Variety of merchants net-short has decreased by 22.82% from final week. SYMBOL TRADING BIAS NET-LONG% NET-SHORT% CHANGE IN LONGS CHANGE IN SH

Variety of merchants net-short has decreased by 22.82% from final week.

|

SYMBOL |

TRADING BIAS |

NET-LONG% |

NET-SHORT% |

CHANGE IN LONGS |

CHANGE IN SHORTS |

CHANGE IN OI |

|

EUR/GBP |

BEARISH |

74.12% |

25.88% |

11.35%

13.76% |

-0.77%

-22.82% |

7.93%

1.33% |

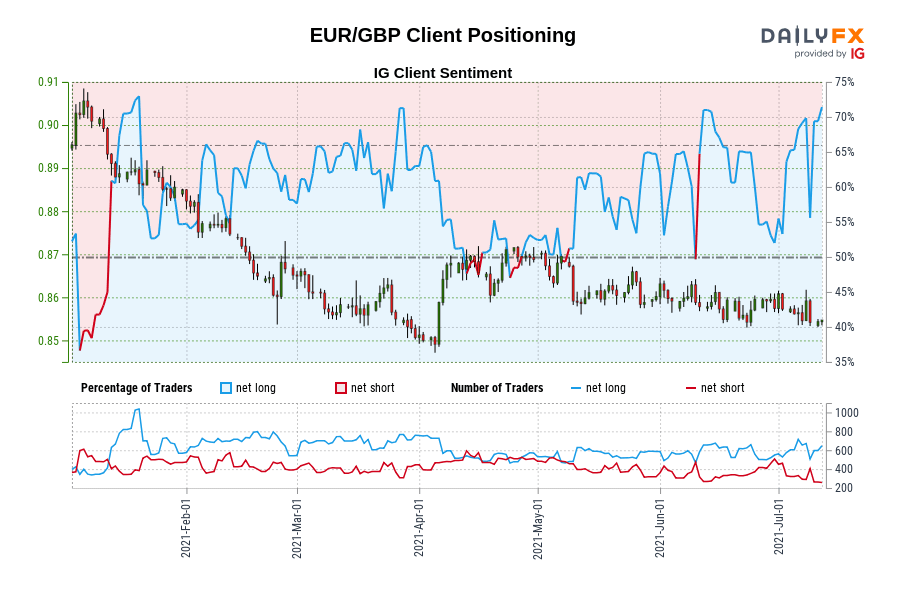

EUR/GBP: Retail dealer information exhibits 74.12% of merchants are net-long with the ratio of merchants lengthy to brief at 2.86 to 1. Our information exhibits merchants at the moment are at their most net-long EUR/GBP since Jan 19 when EUR/GBP traded close to 0.89. The variety of merchants net-long is 11.35% larger than yesterday and 13.76% larger from final week, whereas the variety of merchants net-short is 0.77% decrease than yesterday and 22.82% decrease from final week.

We sometimes take a contrarian view to crowd sentiment, and the actual fact merchants are net-long suggests EUR/GBP costs could proceed to fall.

Merchants are additional net-long than yesterday and final week, and the mixture of present sentiment and up to date adjustments offers us a stronger EUR/GBP-bearish contrarian buying and selling bias.

component contained in the

component. That is most likely not what you meant to do!Load your utility’s JavaScript bundle contained in the component as a substitute.

www.dailyfx.com