Risk Appetite Attempts a RecoveryOn Monday we witness a very different start to the trading week than we did last week. It would appear that the short

Risk Appetite Attempts a Recovery

On Monday we witness a very different start to the trading week than we did last week. It would appear that the short-lived panic has subsided to more reasonable levels, with the volatility Index (VIX) declining from 65 to just over 20, ahead of the New York open. The Aussie dollar is often viewed as a risk asset in the FX space due to its positive correlation with the S&P 500 and has recovered to some degree in recent trading sessions.

Oil, often viewed as a barometer for the global economy, continues its counter-trend move after a sustained sell-off. Lastly, gold attempted to get back to its all-time high. The precious metal has a reputation for rising in times of geopolitical uncertainty but also tends to benefit as central banks look to unwind years of tight monetary policy. This is because gold is a non-yielding asset and becomes relatively more attractive when interest rates are on the way down.

Recommended by Richard Snow

Get Your Free Gold Forecast

Gold

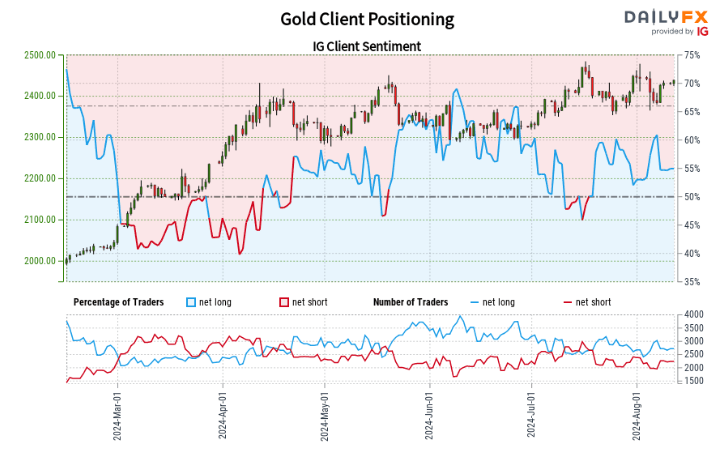

Retail trader data for Gold indicates a slight long bias, with 54.26% of traders net-long and a long-to-short ratio of 1.19 to 1. Net-long traders have increased by 1.07% since yesterday and 12.29% from last week. Net-short traders show a 3.25% increase from yesterday and a 6.33% rise from last week.

Adopting a contrarian view on crowd sentiment suggests potential further downside for Gold prices.

However, the mixed signals ‘less net-long than yesterday but more net-long than last week’ combined with recent changes in positioning, result in a complex trading bias for Gold. The combination of current sentiment and recent changes gives us a further mixed Gold trading outlook.

Gold (Daily) Price Chart with Sentiment Overlayed

Source: TradingView, prepared by Richard Snow

Oil (US Crude)

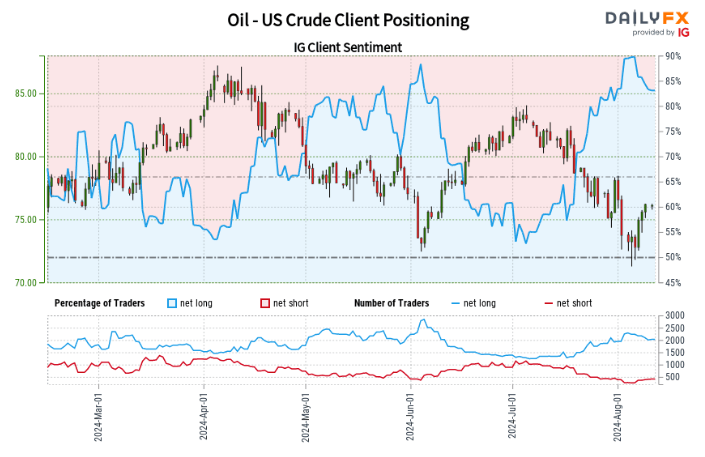

US Crude: An overwhelming 82.73% of retail traders are net-long on Oil – US Crude, with a long-to-short ratio of 4.79 to 1. Net-long traders have increased by 1.78% from yesterday but decreased by 5.84% from last week. Net-short traders show an increase of 2.86% since yesterday and a significant 36.39% rise from last week.

Our contrarian stance on crowd sentiment indicates potential further declines in Oil – US Crude prices.

Nevertheless, the decrease in net-long positions over the week, coupled with the substantial increase in net-short positions, suggests a possible upward price reversal. This is notable despite the prevailing net-long bias among traders.

Oil (Daily) Price Chart with Sentiment Overlayed

Source: TradingView, prepared by Richard Snow

AUD/USD

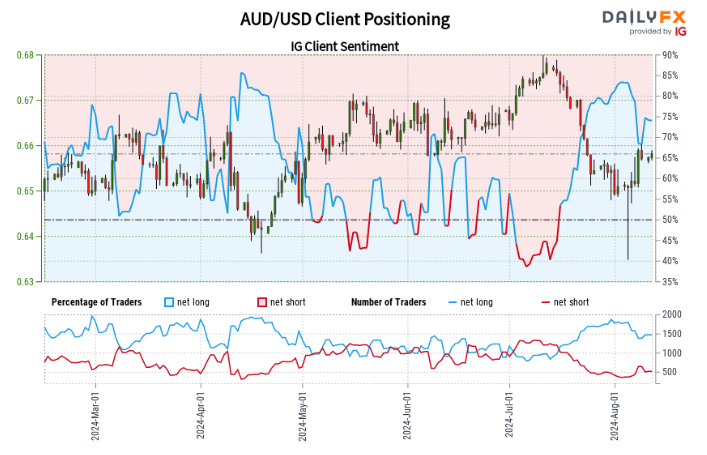

Retail trader data reveals a significant long bias in the AUD/USD market, with 73.38% of traders holding net-long positions. The ratio of long to short traders stands at 2.76 to 1. Compared to yesterday, there’s a 3.49% increase in net-long traders, but a 7.34% decrease from last week. Net-short traders have seen an 8.12% increase since yesterday and a substantial 65.38% rise from last week.

We typically take a contrarian view to crowd sentiment, suggesting AUD/USD prices may continue to fall.

However, the reduction in net-long positions compared to both yesterday and last week, combined with the increase in net-short positions, hints at a possible upcoming reversal to the upside. This is despite the overall net-long bias that remains in place.

AUD/USD (Daily) Price Chart with Sentiment Overlayed

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com