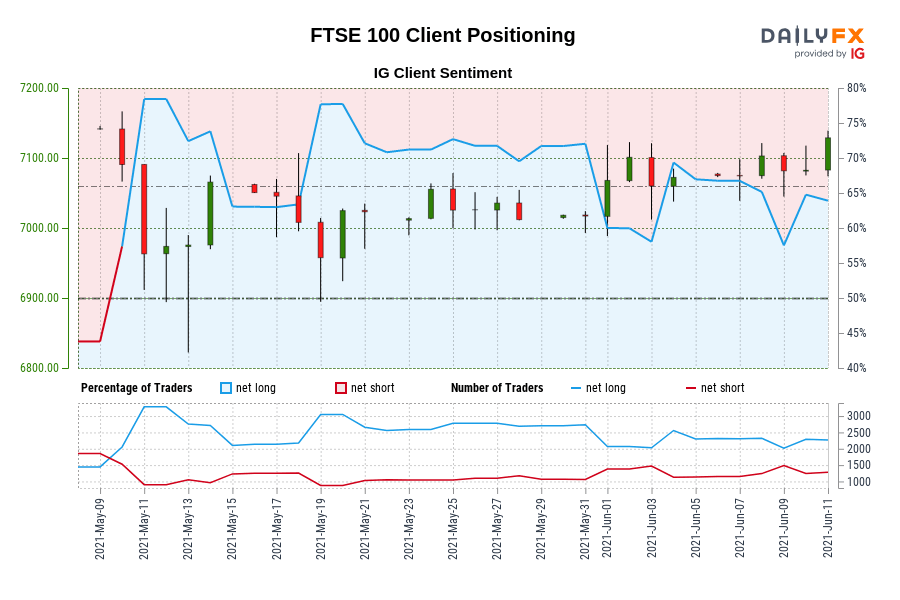

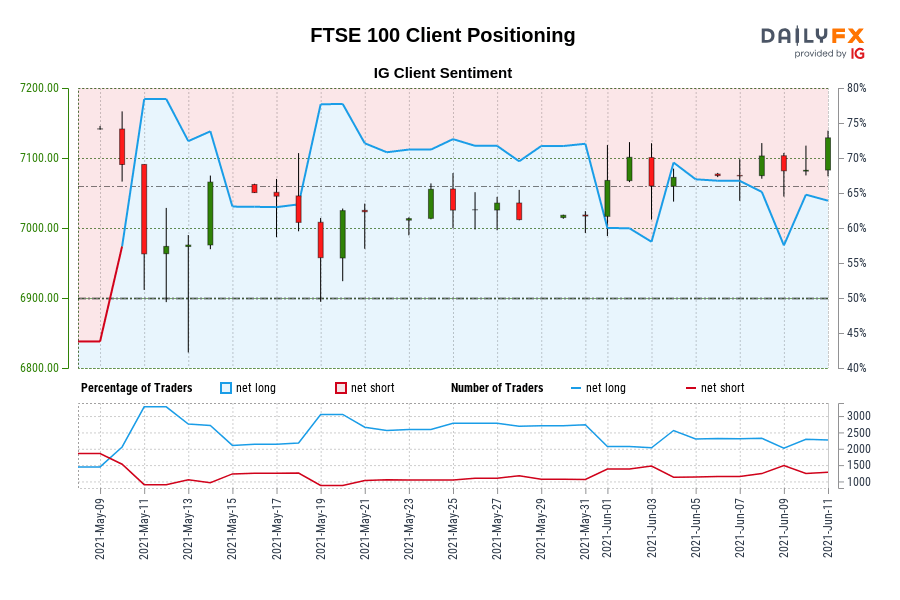

Variety of merchants net-short has elevated by 61.74% from final week. SYMBOL TRADING BIAS NET-LONG% NET-SHORT% CHANGE IN LONGS CHANGE IN SHO

Variety of merchants net-short has elevated by 61.74% from final week.

|

SYMBOL |

TRADING BIAS |

NET-LONG% |

NET-SHORT% |

CHANGE IN LONGS |

CHANGE IN SHORTS |

CHANGE IN OI |

|

FTSE 100 |

BULLISH |

49.37% |

50.63% |

-14.13%

-29.40% |

28.67%

61.74% |

3.26%

-1.22% |

FTSE 100: Retail dealer knowledge reveals 49.37% of merchants are net-long with the ratio of merchants brief to lengthy at 1.03 to 1. In reality, merchants have remained net-short since Could 10 when FTSE 100 traded close to 7,090.70, value has moved 0.54% greater since then. The variety of merchants net-long is 14.13% decrease than yesterday and 29.40% decrease from final week, whereas the variety of merchants net-short is 28.67% greater than yesterday and 61.74% greater from final week.

We usually take a contrarian view to crowd sentiment, and the very fact merchants are net-short suggests FTSE 100 costs could proceed to rise.

Our knowledge reveals merchants at the moment are net-short FTSE 100 for the primary time since Could 10, 2021 when FTSE 100 traded close to 7,090.70. Merchants are additional net-short than yesterday and final week, and the mix of present sentiment and up to date adjustments provides us a stronger FTSE 100-bullish contrarian buying and selling bias.

aspect contained in the

aspect. That is most likely not what you meant to do!nn Load your utility’s JavaScript bundle contained in the aspect as a substitute.www.dailyfx.com