Variety of merchants net-short has decreased by 17.04% from final week.

|

SYMBOL |

TRADING BIAS |

NET-LONG% |

NET-SHORT% |

CHANGE IN LONGS |

CHANGE IN SHORTS |

CHANGE IN OI |

|

GBP/USD |

BEARISH |

50.93% |

49.07% |

28.51%

35.76% |

-0.36%

-17.04% |

12.51%

3.45% |

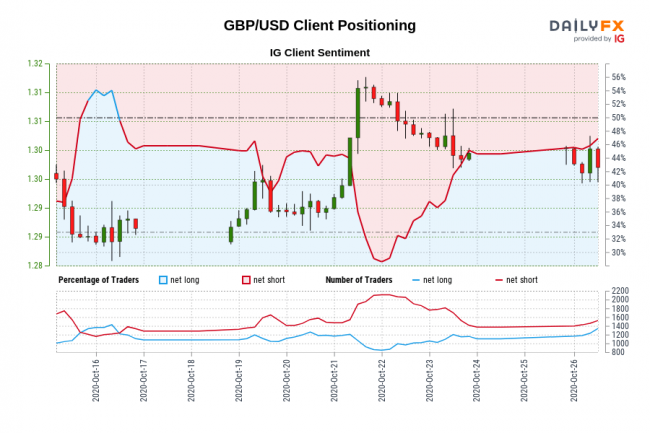

GBP/USD: Retail dealer information exhibits 50.93% of merchants are net-long with the ratio of merchants lengthy to brief at 1.04 to 1. In reality, merchants have remained net-long since Oct 16 when GBP/USD traded close to 1.29, value has moved 0.80% increased since then. The variety of merchants net-long is 28.51% increased than yesterday and 35.76% increased from final week, whereas the variety of merchants net-short is 0.36% decrease than yesterday and 17.04% decrease from final week.

We sometimes take a contrarian view to crowd sentiment, and the very fact merchants are net-long suggests GBP/USD costs could proceed to fall.

Our information exhibits merchants are actually net-long GBP/USD for the primary time since Oct 16, 2020 when GBP/USD traded close to 1.29. Merchants are additional net-long than yesterday and final week, and the mixture of present sentiment and up to date adjustments offers us a stronger GBP/USD-bearish contrarian buying and selling bias.