Brent Crude Oil Fundamentals:OPEC to potentially downgrade optimistic 2022 oil demand forecast on Monday Effects of Hurricane Ida on oil prices r

Brent Crude Oil Fundamentals:

- OPEC to potentially downgrade optimistic 2022 oil demand forecast on Monday

- Effects of Hurricane Ida on oil prices remains modest

- China auctions oil reserves to shelter local refining businesses from increasing raw material prices

OPEC Set to Downgrade Optimistic Oil Demand Forecast in Light of Delta Risks

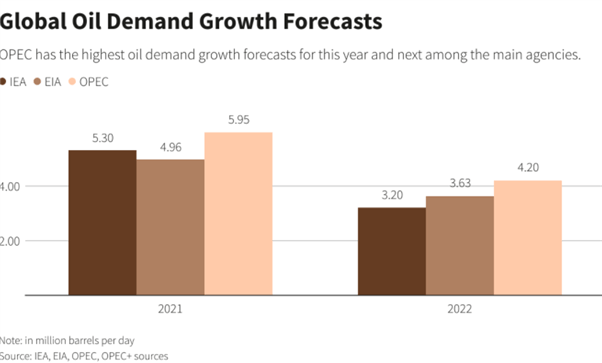

OPEC will likely trim its forecast for 2022 global oil demand in light of increasing challenges around the spread of the Delta variant. OPEC, the International Energy Agency (IEA) and the Energy Information Administration (EIA) all produced forecasts for the remainder 2021 and all of 2022 with OPEC the most optimistic on both estimates.

source IEA,EIA, OPEC+ sources

Earlier this week OPEC decided to increase output by 400,000 barrels per day (bpd) for the month of October, in line with its gradual plan to reintroduce supply into international markets after drastically withdrawing supply at the start of the pandemic.

For OPEC’s 2021 oil demand growth forecast to be met, global demand needs to average around 100 million bpd in the final quarter of this year – almost 1 million bpd higher than the IEA’s fourth-quarter projection.

Price Effects of Hurricane IDA Remain Modest

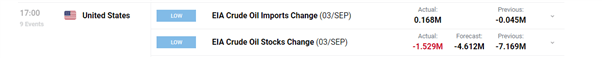

Recent EIA figures suggest a less resilient recovery as US inventories were reduced by 1.529M up to September 3rd versus the anticipated figure of -4.612M.

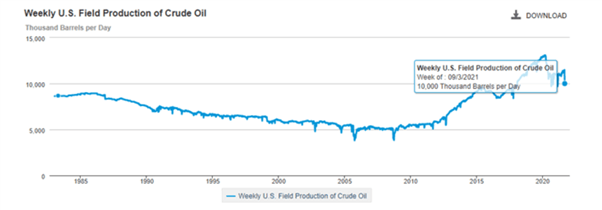

Understandably, weekly field production fell to 10,000k from 11,500k over the period when Hurricane Ida-related disruptions were experienced.

Weekly US Field Production of Crude Oil

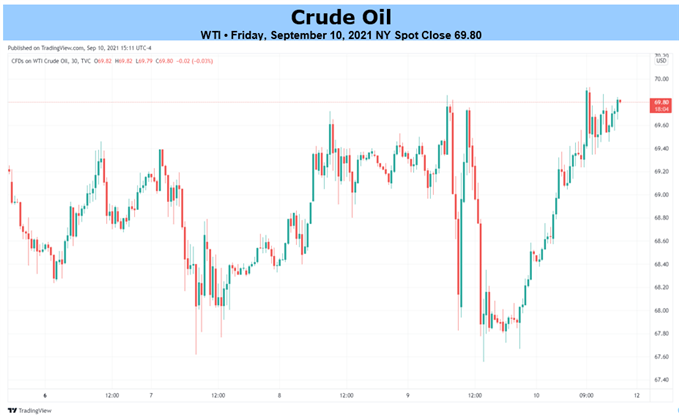

Oil Prices managed to remain relatively contained and largely traded within the weekly range despite recent developments.

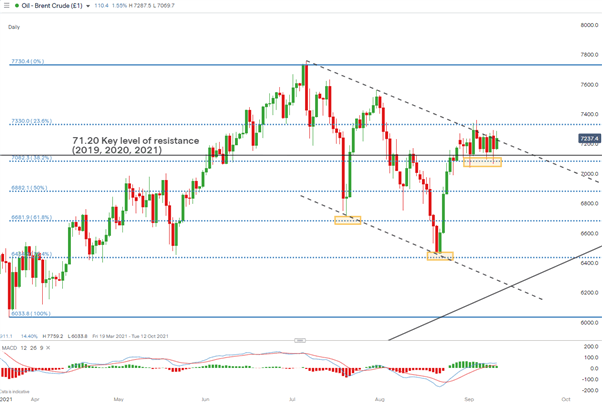

It remains to be seen whether next weeks OPEC revision, should it take place, will result in reduced oil prices or maintain the current sideway direction. As the week draws to a close we see oil prices supported by the key 71.20 level of support but struggling to form a topside breakout above trendline resistance. This may result in continued consolidation, in the absence of any external drivers or shocks.

Daily Crude Oil Chart

Chart prepared by Richard Snow, IG

China Auctions Oil Reserves

Beijing’s reserves administration mentioned on Tuesday that China plans its first public auction of state-owned crude reserves to domestic refiners. The auctions are set to take place in phases in an attempt to better stabilize domestic supply and demand thus guaranteeing the country’s energy security.

While the benchmark Brent crude prices are around 40% higher this year, China’s international crude futures (ISCc1) are up 50%. Details are scarce as there was no mention of volume or timeframes of the auctions.

Chinese International Crude Futures (ISCc1) Over The Last Year

Chart prepared by Richard Snow, Source: Refinitiv

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com