The cryptocurrency market has taken everyone’s attention this year, after making massive gains in different periods, while the volatility has been

The cryptocurrency market has taken everyone’s attention this year, after making massive gains in different periods, while the volatility has been enormous, offering many great trading opportunities. We have concentrated our long-term signals on cryptocurrencies, but we continue to issue trading signals in forex pairs as well, most of them being short-term trades though.

Yesterday we opened two forex signals in EUR/USD and AUD/USD . These pairs have been bearish for many months now, since the FED started giving signs that they were going to finally accept that inflation was surging in the US. Back at the beginning of summer when the USD started to turn bullish, inflation moved above 5%, while now it is heading for 7%.

AUD/USD H4 Chart – The 100 SMA Providing Resistance

MAs keep pushing AUD/USD down

The FED has started to tighten the monetary policy and they are getting increasingly worried as we have heard in recent comments. Some FED members want a faster tightening pace, so the USD has reasons to rally, while the European Central Bank (ECB) is still in the process of trying to accept inflation.

The meeting minutes from the Reserve Bank of Australia were released last night, with the RBA deciding to start the tapering process of the QE programme in next month’s meeting and end it in May 2022. Although, that was anticipated so there was not much reaction to this news. The RBA did sound worried about the new covid variant.

The minutes said that “these options reflected the expectation that the economy would continue to bounce back”. “The emergence of the omicron variant was a new source of uncertainty, but it was not expected to derail the recovery.”

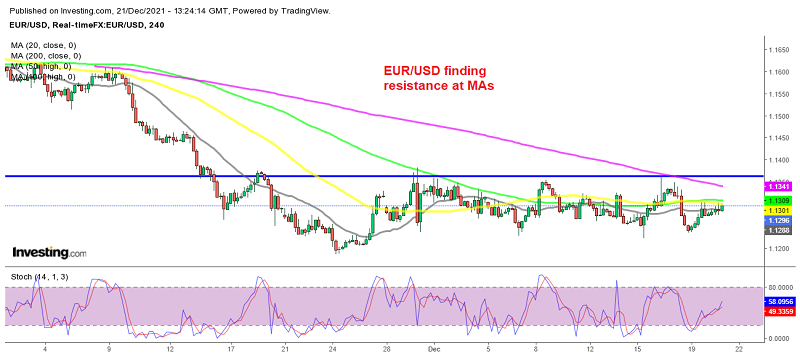

So, EUR/USD and AUD/USD have been retracing higher, although the larger trend is still bearish. The retrace might be over soon, as moving averages are providing resistance for both pairs, while buyers seem to have stopped pushing higher. We are long on these two pairs since last night, so we are waiting for the bearish trend to resume.

EUR/USD

www.fxleaders.com