Retail Trader Sentiment Analysis – Gold, Silver, and US Oil Recommended by Nick Cawley Building Confidence in Trading Gold Reta

Retail Trader Sentiment Analysis – Gold, Silver, and US Oil

Recommended by Nick Cawley

Building Confidence in Trading

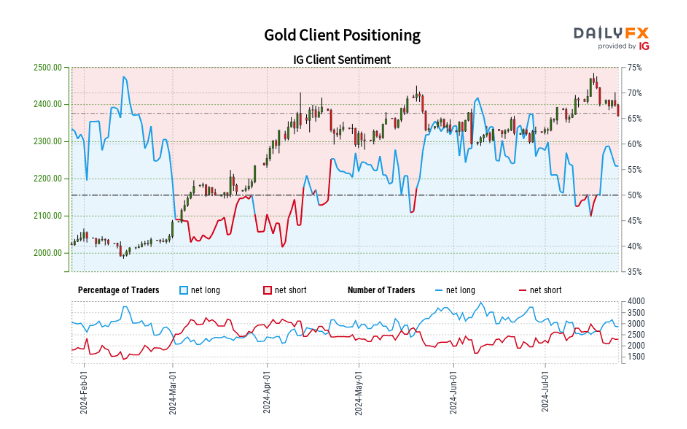

Gold Retail Trader Data: Mixed Bias

Analysis of the latest gold positioning shows:

Current positioning:

- 54.14% of traders are net-long

- Ratio of long to short traders is 1.18 to 1

Recent changes:

- Net-long traders: 16.62% decrease since yesterday, 1.79% decrease from last week

- Net-short traders: 4.69% decrease since yesterday, 18.73% decrease from last week

Sentiment interpretation:

- Contrarian view suggests gold prices may fall due to net-long positioning

- However, recent changes show a mixed picture

Overall, the data indicates a mixed Gold trading bias

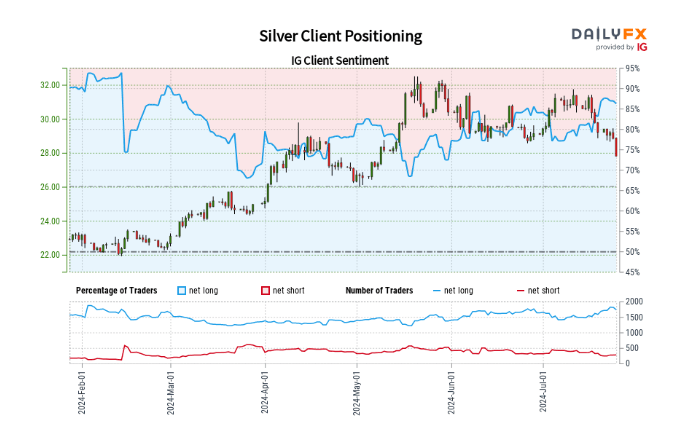

Silver Retail Trader Data: Long Skew but Mixed Sentiment

Analysis of the latest silver positioning shows:

Current positioning:

- 85.13% of traders are net-long

- Ratio of long to short traders is 5.72 to 1

Recent changes:

- Net-long traders: 10.33% decrease since yesterday, 0.12% decrease from last week

- Net-short traders: 1.44% increase since yesterday, 13.76% decrease from last week

Sentiment interpretation:

- Contrarian view suggests Silver prices may fall due to strong net-long positioning

- Recent changes show a slight reduction in net-long positions

Overall, the data indicates a mixed Silver trading bias

| Change in | Longs | Shorts | OI |

| Daily | -8% | -5% | -8% |

| Weekly | 2% | -27% | -3% |

US Oil Retail Trader Data: Mixed Outlook

Analysis of the latest US crude oil positioning shows:

Current positioning:

- 77.94% of traders are net-long

- Ratio of long to short traders is 3.53 to 1

Recent changes:

- Net-long traders: 2.70% decrease since yesterday, 47.71% increase from last week

- Net-short traders: 4.95% increase since yesterday, 43.19% decrease from last week

Sentiment interpretation:

- Contrarian view suggests US crude oil prices may fall due to strong net-long positioning

- Significant weekly changes show a substantial increase in net-long positions

Overall, the data indicates a mixed US crude oil trading bias

Recommended by Nick Cawley

How to Trade Oil

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com