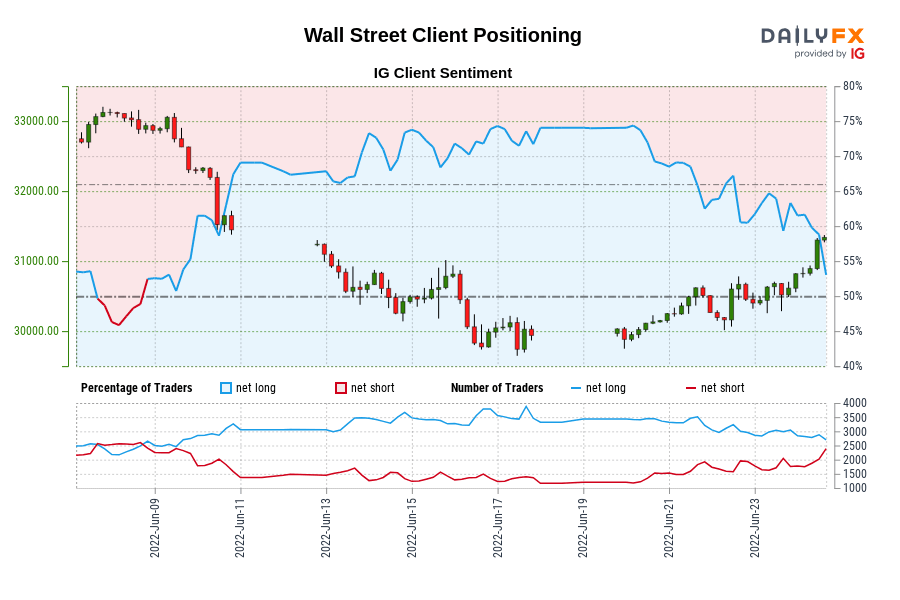

Number of traders net-short has increased by 89.98% from last week. SYMBOL TRADING BIAS NET-LONG% NET-SHORT% CHANGE IN LONGS CHANGE IN SHORTS C

Number of traders net-short has increased by 89.98% from last week.

|

SYMBOL |

TRADING BIAS |

NET-LONG% |

NET-SHORT% |

CHANGE IN LONGS |

CHANGE IN SHORTS |

CHANGE IN OI |

|

Wall Street |

BULLISH |

49.89% |

50.11% |

-14.40%

-28.50% |

34.63%

89.98% |

4.71%

3.99% |

Wall Street: Retail trader data shows 49.89% of traders are net-long with the ratio of traders short to long at 1.00 to 1. In fact, traders have remained net-short since Jun 08 when Wall Street traded near 32,936.00, price has moved 4.86% lower since then. The number of traders net-long is 14.40% lower than yesterday and 28.50% lower from last week, while the number of traders net-short is 34.63% higher than yesterday and 89.98% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Wall Street prices may continue to rise.

Our data shows traders are now net-short Wall Street for the first time since Jun 08, 2022 when Wall Street traded near 32,936.00. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Wall Street-bullish contrarian trading bias.

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com