STOCK MARKET OUTLOOK: S&P 500 INDEX, NASDAQ PRICE EDGE LOWER AS RISING JOBLESS CLAIMS PUTS PRESSURE ON STOCKSS&P 500 drop

STOCK MARKET OUTLOOK: S&P 500 INDEX, NASDAQ PRICE EDGE LOWER AS RISING JOBLESS CLAIMS PUTS PRESSURE ON STOCKS

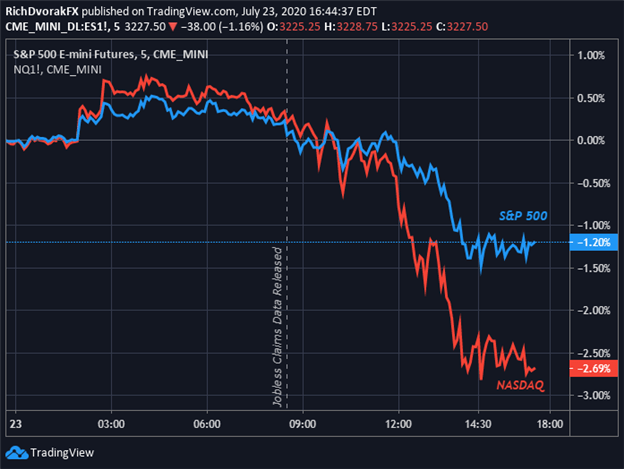

- S&P 500 dropped over 1% and the Nasdaq spiked greater than 2.5% decrease on Thursday

- Inventory market sentiment exhibits indicators of weakening in response to jobless claims information

- Markit PMI studies on faucet for Friday’s buying and selling session would possibly steer shares going ahead

Shares got here below stress on Thursday and completed the buying and selling session close to intraday lows. Buyers tapped the breaks on the chance rally as market sentiment seemingly waned in response to disappointing weekly jobless claims launched previous to the New York opening bell. The S&P 500 slid 1.2% whereas the Nasdaq spiked 2.7% decrease gauged by e-mini futures costs.

Really useful by Wealthy Dvorak

Get Your Free High Buying and selling Alternatives Forecast

S&P 500 PRICE CHART WITH NASDAQ OVERLAID: 5-MINUTE TIME FRAME (23 JUL 2020 INTRADAY)

Chart created by @RichDvorakFX with TradingView

The market’s bearish response to the newest preliminary jobless claims information may need brought on some traders to lift an eyebrow given the ‘unhealthy information is nice information’ atmosphere largely fostered by central financial institution backstops deployed over latest months. That stated, right this moment’s red-colored tape however offers a wholesome reminder that shares can lose worth and don’t ‘solely go up.’

Really useful by Wealthy Dvorak

Traits of Profitable Merchants

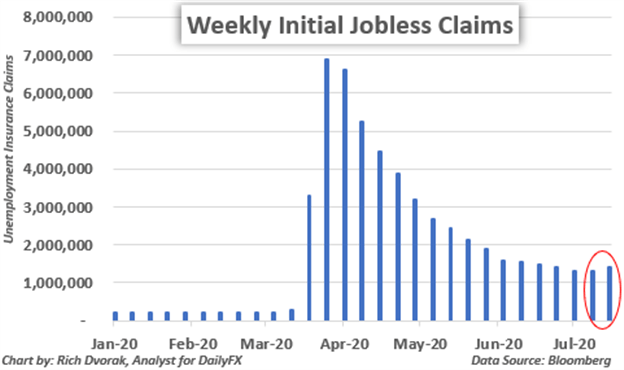

US INITIAL JOBLESS CLAIMS CHART: WEEKLY TIME FRAME (03 JAN TO 17 JUL 2020)

Not solely did preliminary jobless claims information cross the wires at a worse-than-expected 1.4-million for the week ended July 17, the variety of Individuals submitting for unemployment insurance coverage rose sequentially for the primary time since March, and will clarify partly why traders steered shares decrease. In any case, the Fed might be able to print cash and supply liquidity, however the central financial institution can’t print jobs.

Really useful by Wealthy Dvorak

Introduction to Foreign exchange Information Buying and selling

Waiting for Friday’s buying and selling session we discover that one other high-impact financial information launch looms: preliminary Markit PMI readings. One other disappointing datapoint might counsel that the v-shaped financial restoration could also be rising lengthy within the tooth and doubtlessly add to inventory market promoting stress witnessed on Thursday in response to jobless claims. Then again, sustained enchancment in financial exercise indicated by upcoming Markit PMI studies possible stands to reinvigorate investor threat urge for food, which might ship the S&P 500 and Nasdaq snapping again greater.

Hold Studying – USD Worth Outlook: US Greenback Nosedives Forward of Markit PMI Knowledge

— Written by Wealthy Dvorak, Analyst for DailyFX.com

Join with @RichDvorakFX on Twitter for real-time market perception