Fed-Treasury Squabble, Cares Act Funding, S&P 500 - Speaking FactorsTreasury-Fed squabble goes largely unnoticed in markets,

Fed-Treasury Squabble, Cares Act Funding, S&P 500 – Speaking Factors

- Treasury-Fed squabble goes largely unnoticed in markets, dangers stay

- Cares Act funding could also be reintroduced beneath Yellen Treasury

- Present Fed stance seen as acceptable to assist economic system

Treasury Secretary Steven Mnuchin despatched a letter to the Federal Reserve Chair Jerome Powell on the finish of final week. He requested the return of some $430 billion in unused emergency lending funding from the Cares Act. The transfer by the Treasury took many off-guard because the earmarked funds will not be prolonged after the top of this 12 months.

The Federal Reserve (Fed) issued an announcement in response to the Treasury’s request and highlighted the necessity for the funds to be out there. Nonetheless, according to the Cares Act and Federal regulation, the central financial institution is complying with the request. The return of those unallocated funds will go to the Treasury’s Basic Account, successfully ending new lending within the amenities.

Advisable by Thomas Westwater

How can central banks influence markets?

What are the Dangers to Markets from this Squabble?

Whereas underutilized, fears swirled following the information. For now, nonetheless, monetary techniques and markets seem like functioning usually. That is seemingly because of the already overwhelming quantity of assist the Fed is offering by means of different instruments and measures. Nonetheless, eradicating the unused funding dangers leaving monetary markets with out a direct backstop, maybe elevating volatility threat down the highway. The Fed might discover inventive methods to fund emergency amenities if wanted, nonetheless. One route is feasible by means of open market operations.

That could possibly be the case if an surprising shock to the monetary system happens down the highway. The Thanksgiving vacation additionally has well being officers frightened a few spreader occasion. An extra uptick in Covid circumstances is considered seemingly. Nonetheless, the influence on the monetary sector needs to be restricted given current assist from the Federal Reserve.

The Path Ahead for the Fed, S&P 500, US Greenback

Moreover, the incoming Biden administration has tapped former Fed Chair Janet Yellen to steer the Treasury Division. The change in management on the Treasury opens the door to those funds returning to the Fed’s software bag. Authorized specialists suggest that Yellen might be able to roll again Mnuchin’s transfer and restore these funds beneath the prior settlement.

Nonetheless, authorized implications are removed from clear, however at present standing, it does appear to be an choice on the desk for the incoming administration. If that’s the case, it might sign renewed cooperation between the 2 companies and maybe increase confidence in markets additional.

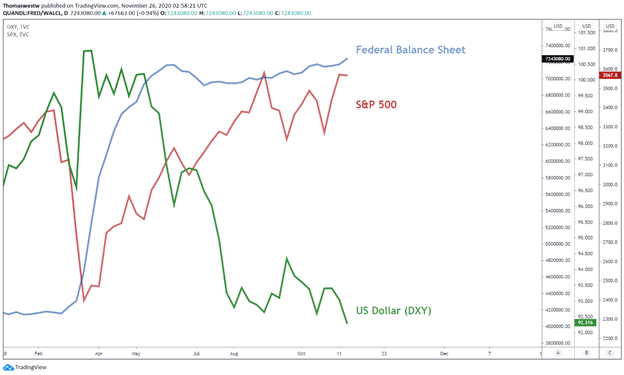

As beforehand talked about, markets have been largely undisturbed following the information. The S&P 500 and the Dow Jones Industrial Common have proceeded to greater floor this week. The Fed’s quantitative easing program continues to reassure markets on the present tempo of $120 billion monthly. The central financial institution’s steadiness sheet now tops $7.2 trillion. Liquidity additionally seems to be functioning with out fear because the haven-linked US Greenback is approaching its lowest degree since early 2018. Additional losses could possibly be in retailer for it given the cooldown in volatility.

Furthermore, the Nov 4-5 FOMC minutes hinted that the central financial institution might quickly select to focus on longer-dated maturities within the present spherical of QE. For now, their financial coverage stance needs to be seen as adequate to assist markets. Nonetheless, merchants can be smart to maintain their eye out for any additional developments between the Fed and Treasury Division.

Advisable by Thomas Westwater

Don’t give into despair, make a recreation plan

Federal Reserve Steadiness Sheet, S&P 500, US Greenback – Day by day Worth Chart

Chart created with TradingView

S&P 500 TRADING RESOURCES

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the feedback part beneath or @FxWestwateron Twitter