At first, it could seem to be volatility danger was prevented in monetary markets. After the worst week on Wall Road since March,

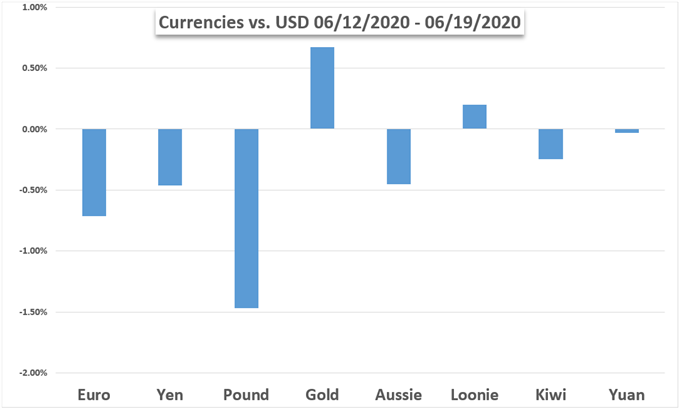

At first, it could seem to be volatility danger was prevented in monetary markets. After the worst week on Wall Road since March, the previous 5 days noticed equities eke out slight good points. But, international trade markets confirmed dynamics of danger aversion. The anti-risk US Greenback and Japanese Yen rose. That is because the growth-oriented Australian Greenback fell. Gold costs remained in range-bound commerce.

Beneficial by David Music

Don’t give into despair, make a sport plan

After a rosy begin, the S&P 500, Dow Jones and Nasdaq Composite struggled to seek out follow-through. Within the background, there appear to be rising fears of a second wave of the coronavirus. New hotspots emerged in Beijing. Within the US, states like California, Florida and Texas reported report single-day rises in Covid-19. In the meantime, the Fed’s steadiness sheet shrank essentially the most this yr.

Rising circumstances could strain native authorities officers to pause or unwind lockdown easing measures. As markets are ahead trying, this might offset additional rosy surprises in financial knowledge from the world’s largest economic system. Merchants shall be awaiting US sturdy items orders, Markit PMIs (manufacturing & companies), private spending and College of Michigan Sentiment.

The Reserve Financial institution of New Zealand and Banco de Mexico (Banxico) have rate of interest choices forward. Traders shall be eyeing their financial assessments. The Worldwide Financial Fund (IMF) can even replace its 2020 outlook. Additional grim projections may derail danger urge for food additional. What else is in retailer for monetary markets within the week forward?

Beneficial by David Music

Are retail merchants leaning into momentum or preventing it?

Uncover your buying and selling persona to assist discover optimum types of analyzing monetary markets

Elementary Forecasts:

Euro Forecast: Outlook for EUR/USD Adverse on Second Wave Fears

Fears of a second wave of coronavirus infections as international locations ease their lockdown measures will doubtless maintain buyers cautious within the week forward, damaging sentiment in direction of currencies such because the Euro.

Australian Greenback Outlook Bearish on Considerations of Second Covid-19 Outbreak

AUD could come below strain within the week forward as worry of a second-wave of Covid-19 rattles monetary markets amid rising China-Australia geopolitical tensions.

Gold Value Outlook, What Can Break the Buying and selling Vary?

Gold costs have been struggling to seek out route – why? Will a shockwave that sinks the Dow Jones and S&P 500 make itself recognized? That may be a key danger for XAU/USD.

US Greenback Resurgence Might Proceed As Fed Stability Sheet Contracts

The US Greenback could proceed its latest restoration because the Federal Reserve’s steadiness sheet contracts $74 billion within the week ending June 17.

USD/MXN Outlook: Current Correction Makes the Peso Enticing

As markets proceed to watch Covid-19 circumstances, the Mexican Peso is ready to comprise a number of the losses

Nasdaq 100, DAX 30 & FTSE 100 Forecasts for the Week

Shares have stalled close to their latest peaks as market members wrestle with accommodative financial coverage and the specter of a second coronavirus wave. Can shares proceed larger?

Technical Forecasts:

Gold Value Forecast: Reversal from Might Low Brings June Excessive on Radar

The technical outlook for gold brings the month-to-month excessive ($1746) on the radar because the pullback from the yearly excessive ($1765) reverses forward of the Might low ($1670).

Sterling (GBP) Collapses Via Help – GBP/USD, EUR/GBP and GBP/AUD Outlooks

After drifting decrease all through the week, Sterling’s falls accelerated on Friday, with the sell-off being additional fueled by information that UK debt to GDP surged to its highest degree since 1963.

Japanese Yen Outlook: USD/JPY & GBP/JPY Charts to Watch

The Japanese yen continues to go nowhere versus the Greenback, however vs Sterling it’s round a probably huge spot on the charts.

DAX 30, FTSE 100 Technical Outlook For Subsequent Week

DAX maintains uptrend as help holds, whereas FTSE 100 goals to make a take a look at of pivotal resistance.

Greenback Value Outlook: USD Restoration Eyes Preliminary Hurdles– DXY Ranges

USD is poised for a second consecutive weekly advance with the rally now concentrating on preliminary resistance. Listed here are the degrees that matter on the DXY weekly technical chart.

Oil Value Forecast: Oil Restoration Continues, WTI Exams the $40 Deal with

Don’t name it a comeback; however lower than two months after Oil traded at -40 costs have begun to re-test the $40 deal with. Can it proceed?

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES AND GOLD