Here's what it is advisable to know as we begin a brand new week and month the place seasonality comes into play in what's his

Here’s what it is advisable to know as we begin a brand new week and month the place seasonality comes into play in what’s historically a risky month for the foreign exchange market:

The week and month ended as we’re prone to proceed with volatility within the FX house induced by a giant bounce within the US greenback vs the yen.

Japan’s finance ministry was warning concerning the yen’s “speedy” rise. Consequently, USD/JPY’s low averted 104.19 key helps and it rose again to the Might-June low by 106 that it broke beneath per week in the past.

The rebound within the pair performed a major position within the greenback’s broader demand throughout FX.

The transfer basically stripped again the entire arduous work carried out the earlier Friday beneath 106 USD/JPY which had helped gasoline final week’s sell-off within the dollar.

Friday’s foreign exchange value motion and predominant tales

In the meantime, it was a day of greenback brief masking throughout the G10s.

EUR/USD had set a 26 month excessive earlier than vendor’s emerged in early European commerce which had taken the pair all the way down to 1.1850 from Asia’s 1.1909 highs. New York continued to promote and the pair made a low of 1.1762. As talked about, the yen was a driver in foreign exchange so had it not been for features within the cross, the key would probably have been trying deeper down into the abyss. EUR/JPY bids buoyed the one unit, with a check of 125.20 earlier than easing again beneath the determine to 124.75 in direction of the shut.

Yen jawboning will probably go away the greenback in a peddle stool in risk-off situations which leaves the bears susceptible of additional upside in USD/JPY in what’s seasonally a poor month for danger urge for food. The June and Might lows have been examined on Friday and will come underneath renewed strain following potential and an preliminary fades if 105.20/50s assist construction holds.

GBP/USD fell in need of the March highs close to the 1.32 degree in what has been an exceptional month for cable bulls, in what can solely be described because the regulation of inertia influencing the value rallying from the mid 1.2250s regardless of the Brexit tail-risks.

AUD, representing the commodity advanced, set a 17-month excessive in early Europe at 0.7227. The pair was, nonetheless, dropping again to a low of 0.7133 for the day in NY, holding at prior resistance and assist construction the place it’s going to face the bears once more firstly of the week the place we now await the Reserve Financial institution of Australia. Much like the euro, had it not been for intense yen promoting, supporting AUD/JPY, decrease ranges may need been anticipated to problem the bull’s commitments at such a important degree because the 0.7060s are within the every day chart.

Extra to return within the Chart of the Day…

For the day forward, July PMI information will set the tone on Monday and we may have Chinese language Caixin Manufacturing PMI in Asia to begin with. This information will observe China’s July manufacturing PMI which final week surprisingly elevated to 51.1 from 50.9 in June, its highest since Mar 20.

DXY come again chance simply elevated

The steep decline within the DXY for July, a 4.4% loss, was its worst month-to-month proportion drop in a decade.

Right here is a few background to the greenback’s latest decline:

It’s August, a month the place nearly all of the world often goes on vacation.

This month has been the worst month for international equities, which might counsel, the greenback ought to thrive.

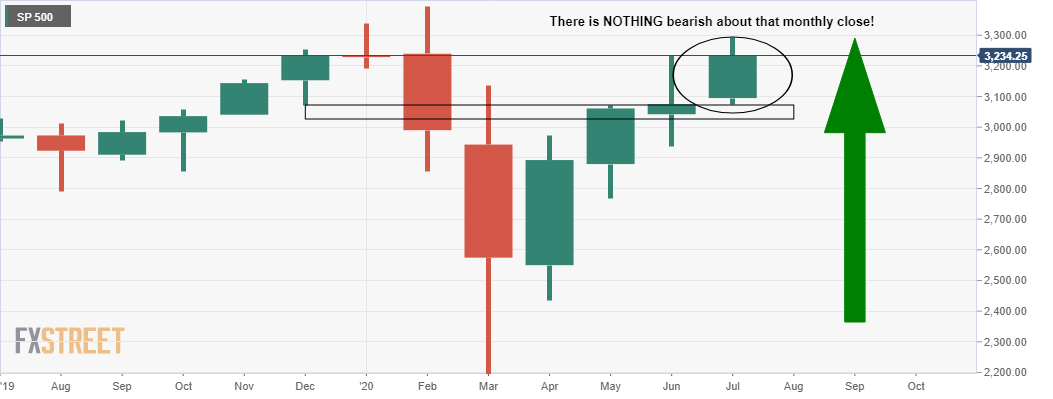

Nonetheless, there’s nothing in any respect bearish trying on the charts of US shares following final week’s tremendous busy week which included the Federal Reserve, Congressional testimonies, excellent earnings from a few of the markets largest names and multi-trillion firms corresponding to Amazon, Apple and Fb.

The S&P 500 index led to a extremely bullish place and chart formation:

Nonetheless, all mentioned and carried out, the US greenback has emerged as essentially the most oversold foreign money on the board.

In actual fact, it’s the most oversold since March’s panic plunge in every day RSIs and its most oversold on weekly RSIs since January 2018’s low, which was the bottom since 2011.

Once we look to positioning, the IMM web spec positioning has been revealing the heaviest web spec greenback brief versus the G10 currencies since 2018’s all-time brief extremes.

As we head into this week, the celebs are aligning for a rebound to snap sequence of consecutive days of decrease highs and lows.

DXY weekly chart: 38.2% upside goal

-637319897484541421.png)

The beneath chart reveals the every day stick reaching a resistance construction, so some draw back corrective motion might be anticipated nonetheless.

Taking place to the 4HR timeframe, we are able to see {that a} 38.2% Fib retracement of the closing value motion for final week would have confluence with prior assist and resistance.

-637319906518836470.png)