US Greenback, Singapore Greenback, New Taiwan Greenback, Thai Baht, Philippine Peso, ASEAN, Basic Evaluation – Speaking FactorsUS

US Greenback, Singapore Greenback, New Taiwan Greenback, Thai Baht, Philippine Peso, ASEAN, Basic Evaluation – Speaking Factors

- US Greenback positive aspects versus ASEAN currencies regardless of rally in Rising Market shares

- Rising longer-dated Treasury yields cushioning Buck on fiscal stimulus bets

- APAC, ASEAN information: China & Indonesian commerce, India industrial output and CPI

Really helpful by Daniel Dubrovsky

Get Your Free USD Forecast

US Greenback ASEAN Weekly Recap

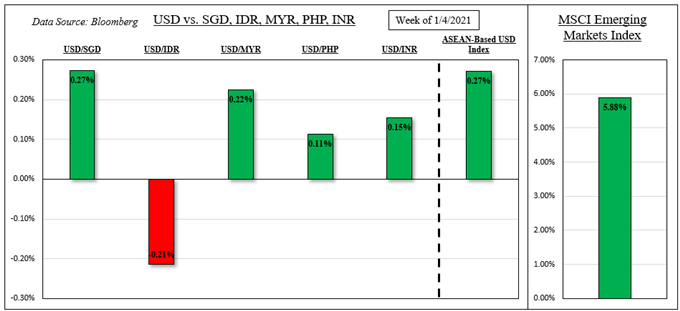

The haven-linked US Greenback acquired a break from its persistent losses to start out off 2021, gaining floor towards ASEAN currencies such because the Singapore Greenback, Malaysian Ringgit and Thai Baht. That is regardless of broad power in creating nation equities, with the MSCI Rising Markets Index (EEM) rallying 5.9%. That was one of the best efficiency over the course of every week in 2 months.

A few notable standouts have been the New Taiwan Greenback and Indonesian Rupiah. The previous gained as Taiwan’s benchmark inventory index rallied virtually 5% over the course of 5 days. The semiconductor-heavy index capitalized on positive aspects in tech shares as TSM reported gross sales rising 13.6% y/y in December. USD/IDR fell as buyers priced in quicker financial restoration expectations.

Final Week’s US Greenback Efficiency

*ASEAN-Based mostly US Greenback Index averages USD/SGD, USD/IDR, USD/MYR and USD/PHP

Exterior Occasion Threat – Treasury Yields, Fiscal Stimulus, US Retail Gross sales and Sentiment

The anti-risk US Greenback, with native lending charges so low, usually tends to weaken when shares outperform, so what offers? Because of Democrats taking each seats within the Georgia Senate runoffs, that has raised fiscal stimulus prospects on the planet’s largest economic system. That has in flip raised the outlook for development and restoration, pushing longer-dated Treasury yields to their highest since early 2020.

Elevating charges of return from the US are probably benefiting the Buck’s attraction, particularly as yields from there outpaced these from ASEAN nations this previous week. Pairs like USD/SGD and USD/THB noticed their regular descents gradual. Going ahead, expectations of presidency stimulus might proceed pushing Treasury yields larger, providing the US Greenback a break from persistent losses.

Take a look at my newest ASEAN technical report for USD/SGD, USD/TWD, USD/THB and USD/IDR ranges!

Final week’s dismal non-farm payrolls report underpinned the necessity for extra assist, as President-elect Joe Biden acknowledged. Nonetheless, because the FOMC minutes revealed, the central financial institution sees the present tempo of bond purchases as applicable. Lose coverage is probably going right here to remain in the interim, and it’s unclear simply how far Treasury charges can run.

Dangers that would provide some gasoline to the US Greenback embrace rising instances of the coronavirus, particularly a brand new more-contagious pressure. Lockdown threats might pose a menace for equities, pushing the Buck larger. All eyes are additionally on US retail gross sales and College of Michigan Sentiment on Friday. These will proceed to disclose the state of well being within the consumption-driven nation.

Really helpful by Daniel Dubrovsky

What are the highest buying and selling alternatives in 2021?

ASEAN, South Asia Occasion Threat – Chinese language and Indonesian Commerce, India Industrial Manufacturing

The ASEAN financial docket is pretty mild, with USD/IDR eyeing Indonesian commerce information on Friday. In South Asia, USD/INR is eyeing Indian industrial manufacturing and CPI on Tuesday. The latter is predicted to gradual additional, opening the door to RBI fee minimize bets and maybe a turning factors for the Indian Rupee. China, a key buying and selling accomplice for ASEAN international locations, launch its commerce steadiness on Thursday.

Take a look at the DailyFX Financial Calendar for ASEAN and international information updates!

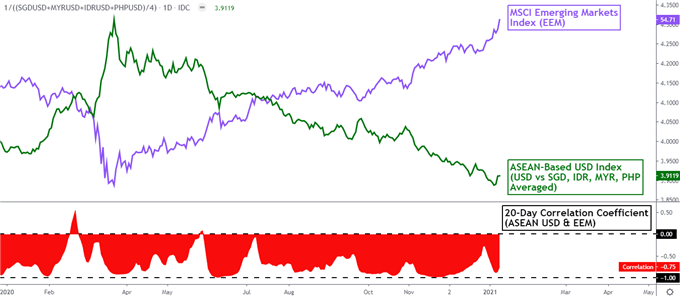

On January 8th, the 20-day rolling correlation coefficient between my ASEAN-based US Greenback index and the MSCI Rising Markets Index fell to -0.75 from -0.63 one week in the past. Values nearer to -1 point out an more and more inverse relationship, although you will need to acknowledge that correlation doesn’t indicate causation.

ASEAN-Based mostly USD Index Versus MSCI Rising Markets Index – Day by day Chart

Chart Created Utilizing TradingView

*ASEAN-Based mostly US Greenback Index averages USD/SGD, USD/IDR, USD/MYR and USD/PHP

— Written by Daniel Dubrovsky, Foreign money Analyst for DailyFX.com

To contact Daniel, use the feedback part beneath or @ddubrovskyFX on Twitter