USD/JPY Evaluation:Japan skilled its largest quarterly decline in GDP on file establishing third straight quarter of damaging dev

USD/JPY Evaluation:

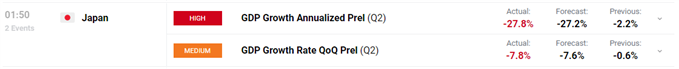

- Japan skilled its largest quarterly decline in GDP on file establishing third straight quarter of damaging development

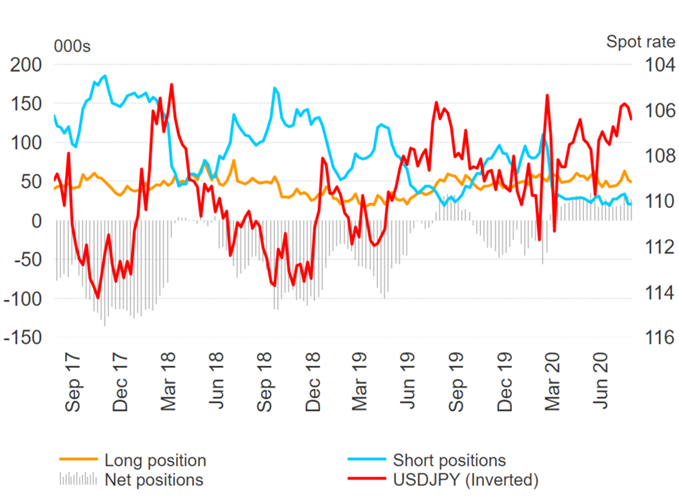

- The Dedication of Merchants (CoT) Report reveals a slight lengthy bias amongst hedge funds/speculators regardless of a softer greenback

- USD/JPY intraday value motion at present at essential space of confluence because the brief time period uptrend faces potential menace

Why is GDP Information So Essential? – A Information to GDP Information and Foreign exchange Buying and selling

Largest Recorded Decline in Japanese GDP

Japanese GDP got here in at -7.8%, barely worse than the anticipated determine of -7.6% as Q2 was formally the worst quarterly contraction on file. Whereas there isn’t a single main financial system that has been shielded from the financial hardships inflicted by the coronavirus pandemic, the world’s third largest financial system has been notably exhausting hit as buying malls stood empty whereas worldwide demand for motor automobiles, a significant Japanese export, dropped considerably.

For all market-moving knowledge releases and occasions see the DailyFX Financial Calendar

For perspective, when evaluating the annualized figures, the file drop (-27.8%) shouldn’t be as unhealthy as that skilled within the US (-32.9%) however stays increased than the Japanese Q1 2009 determine of -17.8% throughout the world monetary disaster.

Dedication of Merchants (CoT) Information Reveals Slight Internet-Lengthy Positioning

CoT knowledge exhibits that main hedge funds, also referred to as the “good cash”, at present maintain extra lengthy Japanese Yen contracts versus brief contracts as there was a gradual decline in shorts (blue) over the past 12 months with longs (orange) remaining fairly flat. We usually witness positions which are reflective of the pattern on this knowledge versus consumer sentiment knowledge which normally counters developments.

Non-commercial Positioning, USD/JPY (inverted)

Supply: Refinitiv, DailyFX

Learn our in-depth information on utilizing the CoT report in foreign currency trading

See Justin McQueen’s article for a full report on the latest CoT knowledge

USD/JPY Key Intraday Technical Ranges

Value motion instantly after the Japanese GDP knowledge launch was largely contained regardless that the determine missed expectations.

At present, buying and selling continues round an space of confluence (on the 4-hour chart) the place trendline assist coincides with the brief time period low round 106.45. The bullish pattern stays intact ought to value shut above the brief time period trendline. Thereafter, preliminary resistance seems on the latest swing excessive and may bullish momentum proceed, 107.05 presents the following resistance zone.

Nonetheless a break and shut under trendline assist and presumably even a break under short-term assist could deliver the 106.20 stage into focus. Additional bearish momentum would then see the 106.00 psychological stage as the following stage of assist.

USD/JPY 4-Hour Chart: Trendline Assist Coinciding with Quick-Time period Low

Chart ready by Richard Snow, IG

Assets used on this evaluation:

Really helpful by Richard Snow

The place is JPY probably headed? Learn quarterly forecast

— Written by Richard Snow for DailyFX.com

Contact and observe Richard on Twitter: @RichardSnowFX