DOW JONES, HANG SENG, ASX 200, ASIA-PACIFIC MARKET OUTLOOK:Asia-Pacific markets could commerce decrease as US fairness futures re

DOW JONES, HANG SENG, ASX 200, ASIA-PACIFIC MARKET OUTLOOK:

- Asia-Pacific markets could commerce decrease as US fairness futures retreated from document highs

- Rising Treasury yields and a stronger USD could exert downward strain on equities, commodities

- UK and Canada core inflation, US retail gross sales figures are in focus at this time

Advisable by Margaret Yang, CFA

Get Your Free Equities Forecast

Yields, US Greenback, Gold, Inflation, Asia-Pacific Shares Outlook:

US fairness futures edged decrease on Wednesday morning after main inventory benchmarks closed close to document highs in a single day. Traders are in all probability attempting to strike a stability between reflation hopes and seemingly overstretched valuations, permitting latest rallies to take a short pause. The S&P 500 index is buying and selling close to 32.Three instances price-to-earnings, far above its five-year common of 21.2. Wealthy multiples could render the index susceptible to profit-taking ought to rising yields and a stronger US Greenback set off a technical pullback.

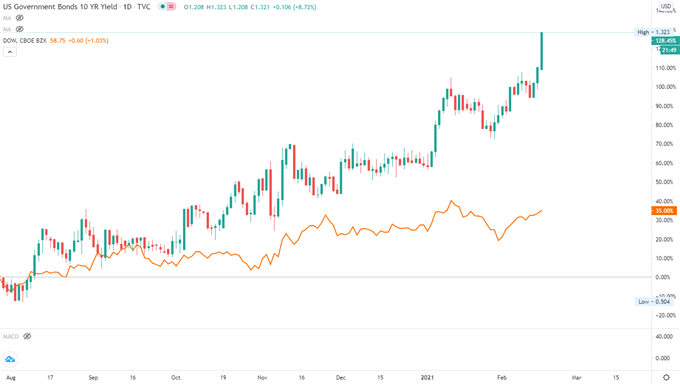

It’s value noting that the 10-year Treasury yield climbed greater than 10bps in a single day to 1.321%, the best degree seen in virtually a yr. Rising yields could exert additional downward strain on treasured steel costs, as a result of the chance price of holding non-yielding property turns into greater. For equities, it implies that intrinsic worth turns into decrease when future money stream steams are discounted again at a better required price of return.

Gold costs plunged 1.26% and broke beneath the US$ 1,800 mark as yield climbed alongside a stronger USD. WTI crude oil costs stayed elevated nonetheless, backed by chilly blast in elements of the US and disruption in crude oil manufacturing in Texas.

US 10-Year Treasury Yield vs. Dow Jones

Chart by TradingView

Asia-Pacific equities look set to retreat from Monday’s highs as profit-taking exercise kicks in. Futures throughout Japan, Australia, Hong Kong, Singapore and India are pointing to a decrease begin. Mainland Chinese language bourses stay shut for the Chinese language New 12 months vacation and can re-open on Thursday. Within the forex market, the risk-sensitive Australian and New Zealand {Dollars} edged decrease, suggesting that sentiment is titled to the bearish aspect.

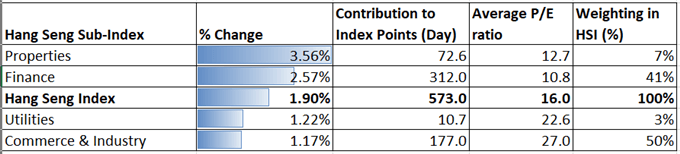

Hong Kong’s Cling Seng Index (HSI) superior 1.9% on Tuesday, breaking via the 30,00Zero psychological resistance degree with no hesitation. Property and finance sub-sectors had been main, with HSBC (+7.65%) being the one largest contributor to the index’s acquire. With the return of mainland traders on Thursday, sectoral rotation could lean in direction of in favor of expertise companies once more.

Supply: his.com.hk

Australia’s ASX 200 index opened barely decrease, dragged by client staples (-2.09%), healthcare (-2.00%) and knowledge expertise (-1.51%) sectors. Supplies (+1.68%) and financials (+0.49%) had been doing the heavy lifting.

On the macro entrance, core inflation charges from UK and Canada will put the British Pound and Canadian Greenback in focus at this time. The discharge of January US retail gross sales information may even be intently eyed by merchants for clues into the well being of the consumption market. Markets foresee a 1.1% MoM development in retail gross sales, revising three consecutive months’ of gentle contraction. That is in view of the newest spherical of stimulus funds and improved pandemic scenario in January. Discover out extra on the DailyFX calendar.

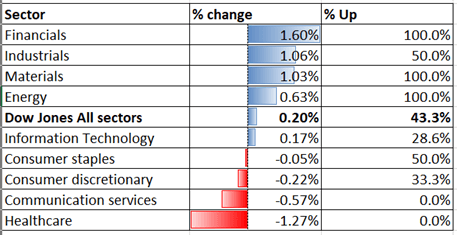

Sector-wise, 5 out of 9 Dow Jones sectors climbed on Tuesday, with 43.3% of the index’s constituents closing within the inexperienced. Financials (+1.60%), industrials (+1.06%) and supplies (+1.03%) had been among the many greatest performing sectors, whereas healthcare (-1.27%) and communication companies (-0.57%) trailed behind.

Dow Jones Sector Efficiency 17-02-2021

Supply: Bloomberg, DailyFX

Advisable by Margaret Yang, CFA

What does it take to commerce round information?

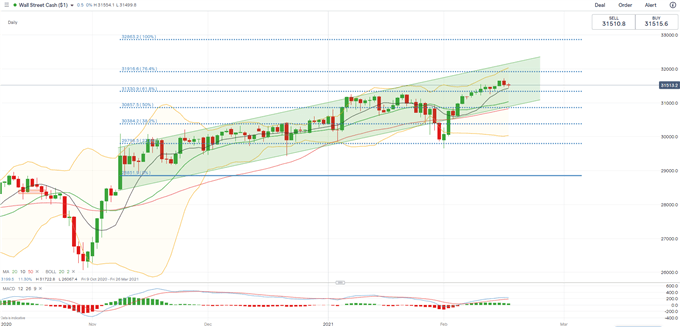

Dow Jones Index Technical Evaluation:

Technically, the Dow Jones index resumed its upward trajectory after returning to the “Ascending Channel”. Costs continued to maneuver greater throughout the higher Bollinger Band, pointing to additional upside potential with an eye fixed on 31.910 – the 76.4% Fibonacci extension degree. The higher Bollinger Band could function a dynamic resistance degree, whereas the 20-Day Easy Transferring Common (SMA) line could also be considered as an instantaneous help.

Dow Jones Index – Day by day Chart

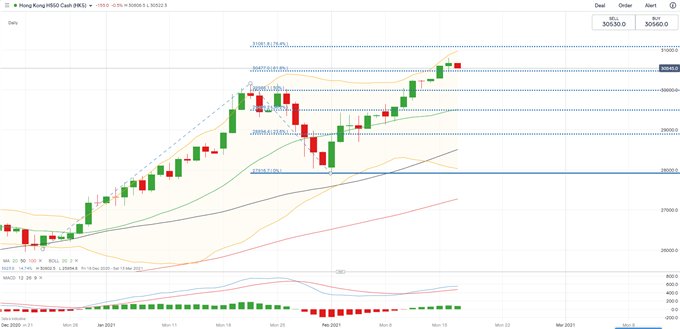

Cling Seng Index Technical Evaluation:

The Cling Seng Index broke above a key resistance degree of 30,140 and has since opened the door for additional upside potential. The index is hitting the higher Bollinger Band, suggesting {that a} technical pullback is feasible earlier than making an attempt for greater highs. Fast help and resistance ranges could be discovered at 30,477 (61.8% Fibonacci extension) and 31.080 (76.4% Fibonacci extension) respectively.

Cling Seng Index – Day by day Chart

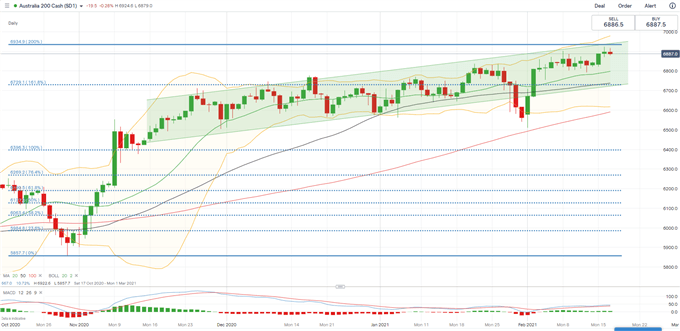

ASX 200 Index Technical Evaluation:

The ASX 200 index is trending greater throughout the “Ascending Channel” as highlighted beneath. The general pattern stays bullish-biased as steered by upward-sloped Transferring Averages. A direct resistance degree could be discovered at 6,935 (the 200% Fibonacci extension), and an instantaneous help degree could be discovered at 6,780 (20-Day SMA).

ASX 200 Index – Day by day Chart

Advisable by Margaret Yang, CFA

Constructing Confidence in Buying and selling

— Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Feedback part beneath or @margaretyjy on Twitter