The weekly Baker-Hughes U.S. Rig Rely is in ― drumroll please ― there are at present 180 energetic U.S. oil rigs in operation, down from 181 final

The weekly Baker-Hughes U.S. Rig Rely is in ― drumroll please ― there are at present 180 energetic U.S. oil rigs in operation, down from 181 final Friday. Briefly, the American fracking business continues to consolidate amid an unprecedented credit score crunch. Nonetheless, WTI costs are holding agency simply north of $40.00 per barrel, sustaining the rally from final April.

For WTI futures, buying and selling volumes have rolled from the August contract to the September situation. The unfold between the 2 is $0.18, with each contracts off barely on the day. As we roll towards August, the tremendous contango of final spring is gone with deferred contracts buying and selling at a lot tighter premiums.

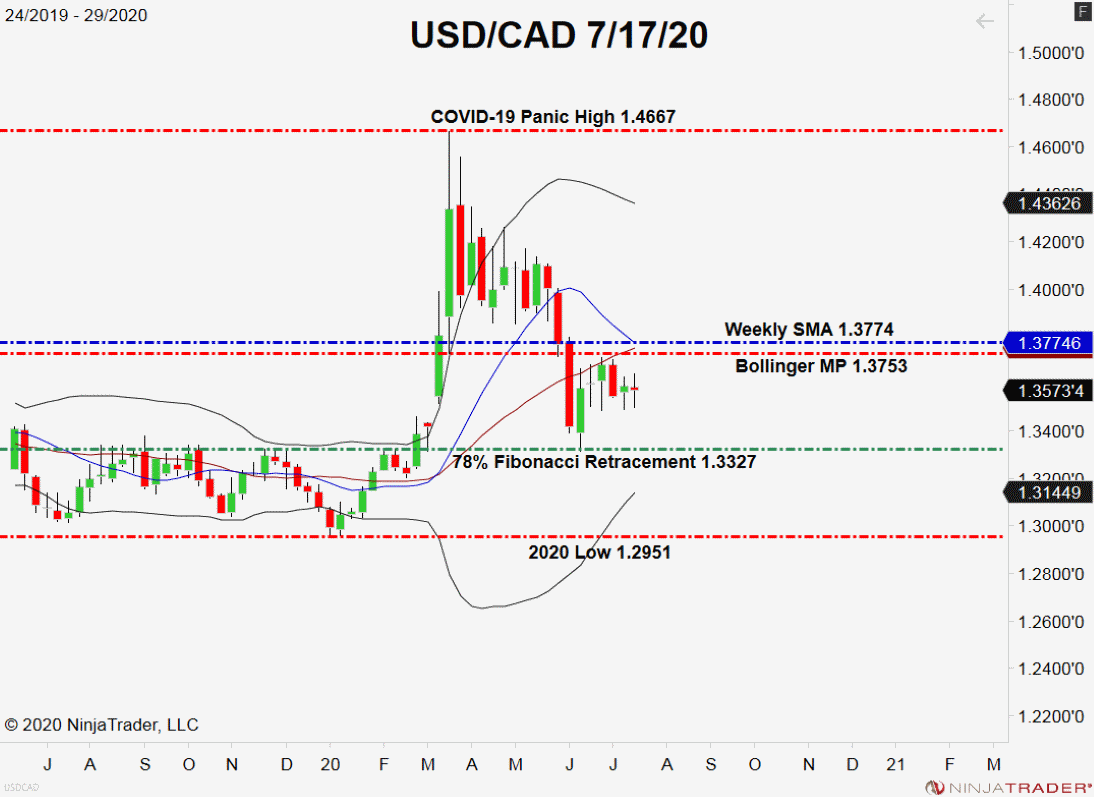

Following the Baker-Hughes report, the USD/CAD seems relaxed with WTI crude oil gaining a foothold at $40.00. Let’s dig into the technicals for this pair and see if it’s prepared to interrupt out.

Baker-Hughes Falls, USD/CAD Holds The Line

For the second consecutive week, the USD/CAD is in deep consolidation. Charges simply can’t appear to stray from the 1.3575 degree.

+2020_29+(11_36_30+AM).png)

Proper now, it doesn’t appear like the Loonie is inquisitive about shifting a lot wherever. Nonetheless, there are two ranges value expecting subsequent week’s commerce:

- Resistance(1): Bollinger MP, 1.3753

- Assist(1): 78% Fibonacci Retracement, 1.3327

Overview: Till confirmed in any other case, taking part in rotational methods within the USD/CAD is the way in which to go. As a way to do that, merely promote topside resistance and purchase draw back help. Maintain revenue targets and cease losses modest, not more than 25 pips.

For the U.S. shale business, issues don’t look good. On the brilliant facet, at the very least at this time’s Baker-Hughes determine fell by just one oil rig. If nothing else, the business contraction could also be approaching its backside.