S&P 500 PRICE OUTLOOK: VIX FEAR-GAUGE JUMPS AS FISCAL STIMULUS TALKS FAIL TO BEAR FRUITS&P 500 worth motion pivoted decre

S&P 500 PRICE OUTLOOK: VIX FEAR-GAUGE JUMPS AS FISCAL STIMULUS TALKS FAIL TO BEAR FRUIT

- S&P 500 worth motion pivoted decrease from intraday highs as dealer optimism for extra coronavirus support light all through the buying and selling session

- Home Speaker Pelosi dismissed the newest try by Treasury Secretary Mnuchin to succeed in an settlement on one other fiscal stimulus package deal

- The VIX Index, or fear-gauge, continues to edge increased as traders search to hedge in opposition to daunting draw back dangers confronted shares

Shares closed Thursday’s buying and selling session increased with the S&P 500, Dow Jones, and Nasdaq gaining 0.53%, 0.13%, and 1.42% respectively. The S&P 500 Index prolonged its advance as main inventory indices proceed clawing again draw back from September’s sharp slide. Returning threat urge for food and enhancing market sentiment appears to largely comply with information that US politicians have returned to the negotiating desk for discussions on deploying one other coronavirus support package deal.

Newest fiscal stimulus talks appear to be going nowhere, nonetheless, based on the newest commentary from Home Speaker Nancy Pelosi. The $1.6-trillion fiscal stimulus deal proposed by Treasury Secretary Steven Mnuchin on behalf of the Trump administration continues to be far wanting the $2.0-plus trillion price ticket wanted by Democrats. Pelosi pouring chilly water on the fiscal stimulus deal following a cellphone name with Mnuchin Thursday afternoon prompted shares to give up a good portion of intraday positive factors.

Advisable by Wealthy Dvorak

Get Your Free Equities Forecast

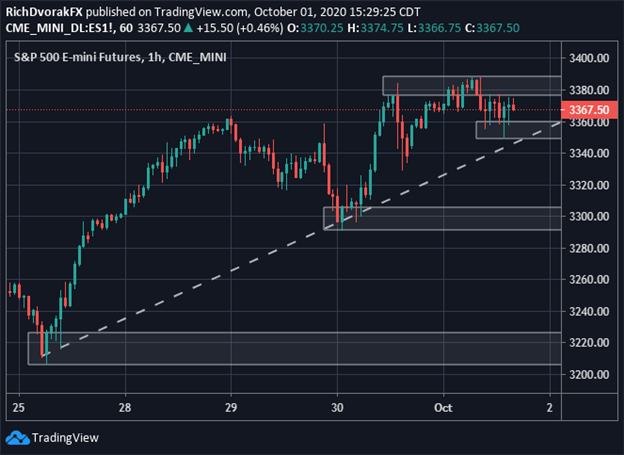

S&P 500 PRICE CHART: 1-HOUR TIME FRAME (25 SEP TO 01 OCT 2020)

Chart created by @RichDvorakFX with TradingView

The mounting want for extra fiscal stimulus has been echoed by Fed Chair Jerome Powell in current congressional testimonies. Seeing that shares hinge largely on accommodative coverage from each financial and monetary authorities, failure to go one other coronavirus support package deal has potential to ship the S&P 500 plunging for one more take a look at September lows close to the three,200-price degree. That stated, lingering uncertainty round whether or not or not Republicans and Democrats will break the political gridlock possible drove right this moment’s bid beneath the S&P 500 VIX Index, or fear-gauge, as traders hedge in opposition to potential draw back dangers.

Advisable by Wealthy Dvorak

Introduction to Foreign exchange Information Buying and selling

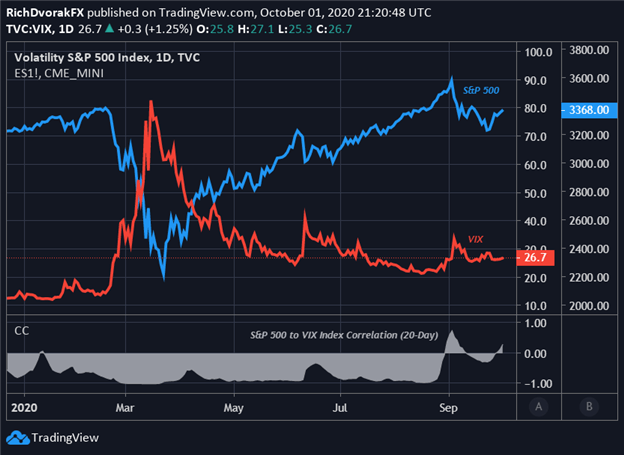

VIX INDEX PRICE CHART: DAILY TIME FRAME (25 JUN TO 01 OCT 2020)

Chart created by @RichDvorakFX with TradingView

Although some say technical evaluation on the VIX Index is a chart crime, and whereas there’s some credence to that college of thought, I wish to argue that patterns and tendencies of underlying investor demand for draw back safety may be noticed. On that observe, the VIX ‘fear-gauge’ turned sharply increased early final month as shares launched into a textbook correction by falling 10% from all-time highs notched in August.

Advisable by Wealthy Dvorak

Traits of Profitable Merchants

The VIX Index spiked nicely into the 30.00-handle from the 22.00-level in response, however as equities rebounded because of rekindled stimulus negotiations in addition to the averted authorities shutdown, the VIX subsequently pulled again. Trying forward, a breach of final month’s low on the VIX Index close to the 25.00-mark might sign that investor demand for draw back safety is dwindling and threat urge for food is rising.

S&P 500 PRICE CHART WITH VIX INDEX OVERLAID: DAILY TIME FRAME (DEC 2019 TO OCT 2020)

Chart created by @RichDvorakFX with TradingView

If materialized, this may correspond with a topside breakout by the S&P 500 above technical resistance on the 3,400-price degree given the inverse relationship usually held by the S&P 500 and VIX Index. But, it’s price mentioning that the S&P 500 to VIX Index 20-day correlation not too long ago turned constructive because it did mid-January and late-August. In flip, this could possibly be sending a foul omen to inventory market bulls if historical past is to repeat itself.

| Change in | Longs | Shorts | OI |

| Every day | 0% | 3% | 2% |

| Weekly | -20% | 25% | 4% |

Additionally, the VIX Index at present gravitates round its now positively-sloped 50-day transferring common. Anticipated market volatility has potential to remain comparatively elevated round present ranges in gentle of evident uncertainty that stems from the US presidential election proper across the nook. To not point out, October is traditionally probably the most unstable and worst performing month for the S&P 500 Index, which poses an extra headwind for shares.

Hold Studying: US Greenback Bounces Off Help Amid Key Financial Information Releases

— Written by Wealthy Dvorak, Analyst for DailyFX.com

Join with @RichDvorakFX on Twitter for real-time market perception