Variety of merchants net-short has elevated by 3.26% from final week. SYMBOL

Variety of merchants net-short has elevated by 3.26% from final week.

|

SYMBOL |

TRADING BIAS |

NET-LONG% |

NET-SHORT% |

CHANGE IN LONGS |

CHANGE IN SHORTS |

CHANGE IN OI |

|

BULLISH |

49.60% |

50.40% |

-2.60%

-24.75% |

14.80%

3.26% |

5.45%

-12.83% |

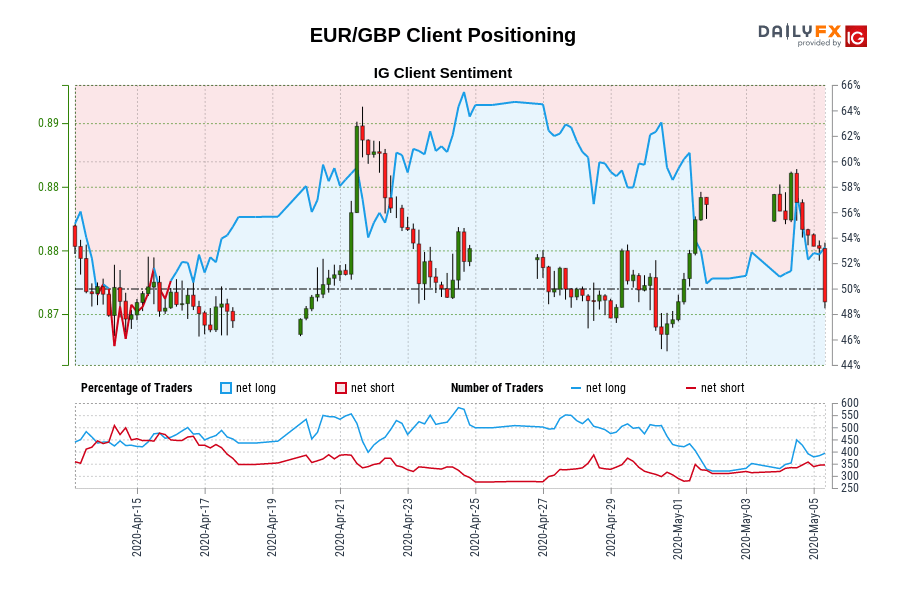

EUR/GBP: Retail dealer information reveals 49.60% of merchants are net-long with the ratio of merchants brief to lengthy at 1.02 to 1. In reality, merchants have remained net-short since Apr 15 when EUR/GBP traded close to 0.87, value has moved 0.06% increased since then. The variety of merchants net-long is 2.60% decrease than yesterday and 24.75% decrease from final week, whereas the variety of merchants net-short is 14.80% increased than yesterday and three.26% increased from final week.

We sometimes take a contrarian view to crowd sentiment, and the very fact merchants are net-short suggests EUR/GBP costs might proceed to rise.

Our information reveals merchants at the moment are net-short EUR/GBP for the primary time since Apr 15, 2020 when EUR/GBP traded close to 0.87. Merchants are additional net-short than yesterday and final week, and the mix of present sentiment and up to date modifications provides us a stronger EUR/GBP-bullish contrarian buying and selling bias.