Small Caps, Copper, EM FX Poised to Outpace Coming into 1Q’21, my expectation was that “on this low rate of interest world with pent up mixture de

Small Caps, Copper, EM FX Poised to Outpace

Coming into 1Q’21, my expectation was that “on this low rate of interest world with pent up mixture demand and important slack on the planet’s main economies, there may be ample room for progress. If progress is the story of 2021, the underperformers of early-2020 ought to do nicely.”

Thematically, as a long-term place dealer, my viewpoint has not modified; nevertheless, it’s value acknowledging outperformances and underperformances to this point. Notably: I anticipated, however underappreciated, the tempo with which US Treasury yields would rise firstly of the yr.

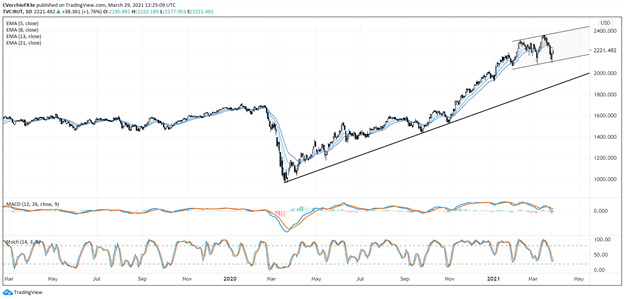

US Russell 2000 (RUT) Technical Evaluation: Each day Chart (March 2019 to March 2021)

Chart ready by Christopher Vecchio, created with TradingView

In early January, it was famous that “small cap and mid cap shares ought to outperform giant caps ex-tech, and to this finish, the Russell 2000 affords extra potential than the S&P 500. However the Nasdaq 100 nonetheless appears to be like prefer it needs increased; the symmetrical triangle breakout in early-December 2020 seems to be simply getting began.”

The Russell 2000 is up by +12.48% in 2021 whereas the S&P 500 is up by +6.07%. Nevertheless, the Nasdaq 100 is barely up by +0.70%. Tech could proceed to lag in 2Q’21 because the asset allocation churn continues in the direction of growth-sensitive, small- and mid-cap equities. With that backdrop, the Russell 2000 ought to outpace the S&P 500, which ought to outpace the Nasdaq 100.

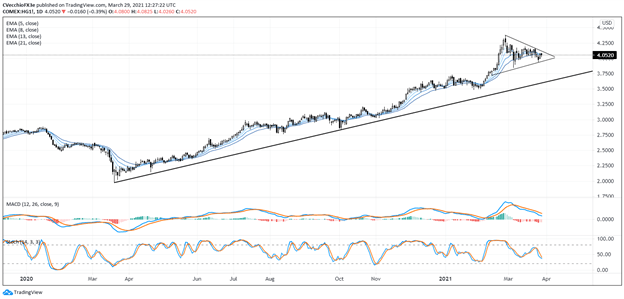

Copper (XCU/USD) Technical Evaluation: Each day Chart (December 2019 to March 2021)

Chart ready by Christopher Vecchio, created with TradingView

Nothing adjustments when it comes to my outlook for the metals: “copper and silver seem poised to outperform gold, which generally trails during times with excessive liquidity and excessive progress (I like blended publicity of lengthy copper and quick gold, or lengthy silver and quick gold, which probably curtail upside potential however add diversification to portfolio composition).” The truth is, copper costs look like in a symmetrical triangle as 1Q’21 involves an finish; the copper/gold ratio has been flagging, poised to proceed within the course favoring increased copper costs relative to gold.

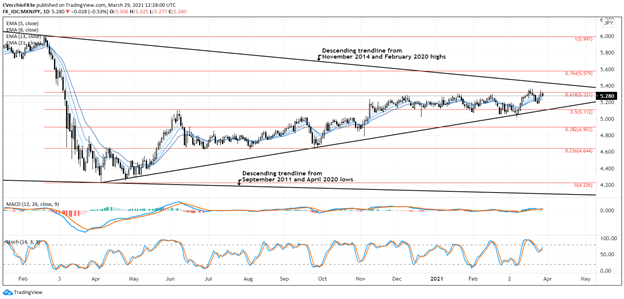

MXN/JPY Technical Evaluation: Each day Chart (January 2020 to March 2021)

Chart ready by Christopher Vecchio, created with TradingView

Admittedly, I used to be not optimistic sufficient in regards to the British Pound coming into 1Q’21 (though my tune shortly modified). Given the variations in vaccination charges between the UK and the EU, in addition to the trajectory of ‘home downside fixing,’ it seems that the long-term viability of the EU is again in query whereas the post-Brexit UK is of little concern. EUR/USD may spend a lot of 2Q’21 buying and selling under 1.2000 whereas GBP/USD could also be biding time earlier than it makes makes an attempt at 1.4000 and 1.4500 within the coming weeks.

Shifting ahead, as we enter the ‘risk-on’ a part of the yr (from a seasonality perspective), EM FX ought to begin to outpace developed FX, with pairs like MXN/JPY and ZAR/JPY outpacing pairs like GBP/CHF or USD/JPY (which didn’t happen in 1Q’21, regardless of expectations in any other case). The Mexican Peso stays fascinating, given the nation’s publicity to the silver commerce because the world’s high exporter of the steel, in addition to its reliance on the US economic system: 30% of Mexican GDP could be attributed to commerce exercise with the US.

Beneficial by Christopher Vecchio, CFA

Get Your Free Prime Buying and selling Alternatives Forecast

component contained in the

component. That is most likely not what you meant to do!nn Load your software’s JavaScript bundle contained in the component as an alternative.www.dailyfx.com