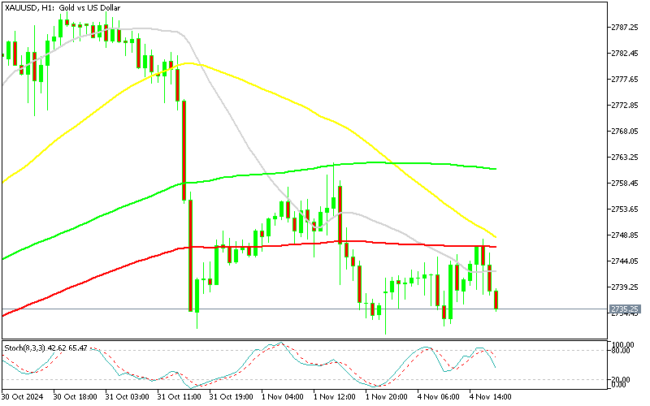

Gold buyers were testing the 100 SMA earlier today, but that moving average turned into resistance, rejecting XAU, so we decided to open a Gold sell signal. The USD has been making some considerable losses, opening with a bearish gap last night, but Gold hasn’t been able to benefit, which shows that the pressure is on the downside.

Gold Chart H1 – The 100 SMA Rejected the Price

In 2024, gold has seen a substantial bullish trend, rising approximately 35% from its starting price of $2,000 and setting multiple records as it approaches $2,800. The rise has been fueled by various factors, including technical indicators and economic uncertainty, but recent market dynamics have become more erratic as the U.S. presidential election approaches.

Election Impacts on Gold Prices

The upcoming U.S. election has intensified market volatility, with both political outcomes potentially impacting gold prices differently:

- Republican Victory: Analysts expect a Republican win to push gold even higher, potentially reaching $3,000 by year-end, with the U.S. dollar (USD) likely to strengthen alongside it.

- Democratic Victory: A Democratic win could ease some uncertainty, likely leading to a correction lower in both gold and the USD.

Record Highs and Technical Support for Gold

Gold recently hit a record high of $2,790, bolstered throughout the year by key technical indicators. One such indicator is the 50 Simple Moving Average (SMA) on the H4 chart, which has consistently provided support for buying pressure. However, at the end of the week, gold prices took a sharp drop. This shift was largely due to:

- A decline in September’s unemployment claims.

- Better-than-expected data on Personal Consumption Expenditures (PCE) inflation.

On Thursday, gold briefly dropped below the 50 SMA for the first time in three weeks, signaling a potential shift in market sentiment. This price movement was accompanied by a notable rise in trading volume, indicating increased demand and necessitating larger transactions.

Economic and Geopolitical Factors

Economic uncertainties and global geopolitical tensions have played a significant role in gold’s price rally throughout 2024. Recent U.S. data, including the CB Employment Trends and Factory Orders report for October, released earlier today, did not present a favorable economic outlook, adding to the complexities influencing gold’s trajectory.

Gold Live Chart

GOLD

www.fxleaders.com