STOCK MARKET FORECAST – S&P 500, DOW JONES, NASDAQ TARGET RECORD HIGHS DESPITE UNEMPLOYMENT SOARING AND CHINA TENSION ESCALAT

STOCK MARKET FORECAST – S&P 500, DOW JONES, NASDAQ TARGET RECORD HIGHS DESPITE UNEMPLOYMENT SOARING AND CHINA TENSION ESCALATING AS FLOYD PROTESTS TURN TO RIOTS

- Inventory costs have rebounded handsomely since mid-March because the S&P 500, Dow Jones Index and Nasdaq Composite recoil sharply again towards all-time highs

- Market sentiment appears simply shy of full euphoria as investor complacency swells in response to the FOMC backstop and hopes for a V-shape financial restoration

- Bullish fairness traders blindly overlook threats from US-China rigidity escalating, double-digit unemployment charges nonetheless rising, and Floyd protests turning into riots

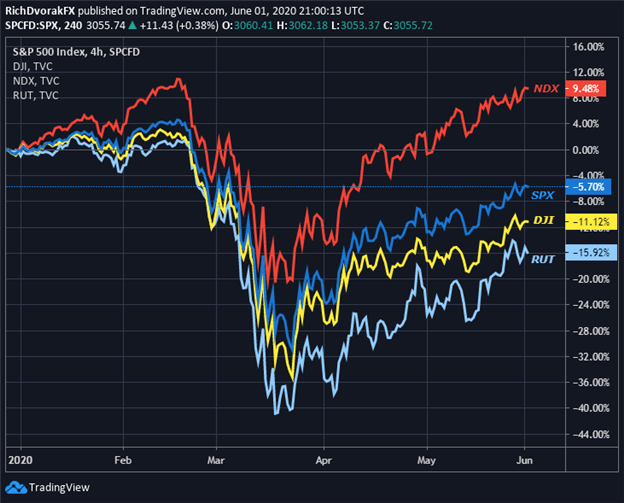

Shares within the S&P 500, Dow Jones and Nasdaq have ripped increased by about 35% since bottoming mid-March. The relentless inventory shopping for bonanza over current weeks has propelled well-liked US fairness benchmarks inside placing distance of their all-time highs notched earlier this 12 months.

Be taught Extra – Variations Between the S&P 500, Dow, Nasdaq

As an illustration, the tech-heavy Nasdaq now rests a mere 1.3% away from its 18 February 2020 shut on the 9,720-price degree after an astonishing restoration from one of many sharpest inventory market selloff in fashionable historical past. This compares to an equally spectacular, although not as sturdy, rebound notched by the S&P 500 and Dow Jones, which commerce about 9% and 13% under their file highs, respectively.

S&P 500 PRICE CHART WITH DOW JONES, NASDAQ OVERLAID: STOCK MARKET INDEX PERFORMANCE (31 DEC 2019 TO 01 JUN 2020)

Chart created by @RichDvorakFX with TradingView

Unprecedented quantities of central financial institution liquidity and authorities stimulus have flooded markets to shore up sentiment and fight financial fallout from the coronavirus pandemic. An expanded FOMC arsenal, just like the Fed backstop for high-yield company debt, mixed with trillions of {dollars} in Treasury purchases, stand out as two overarching drivers which have fueled the eye-popping surge in inventory valuations to ranges final seen in the course of the dot-com bubble practically 20 years in the past.

| Change in | Longs | Shorts | OI |

| Day by day | 12% | -1% | 2% |

| Weekly | 4% | -4% | -2% |

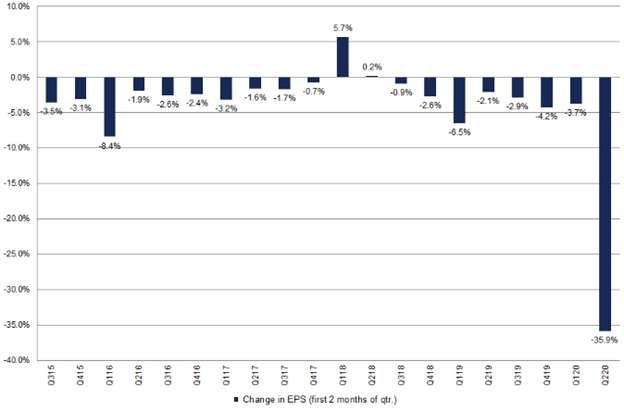

This has largely allowed the S&P 500 Index to defy the gravitational pull decrease from collapsing inventory market earnings. The unbelievable comeback by shares appears more and more out of contact with actuality, nonetheless, as investor complacency builds and unwavering threat urge for food crushes volatility.

S&P 500 EARNINGS PER SHARE ESTIMATES FOR 2Q-2020 (% CHANGE)

Chart Supply: FactSet

Along with S&P 500 EPS estimates freefalling, the variety of unemployed grows by the tens of millions each week, and layoffs don’t look non permanent on stability as job losses mount. Additionally, after spending months in lockdown to cease the coronavirus from spreading, which paralyzed the worldwide economic system and prompted 1Q-2020 US GDP to collapse by a staggering 5%, People now collect by 1000’s amid violent protests over the demise of George Floyd throughout main cities like Minneapolis, Los Angeles, and Chicago.

Really useful by Wealthy Dvorak

Traits of Profitable Merchants

To not point out, as US-China rigidity escalates within the wake of the coronavirus pandemic, Washington and Beijing have lobbed more and more terse remarks backwards and forwards over current weeks, which additionally follows the alleged blow to Hong Kong autonomy as a result of newest nationwide safety legislation imposed. Although particulars from the Trump-China presser final Friday revealed little urge for food from the White Home to impose contemporary tariffs or scrap the part one commerce deal.

Be taught Extra – A Transient Historical past of Commerce Wars: Timeline of Occasions Affecting International Commerce & Monetary Markets

This supplied a strong enhance to shares and different pro-risk belongings just like the Australian Greenback. The transfer may show short-lived, nonetheless, contemplating reviews over the weekend that Chinese language officers, in a rebuke to Trump, advised prime state-run agricultural companies to draw back from buying American farm items like soybeans.

Really useful by Wealthy Dvorak

Introduction to Foreign exchange Information Buying and selling

Moreover, the financial calendar signifies that a number of heavy-hitting information releases are anticipated this week, like PMI reviews and nonfarm payrolls, which have potential to catalyze a deterioration in market sentiment. Whereas more and more less-horrendous information readings may present a cause for optimism, and maybe help increased inventory costs, it’s tough to dismiss the truth that over 25 million People are unemployed and look previous the secondary ‘domino impact’ on shopper confidence, financial savings, and consumption.

Really useful by Wealthy Dvorak

Get Your Free Prime Buying and selling Alternatives Forecast

Correspondingly, whereas traders overlook the aforementioned bearish headwinds,S&P 500 value outlook appears progressively skewed to the draw back because the inventory market index fluctuates round astronomically excessive valuations. Shares might proceed marching increased, nonetheless, in mild of the trending market and absence of a catalyst that carries sufficient impetus to ignite a reversal. Nonetheless, it appears more and more seemingly the S&P 500 may succumb to a dangerous destiny if a day of reckoning dishes complacent traders a wholesome serving of financial actuality.

Learn Extra – Inventory Market Forecast: Ought to I Promote in Might and Go Away?

— Written by Wealthy Dvorak, Analyst for DailyFX.com

Join with @RichDvorakFX on Twitter for real-time market perception