Pure Gasoline Forecast – Speaking FactorsPure fuel demand might take huge hit on warmer-than-average temperature forecastSeasonal

Pure Gasoline Forecast – Speaking Factors

- Pure fuel demand might take huge hit on warmer-than-average temperature forecast

- Seasonal shift in temperature more likely to hold strain on costs from the demand aspect

- 200-day Easy Transferring Common in focus as trendline break sees costs transferring decrease

Really helpful by Thomas Westwater

Get Your Free Prime Buying and selling Alternatives Forecast

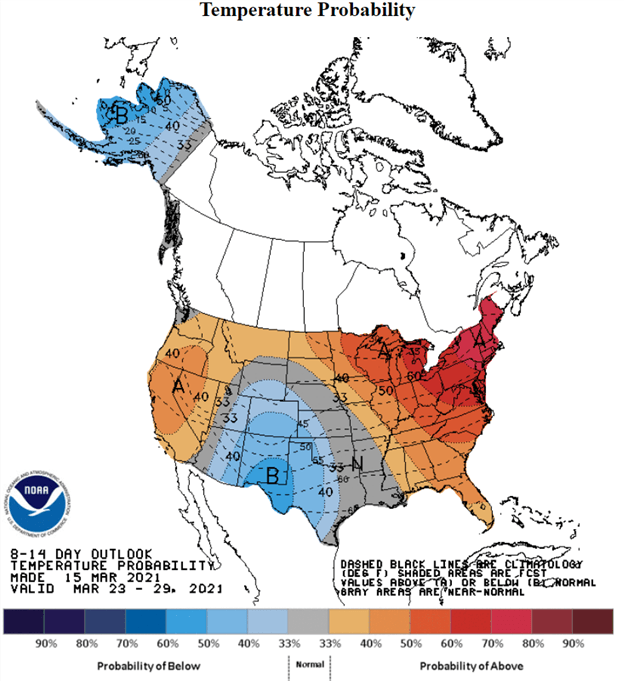

The latest 8- to 14-day temperature outlook from the Nationwide Climate Service’s Local weather Prediction Heart paints an unfavorable image for pure fuel costs. Forecasted temperatures within the northeastern and western parts of america shall be above common over the subsequent two weeks. The south will possible be cooler than regular. Total, the anticipated hotter climate – particularly throughout the northeastern US – will possible weigh on demand, driving pure fuel costs decrease.

NOAA 8-14 DAY OUTLOOK TEMPERATURE PROBABILITY

Supply: NOAA

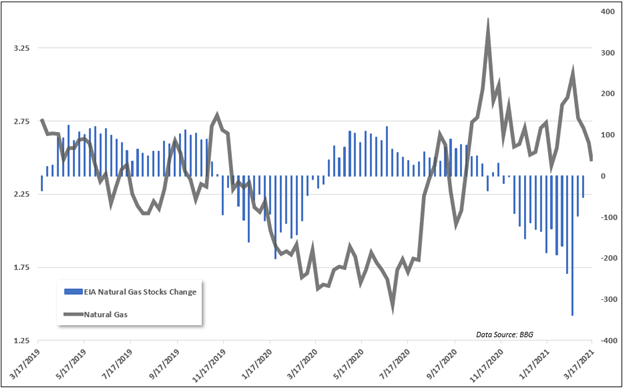

With spring shortly approaching in america and hotter climate together with it, pure fuel costs might come beneath elevated strain because the heating fuel faces decreased demand prospects. Analysts expect a draw of solely 21.67 billion cubic ft (bcf) for this week’s EIA storage change, in response to Bloomberg’s median forecast. That compares to a 52 bcf draw for the week prior.

That mentioned, even when hotter climate doesn’t manifest this week because the NOAA’s forecast lays out, pure fuel costs face decreased demand going into the summer season. Whereas late-season storms or uncommon chilly spells throughout america stay doable, bullish sentiment seems to be on the backfoot as costs proceed to maneuver decrease. A basic shift might want to see a major shock to produce or demand if costs are to maneuver larger.

EIA Pure Gasoline Shares Weekly Change versus Pure Gasoline Value

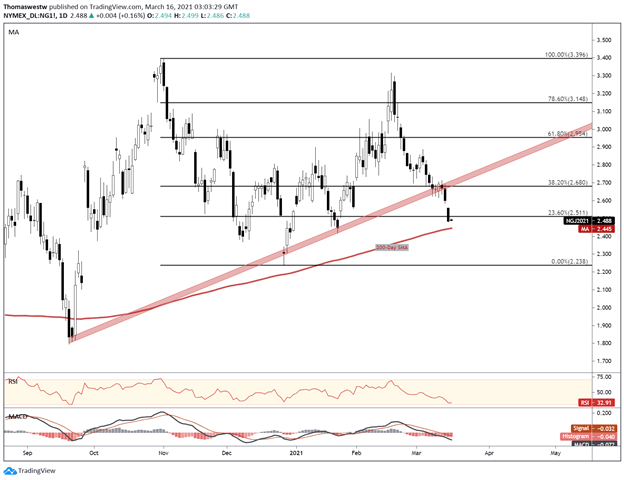

Pure Gasoline Technical Forecast

Costs have damaged under a key trendline from the September swing decrease earlier this week, severely degrading pure fuel’s technical posture. The 23.6% Fibonacci retracement from the October to December transfer was decisively breached on the violent draw back transfer. The full transfer from the February swing excessive is now at 25%.

The 200-day Easy Transferring Common (SMA) – which sits inside 2% of present costs at 2.445 – is now in focus for a possible space for bulls to defend. MACD is oriented decrease with a bearish tilt whereas the Relative Power Index (RSI) hovers simply above oversold territory. If the 200-day SMA breaks, extra losses could also be in retailer. Alternatively, a short-term bounce of the important thing SMA can be unsurprising, however look ahead to any bounce to fade given the elemental backdrop.

Pure Gasoline Every day Chart

Chart created with TradingView

Pure Gasoline TRADING RESOURCES

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the feedback part under or @FxWestwateron Twitter

ingredient contained in the

ingredient. That is most likely not what you meant to do!nn Load your software’s JavaScript bundle contained in the ingredient as an alternative.www.dailyfx.com