XRP/USD closed at 1.06000 after putting a excessive of 1.58901 and a low of 1.06000. After posting positive aspects for 2 consecutive periods, XRP/

XRP/USD closed at 1.06000 after putting a excessive of 1.58901 and a low of 1.06000. After posting positive aspects for 2 consecutive periods, XRP/USD dropped on Wednesday and reached its lowest since 26th April. XRP holders have been attempting to realize a voice in motion in opposition to Ripple Labs and a few of its executives filed by the SEC. Nevertheless, the regulator has opposed by any means at its disposal, and this has weighed on the cryptocurrency.

Regardless of its ongoing lawsuit in opposition to SEC, Ripple has introduced a partnership with Egypt’s largest financial institution, the Nationwide Financial institution of Egypt (NBE). RippleNet, a worldwide funds community, will join NBE with LuLu Worldwide Alternate, a monetary companies supplier primarily based in UAE, and cross-border course of funds. Egypt obtained remittances as much as $24 billion in 2020 from its residents within the Gulf States, together with the UAE. The North African nation was one of many high 5 remittance recipients globally after India, China, Mexico, and the Philippines.

The group head of NBE stated that the financial institution was repeatedly aiming to develop and improve the infrastructure of cross-border remittances because it performs an important position within the Egyptian economic system. This information additional capped losses in XRP/USD costs on Wednesday. However the coin ended its day with losses as the entire crypto market got here underneath strain after China introduced buying and selling in cryptocurrency as unlawful and warned in opposition to it as a result of excessive danger concerned amid speculations.

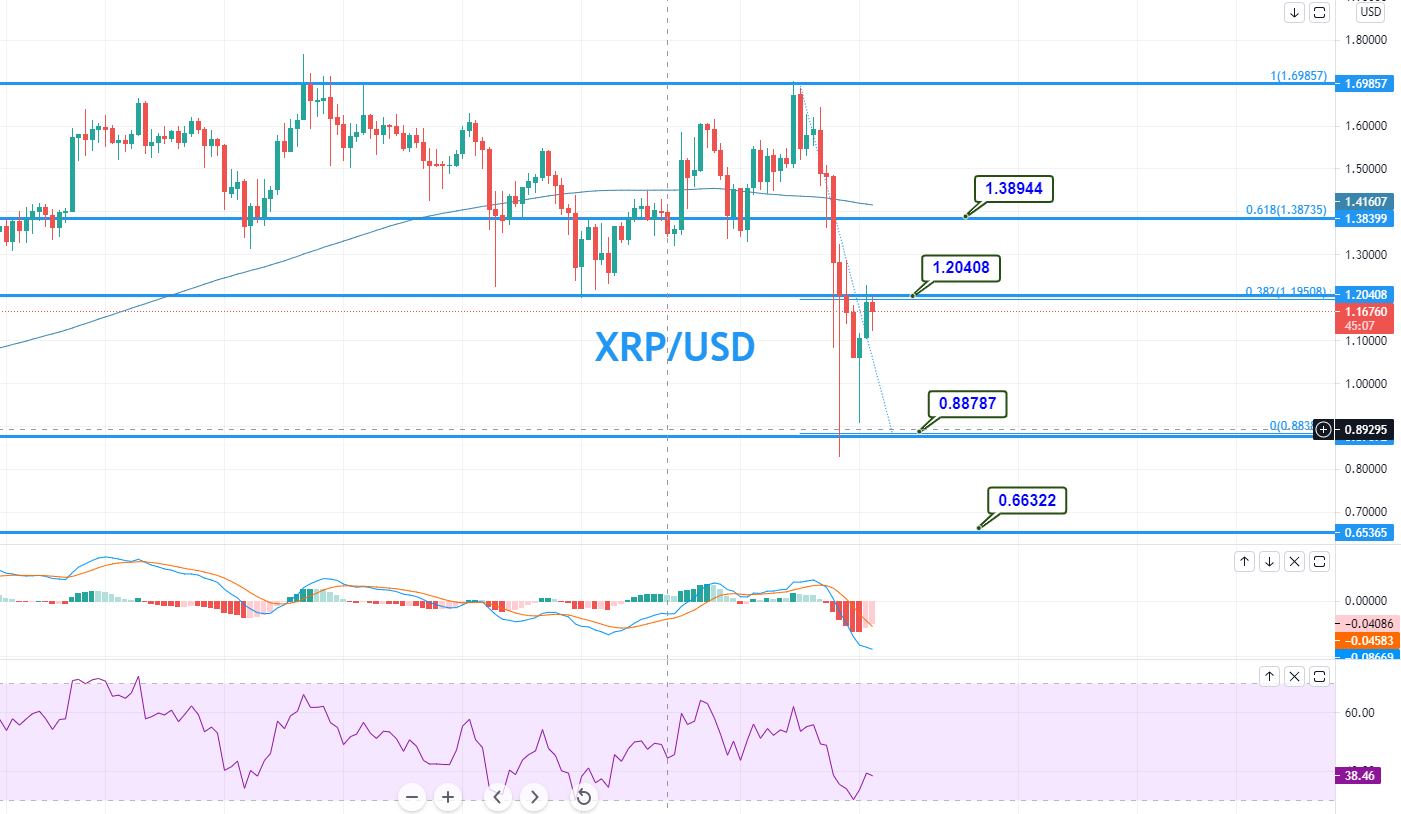

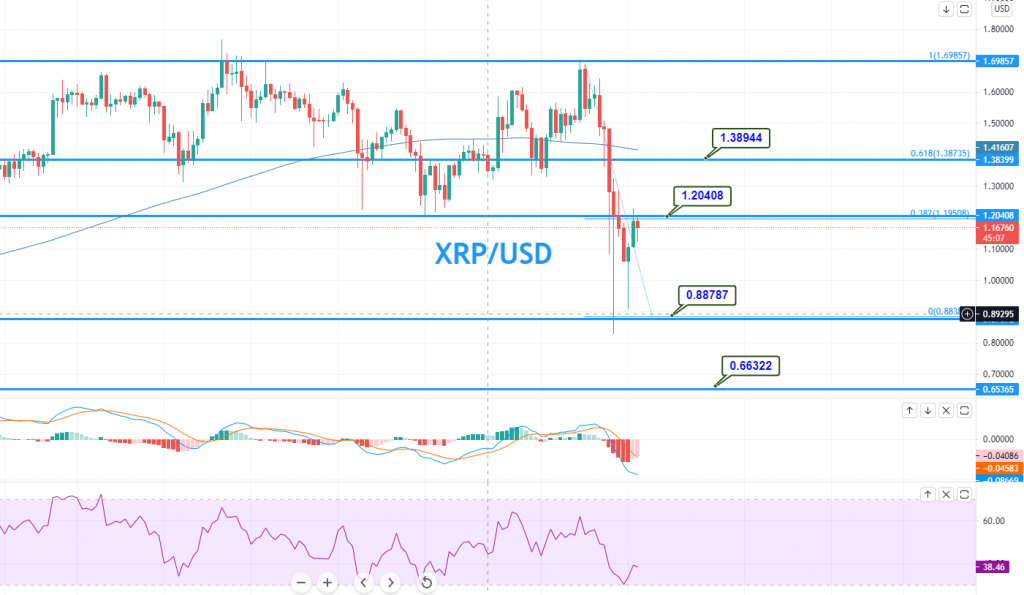

XRP/USD Every day Technical Ranges

Assist Resistance

0.88367 1.41268

0.70733 1.76535

0.35466 1.94169

Pivot Level: 1.23634XRP/USD has bounced off to commerce under 1.2040 degree, dealing with rapid resistance at 1.2040. This degree additionally marks a 38.2% Fibonacci retracement degree. Under this, the chances of bearish bias stay sturdy; due to this fact, we might search for a promote commerce to seize a fast promote till 1 or 0.8890. Nevertheless, within the case of a bullish breakout of 1.2040 degree, the pair might soar till the 1.3894 degree of 61.8% retracement. Good luck, and keep tuned!