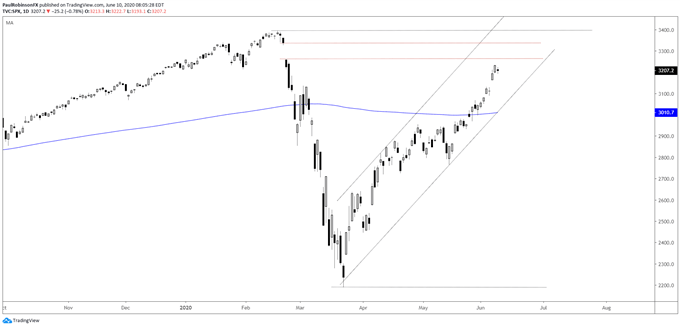

The S&P 500 is shortly approaching the February 21/24 hole that kicked off the coronavirus rout, with

The S&P 500 is shortly approaching the February 21/24 hole that kicked off the coronavirus rout, with the void operating from 3257 as much as 3337. Right now the danger/reward for recent trades isn’t notably favorable. Contemporary longs are liable to a pullback given how prolonged value has turn out to be, however on the identical time momentum continues to be a bit too robust to be fading. A pullback would assist alleviate among the short-term excessive and doubtlessly supply threat/reward alternative, whereas a run and reversal off resistance could give merchants the higher hand from the brief facet.

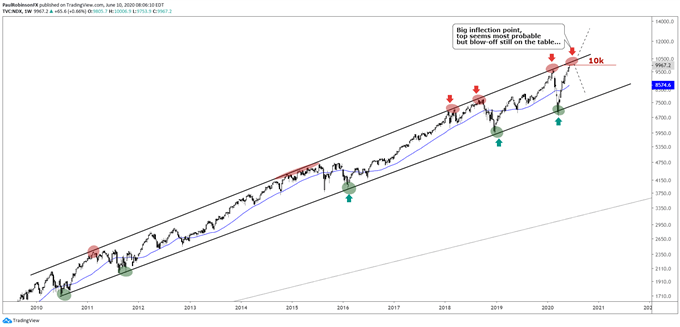

The Nasdaq 100 is at file highs and approaching a really large inflection level as nicely within the type of the higher parallel of a channel relationship again a decade. It has marked the excessive of up-moves on a couple of events since early 2018, so it may once more right here quickly. Or, if the speculative fervor of the market continues to develop we might even see an overthrow of the channel that takes the type of a blow-off prime. In both case the market seems near an inflection level that would form how markets commerce for a while to return.

Advisable by Paul Robinson

Discover Out the #1 Mistake Merchants Make

S&P 500 Day by day Chart (large hole close to)

S&P 500 Chart by TradingView

Nasdaq 100 Weekly Log Chart (large inflection level)

Nasdaq 100 Chart by TradingView

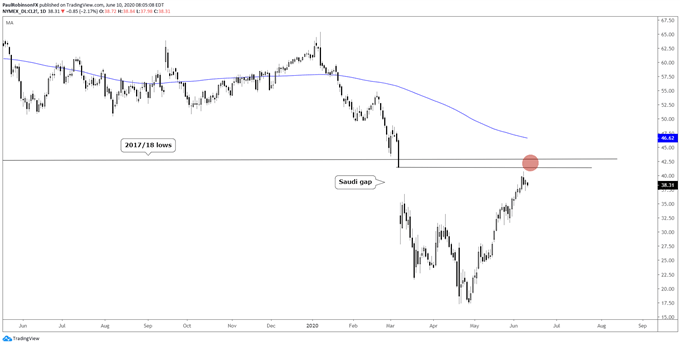

Crude oil is on the verge of filling an essential hole through the one created in March when the Saudi’s sank oil over the weekend main into March 9. The huge hole is sort of stuffed and simply above the hole there’s each the 2017 and 2018 lows within the 42.60s. This is able to make any push greater from greater doubtlessly the final one earlier than a significant decline could take form.

Crude Oil (Aug contract) Day by day Chart (gap-fill/resistance)

Crude Oil Chart by TradingView

To see all of the charts we checked out, try the video above…

Sources for Index & Commodity Merchants

Whether or not you’re a new or an skilled dealer, DailyFX has a number of sources accessible that will help you; indicator for monitoring dealer sentiment, quarterly buying and selling forecasts, analytical and academic webinars held day by day, and buying and selling guides that will help you enhance buying and selling efficiency.

We even have a sequence of guides for these trying to commerce particular markets, such because the S&P 500, Dow, DAX, gold, silver, crude oil, and copper.

—Written by Paul Robinson, Market Analyst

You may observe Paul on Twitter at @PaulRobinsonFX

http://bit.ly/2mH2rMt