S&P 500, HANG SENG, NIKKEI 225, ASIA-PACIFIC MARKET OUTLOOK:The S&P 500 index closed marginally increased as tech gained,

S&P 500, HANG SENG, NIKKEI 225, ASIA-PACIFIC MARKET OUTLOOK:

- The S&P 500 index closed marginally increased as tech gained, however two thirds of the shares fell

- Asia-Pacific indices look set to drag again barely from their current highs

- Southbound influx in HK through inventory connections fell for a second day, risking a pullback within the HSI

Really useful by Margaret Yang, CFA

Get Your Free Equities Forecast

S&P 500, Cling Seng, Earnings, Asia-Pacific Shares Outlook:

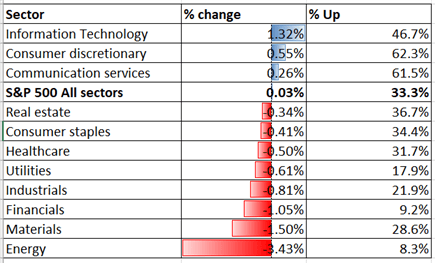

Asia-Pacific shares look set to open broadly decrease after Wall Avenue noticed a combined buying and selling session. The S&P 500 index edged marginally increased, led by heavy-weight data expertise (+1.32%), client discretionary (+0.55%) and communication providers (+0.26%), whereas two thirds of its constituents completed decrease. Traders are maybe in search of recent catalysts to assist Wall Avenue’s record-breaking rally when inventory market valuations are near two-decade highs.

US earnings continued to ship optimistic surprises, with 15 out of 19 S&P 500 corporations beating market forecasts final evening (desk on the finish). Intel’s share worth fell 4.5% in aftermarket commerce regardless of posting a document income and higher-than-expected EPS. To date within the earnings season, greater than 85% of the blue chips have smashed analysts’ forecasts. Learn extra on my earnings outlook report.

S&P 500 Sector Efficiency 21-01-2021

Supply: Bloomberg, DailyFX

A combined US session might set a bitter tone for Asia-Pacific markets, with fairness futures pointing to a decrease begin throughout Japan, Australia, Hong Kong, Malaysia and India on Friday morning. Japan’s Nikkei 225 inventory market benchmark seems set to open mildly decrease after gaining 0.82% on Thursday.

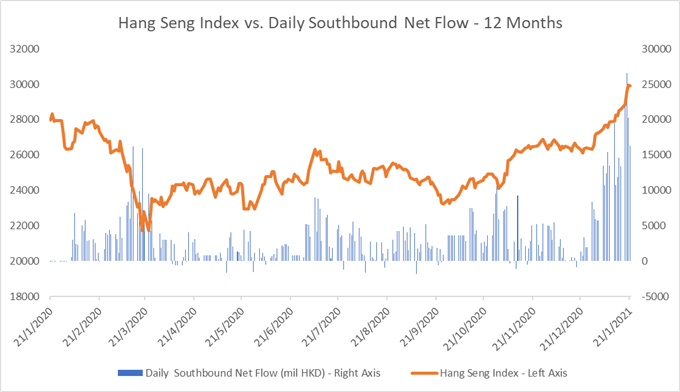

The Cling Seng Index (HSI) is going through some promoting strain because the index makes an attempt to problem a psychological resistance stage at 30,000. The HSI registered a whopping 15% acquire during the last month, propelled by substantial quantity of southbound influx through the Hong Kong-Shanghai and Hong Kong-Shenzhen inventory connections. It’s value noting that day by day southbound influxhas fallentwo days in a row to HK$ 16,263 million from a document excessive of 26,592 million seen on January 19th, reflecting cooling urge for food from mainland buyers for Hong Kong shares. Complete southbound flows contributed to round 30% HKEX’s day by day turnover lately.

Cling Seng Index vs. Every day Southbound Web Stream – 12 Months

Supply: Bloomberg, DailyFX

Australia’s ASX 200 Index opened 0.11% decrease amid a defensive buying and selling session. Healthcare (+1.99%), client discretionary (+1.25%) and client staples (+0.52%) have been main whereas vitality (-2.06%) and data expertise (-1.71%) have been lagging.

On the macro entrance, UK retail gross sales and a string of Markit Manufacturing PMIs throughout the EU and US shall be carefully eyed on Friday. Discover out extra from DailyFX calendar.

Really useful by Margaret Yang, CFA

What does it take to commerce round knowledge?

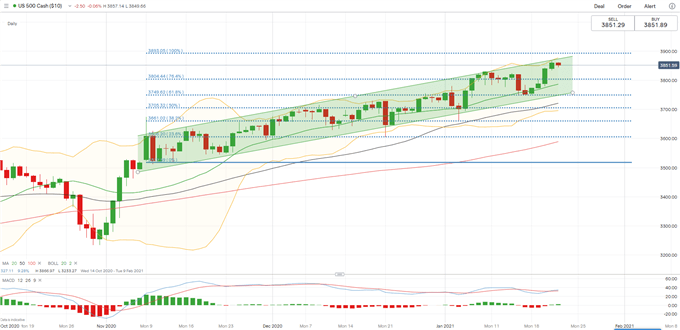

S&P 500 Index Technical Evaluation:

Technically, the S&P 500 index prolonged its upward trajectory inside an “Ascending Channel” as highlighted within the chart under. The bull pattern is well-supported by its 20-Day Easy Transferring Common (SMA) line, albeit the higher ceiling of the channel might function an instantaneous resistance. Assist and resistance ranges could be discovered at 3,893 (100% Fibonacci extension) and three,804 (76.4% Fibonacci extension) respectively.

S&P 500 Index – Every day Chart

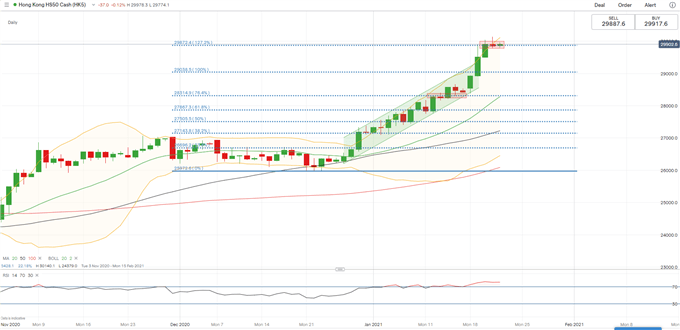

Cling Seng Index Technical Evaluation:

The Cling Seng Index is driving a robust pattern and is about to problem a psychological resistance stage at 30,000. Breaching it might open the door for additional upside potential with an eye fixed on 30,933 – the 161.8% Fibonacci extension. A failed try, nonetheless, might result in a technical pullback to check an instantaneous assist stage at 29,038 – the 100% Fibonacci extension. The RSI indicator stretches past the overbought threshold of 70, reflecting robust upward momentum but in addition warns a couple of technical correction.

Cling Seng Index – Every day Chart

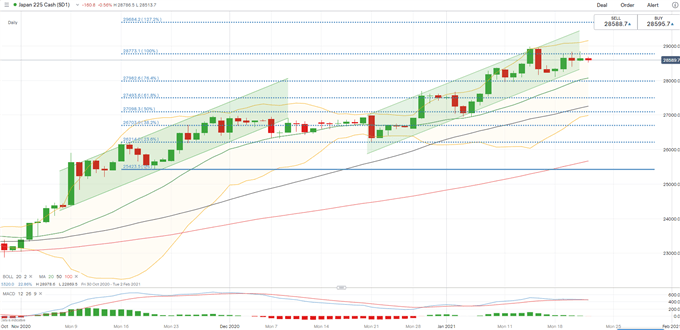

Nikkei 225 Index Technical Evaluation:

The Nikkei 225 index hit the 100% Fibonacci extension stage of 28,770 and has retraced barely since. The general pattern stays bullish as highlighted within the two “Ascending Channels” under, though a interval of consolidation could also be seen earlier than the index makes an attempt increased highs. A bearish MACD crossover might trace at short-term strain. Speedy assist and resistance ranges could be discovered at 27,800 (76.4% Fibonacci extension) and 28,770 (100% Fibonacci extension) respectively.

Nikkei 225 Index – Every day Chart

Really useful by Margaret Yang, CFA

Constructing Confidence in Buying and selling

S&P 500 Earnings Calendar 21-22nd January 2021

|

Title |

Date |

Interval |

Precise |

Estimate |

Shock |

|

TAL Training Group |

21/1/2021 |

Q3 21 |

0.02 |

0.066 |

(69.70) |

|

M&T Financial institution Corp |

21/1/2021 |

This autumn 20 |

3.54 |

3.012 |

17.50 |

|

Truist Monetary Corp |

21/1/2021 |

This autumn 20 |

1.18 |

0.951 |

24.10 |

|

KeyCorp |

21/1/2021 |

This autumn 20 |

0.57 |

0.43 |

32.60 |

|

Fifth Third Bancorp |

21/1/2021 |

This autumn 20 |

0.87 |

0.688 |

26.50 |

|

Vacationers Cos Inc/The |

21/1/2021 |

This autumn 20 |

4.91 |

3.198 |

53.50 |

|

Baker Hughes Co |

21/1/2021 |

This autumn 20 |

(0.07) |

0.172 |

(140.70) |

|

Northern Belief Corp |

21/1/2021 |

This autumn 20 |

1.49 |

1.488 |

0.20 |

|

FuelCell Power Inc |

21/1/2021 |

This autumn 20 |

(0.07) |

(0.023) |

(201.00) |

|

Union Pacific Corp |

21/1/2021 |

This autumn 20 |

2.36 |

2.244 |

5.20 |

|

Intel Corp |

21/1/2021 |

This autumn 20 |

1.42 |

1.111 |

27.80 |

|

CSX Corp |

21/1/2021 |

This autumn 20 |

0.99 |

1.005 |

(1.50) |

|

Intuitive Surgical Inc |

21/1/2021 |

This autumn 20 |

3.58 |

3.154 |

13.50 |

|

Seagate Expertise PLC |

21/1/2021 |

Q2 21 |

1.29 |

1.134 |

13.80 |

|

PPG Industries Inc |

21/1/2021 |

This autumn 20 |

1.59 |

1.569 |

1.30 |

|

Worldwide Enterprise Machine |

21/1/2021 |

This autumn 20 |

2.07 |

1.791 |

15.60 |

|

SVB Monetary Group |

21/1/2021 |

This autumn 20 |

7.40 |

3.873 |

91.10 |

|

Individuals’s United Monetary Inc |

21/1/2021 |

This autumn 20 |

0.35 |

0.318 |

10.10 |

|

Boston Non-public Monetary Holdi |

21/1/2021 |

This autumn 20 |

0.30 |

0.17 |

76.50 |

|

Areas Monetary Corp |

22/1/2021 |

This autumn 20 |

0.419 |

||

|

Kansas Metropolis Southern |

22/1/2021 |

This autumn 20 |

1.925 |

||

|

Huntington Bancshares Inc/OH |

22/1/2021 |

This autumn 20 |

0.293 |

||

|

New Oriental Training & Techn |

22/1/2021 |

Q2 21 |

0.341 |

||

|

Reliance Industries Ltd |

22/1/2021 |

Q3 21 |

18.176 |

||

|

Reliance Industries Ltd |

22/1/2021 |

Q3 21 |

18.176 |

||

|

Schlumberger NV |

22/1/2021 |

This autumn 20 |

0.175 |

||

|

Ally Monetary Inc |

22/1/2021 |

This autumn 20 |

1.066 |

Supply: Bloomberg

— Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Feedback part under or @margaretyjy on Twitter