S&P 500 Value Outlook:Tesla has climbed greater than 260% within the year-to-date, shattering the tempo of the S&P 500 A

S&P 500 Value Outlook:

- Tesla has climbed greater than 260% within the year-to-date, shattering the tempo of the S&P 500

- A fourth consecutive quarter of profitability has made Tesla eligible for S&P 500 inclusion

- In the meantime, sturdy earnings from Microsoft went comparatively unnoticed as investor curiosity clings to the continued Tesla mania

S&P 500 Forecast: Tesla Profitability Sees Inventory Set for Index Inclusion

US indices ended Wednesday buying and selling modestly larger as merchants awaited earnings from two company behemoths, Microsoft and Tesla. As a member of the trillion greenback membership, Microsoft is afforded large affect over the Nasdaq 100 and broader know-how sentiment.

A Temporary Historical past of Main Monetary Bubbles, Crises and Flash-Crashes

Tesla, alternatively, has captured the curiosity of retail and seasoned dealer alike – typically for various causes – after surging greater than 260% within the year-to-date. Consequently, the inventory has develop into a media favourite, permitting it to overshadow corporations with arguably higher perception into the macroeconomic panorama.

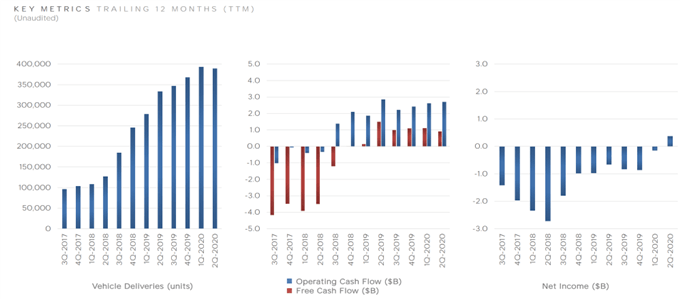

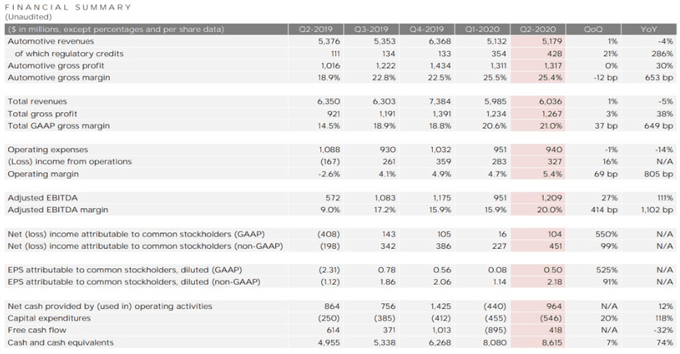

Supply: Tesla Investor Relations

Whereas many analysts, together with myself, have warned the present valuation of Tesla is probably going unsustainable, it’s laborious to disclaim the corporate’s arduous path to profitability. After years of losses and hurdles, the electrical car maker has lastly etched out a sequence of victories. That being stated, it appears a file sale of $421 million in regulatory credit may have been the differentiating issue between a worthwhile quarter and one other interval of unprofitability.

Supply: Tesla Investor Relations

Subsequently, Tesla shareholders can rejoice at current, as TSLA shares look destined for an inventory on the S&P 500. Whether it is to happen, the itemizing ought to happen on the third Friday of September, however the longevity of such a place appears extra tenuous. Both manner, Tesla is strapped in to the speculative rollercoaster fueled by retail merchants and a mountain of threat urge for food. However, merchants in search of TSLA publicity ought to tread rigorously and train correct threat administration.

Critically, the inventory’s addition to the S&P 500 will necessitate publicity from S&P 500-tracking funds just like the SPY ETF. The required product-tailoring may see traders acquire publicity to a inventory within the midst of an enormous speculative bubble which may enhance market instability in flip. That stated, diversification ought to work to nullify its impression. Regardless, the addition of Tesla to the S&P 500 warrants some concern for my part.

A Stellar Quarter for Microsoft Goes Unnoticed

Overshadowed by monetary information media’s love for Tesla, Microsoft provided stellar earnings, skating previous Wall Avenue estimates. Though shares slipped modestly in after-hours buying and selling, I’d argue the outcomes are sufficient to assuage fears amongst market members. With that in thoughts, the Nasdaq 100 may take pleasure in a lift within the coming days as sentiment appears poised to obtain a spark from each Tesla and Microsoft.

Nasdaq 100 Value Chart: 4 – Hour Time Body (April 2020 – July 2020)

Whereas the validity of Tesla’s valuation is up for debate, the broader narrative ought to stay constructive for broader fairness power. Because it stands, the Nasdaq 100 merchants close to the higher sure of an ascending channel and powerful earnings outcomes may make the present worth place considerably much less precarious. Regardless, the character of earnings season will see traders rapidly shift their focus to the following high-profile report for affect.

Really useful by Peter Hanks

Get Your Free Equities Forecast

To that finish, key tech earnings will proceed with Intel Thursday afternoon, adopted by AMD and Fb after the shut subsequent Tuesday and Wednesday respectively. Subsequent week’s experiences will peak with the arrival of quarterly outcomes for Amazon, Apple and Google after Thursday’s shut. Collectively, the three FANGMAN members account for roughly 30% of the Nasdaq 100. Within the meantime, comply with @PeterHanksFX on Twitter for updates and evaluation as traders await the looming occasion threat.

–Written by Peter Hanks, Strategist for DailyFX.com

Contact and comply with Peter on Twitter @PeterHanksFX