires

- UK consumers under pressure as energy, taxes and NHI contributions all set to increase

- Large speculators flip net-long, what does this mean for the Pound?

Boris Johnson Announces Sanctions on Russia

In line with other NATO alliance members, the UK announced that five banks have had their assets frozen, along with three Russian billionaires – who are also said to have received travel bans. Such measures were described as the “first barrage” which could be extended if need be.

In addition, Russian parliamentarians who voted to recognize the breakaway regions of Donetsk and Lugansk as independent territories would also be sanctioned. In the coming weeks, British firms would be prevented form doing business in Donetsk and Lugansk as is the case in Crimea which was annexed from Ukraine in 2014.

UK Consumers Pessimistic about the UK Economy

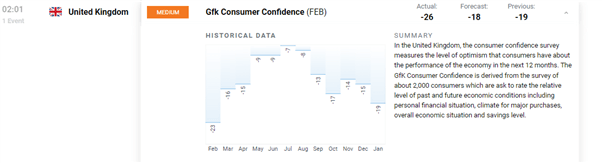

The UK consumer confidence survey, compiled by Gfk recorded its sharpest month on month drop in February since the start of the pandemic. The figure has been trending lower since November and dropped from -19 to -26.

UK consumers expressed concern over energy and food price rises, increased taxation and rising interest rates, putting pressure on disposable income and the potential for greater levels of indebtedness. UK Prime Minister Boris Johnson has announced measures to try soften the burden on the consumer but has failed to rule out increases in social welfare contributions as it is necessary to pay for health care.

Customize and filter live economic data via our DaliyFX economic calendar

Large Speculators Flip Net-Long on Sterling (GBP)

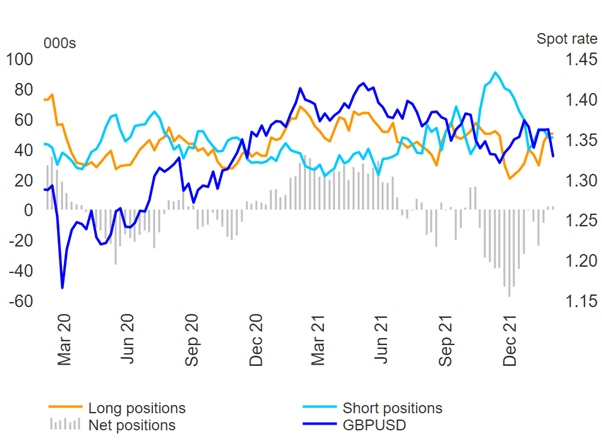

After a long period where hedge funds and other large speculators piled into Sterling short positions, we are now seeing a change in ‘smart money’ sentiment as long positions narrowly outweigh shorts. This however, may simply be the result of profit taking from extreme short positioning instead of an outright sentiment reversal. The above point becomes clearer after examining the drastic reduction in shorts while longs picked up to a much lesser extent.

Long and Short Sterling Positions and GBP/USD Overlay, CFTC Data

Source: Refinitiv, CFTC, CoT Report prepared by Richard Snow

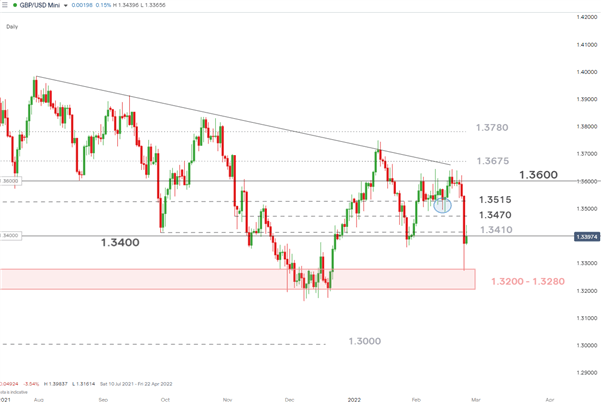

GBP/USD Daily Chart

Source: IG, prepared by Richard Snow

Major Risk Events for the Week Ahead

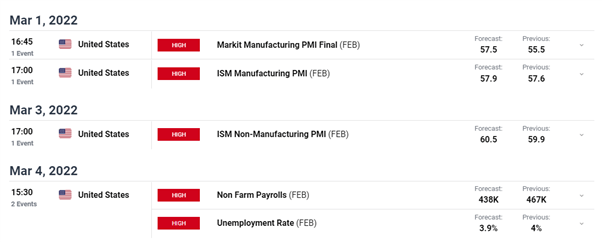

Admittedly, the economic calendar has taken a back seat for much of this week as conflict broke out in Ukraine. The unfolding military action been the main driver in global markets but the immediate pullback in gold, oil, and risk-correlated FX currencies like the AUD and GBP suggest that we may have already reached the period of ‘peak shock’.

Slightly Bullish GBP/USD

The bullish bias heading into next week is based on the almost immediate recovery in risk assets and the early stages of a return to talks as the Kremlin expressed it is open to talks in Minsk.

However, economic data of high importance is still unlikely to significantly move markets as the geopolitical situation remains uncertain. Next week we see US PMIs and NFP data in the absence of high importance GBP scheduled events.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com