Silver, XAG/USD, Copper, US Presidential Election, Technical Evaluation - Speaking FactorsSilver and Copper costs consolidating f

Silver, XAG/USD, Copper, US Presidential Election, Technical Evaluation – Speaking Factors

- Silver and Copper costs consolidating forward of US election

- How can the end result affect XAG/USD and the pink steel?

- Silver pressuring key resistance as Copper holds on assist

Treasured metals and commodities, equivalent to silver and copper respectively, have been in a consolidative state because the finish of September. Buyers have been saved on the sting, awaiting the end result of one other fiscal package deal from the world’s largest economic system. Now, with the US presidential election simply across the nook, how can its end result provide what’s to come back for XAG/USD and the ‘pink steel’?

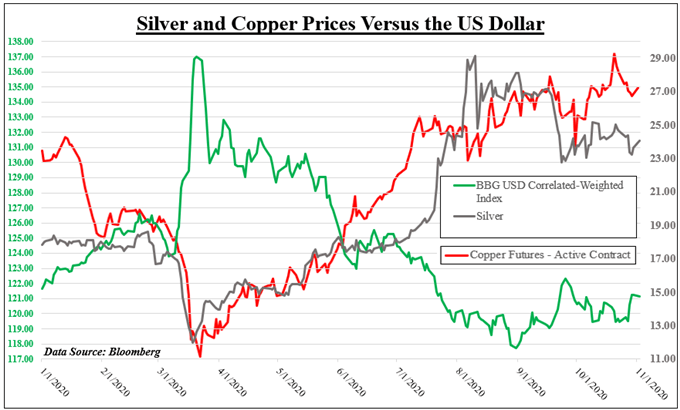

On the chart beneath, I’ve highlighted the comparatively inverse relationship between the haven-linked US Greenback and with silver and copper all through this 12 months. XAG/USD can at instances be seen as an anti-fiat hedge, much like gold. A by-product of easing measures the Federal Reserve took this 12 months to assist the economic system was a less expensive greenback as volatility ebbed. This boosted silver costs, that are nonetheless up over 30% this 12 months.

Really useful by Daniel Dubrovsky

Don’t give into despair, make a recreation plan

Copper is usually seen as a bellwether for international development. After tanking about 30% from January – March through the coronavirus outbreak, the pink steel proceeded to soar over 60% earlier than stabilizing over a month in the past. This doubtless mirrored rising hopes of a restoration as nations internationally launched into stimulus measures, each financial and monetary, to jumpstart a world floor to a halt amid virus-containing lockdowns.

Now within the close to time period, silver and copper costs are awaiting the outcomes of the US election at this time. Along with the destiny of one other stimulus package deal, the continuation of commerce wars are additionally on the desk. Rising prospects of a Biden-win situation have opened the door to extra assist, relying on the make-up of the Senate. This might in flip bode effectively for silver and copper costs.

Try DailyFX’s content material across the US election

A victory for incumbent Donald Trump will doubtless stir volatility within the coming days. That will increase demand for liquid hedges, of which the US Greenback and Treasuries are conventional ones. Such an end result might dent silver and copper costs. As the fireplace settles down nevertheless, fears of escalating US-China tensions might throw off the pink steel’s ascent. Nonetheless, a low-interest-rate surroundings will help soothe draw back potential.

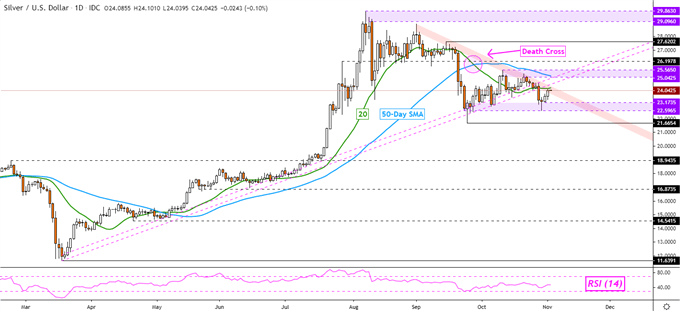

Silver Technical Evaluation

Silver costs are pressuring a descending channel of resistance from late August. The technical outlook is barely tilted to the draw back within the aftermath of a bearish ‘Dying Cross’. That was fashioned in September when the 50-day Easy Shifting Common (SMA) crossed underneath the 20-day SMA. Significant upside progress doubtless entails a push above the 25.04 – 25.56 resistance zone. A resumption of the July prime would place the deal with the September low at 21.66.

| Change in | Longs | Shorts | OI |

| Each day | 1% | 6% | 2% |

| Weekly | -7% | 7% | -6% |

XAG/USD Each day Chart

Chart Created in TradingView

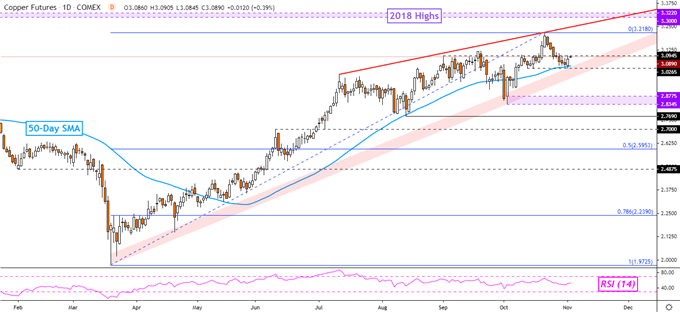

Copper Technical Evaluation

After persistent losses since late October, copper futures paused declining on the 50-day SMA and the higher boundary of a rising channel of assist from March. A climb above the three.0945 inflection level exposes 3.2180 for an try to resume the dominant uptrend in the direction of 2018 highs. In any other case, a drop underneath rising assist exposes the two.8775 – 2.8345 assist zone in the direction of the August low.

Copper Futures Each day Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Forex Analyst for DailyFX.com

To contact Daniel, use the feedback part beneath or @ddubrovskyFX on Twitter