Silver (XAG/USD) Speaking Factors:Silver (XAG/USD) costs stay supported above $23,00 as sentiment stays combined.Jackson Gap Symposium stays a key

Silver (XAG/USD) Speaking Factors:

- Silver (XAG/USD) costs stay supported above $23,00 as sentiment stays combined.

- Jackson Gap Symposium stays a key catalyst for Gold and Silver costs

- US Greenback stays susceptible, all eyes on the Fed

Silver (XAG/USD) costs at present stay supported above the important thing psychological stage of $23.00, sustaining its resilience forward of the Jackson Gap Symposium. As a result of rising Covid-19 circumstances, the summit will now be held nearly over the following two days.

Following final week’s FOMC Assembly minutes the place the Federal Reserve approached inflationary considerations with a extra hawkish tone, Gold, Silver and different safe-haven property gave again a portion of positive aspects as expectations of tapering had been digested by the market, pushing Silver costs to a important stage of assist at $22.90.

Since then, the tone has as soon as once more turned dovish as rising Covid-19 circumstances proceed to weigh on the financial system, putting the Federal Reserve in a troublesome spot as inflation continues to run scorching.

Study How you can Commerce Gold by CombiningTechnical and Elementary Evaluation

Silver (XAG/USD) Value Motion

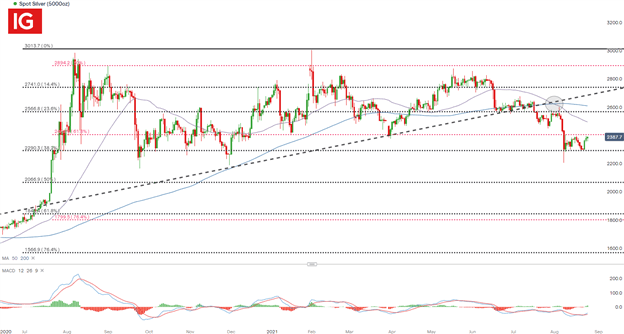

A shift in sentiment has seen Silver retreat from the February 2021 excessive, the place costs retested $30.00. However after falling beneath the 50-period Transferring Common on the weekly time frame, the Transferring Common Convergence/Divergence (MACD) has swiftly been making its means again in direction of the zero line, a sign that Silver bulls have been dropping steam.

Silver (XAG/USD) Weekly Chart

Chart ready by Tammy Da Costa utilizing TradingView

From a shorter-term perspective, the current bearish rhetoric was additional confirmed by the formation of a dying cross on the day by day time frame, which offered bears the chance to drive costs again to the 38.2% Fibonacci retracement of the 2020 – 2021 transfer which continues to offer assist for the dear steel at $22.90.

As sentiment stays combined, geopolitical dangers and rising Covid-19 circumstances has continued to assist demand for safe-haven Silver, permitting value motion to stabilize between the important thing Fibonacci ranges of historic main strikes.

Silver (XAG/USD) Every day Chart

Chart ready by Tammy Da Costa utilizing IG Charts

Ought to bulls want to regain dominance over the systemic, outstanding development, a break above the 50% retracement of $25.86 could also be required.

Likewise, for the bearish narrative to persist, bears shall be required to drive costs beneath $23.00.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and comply with Tammy on Twitter: @Tams707

component contained in the

component. That is in all probability not what you meant to do!Load your utility’s JavaScript bundle contained in the component as a substitute.

www.dailyfx.com