Earnings season could be a nice time for a dealer to get perception on their fairness investments, in addition to profit from short-term volatility. However with a purpose to maximize this buying and selling alternative, there are some key concerns to make earlier than diving in. Learn on for our three steps to comply with when utilizing earnings experiences for buying and selling.

Three Steps for Utilizing Earnings Experiences in Your Buying and selling

Making ready for earnings season includes selecting the businesses to deal with and endeavor thorough analysis available on the market earlier than executing the commerce.

1) Select Corporations to Focus On

Step one is to pick out the shares to commerce through the interval. It’s advisable for merchants to go for a small variety of firms, maybe shares with which they’re acquainted or commerce already and discover out the dates on which their earnings will likely be launched. Giant bellwether shares are value investigating, whether or not one is buying and selling them or not, as their outcomes can influence wider industries.

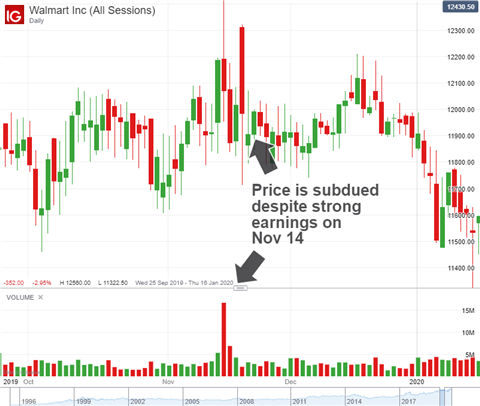

When deciding on the shares to go for, merchants ought to perceive that the relationship between an earnings consequence and subsequent worth response is just not at all times simple. Though better-than-expected earnings are usually bullish, they don’t at all times translate to fast worth features and the alternative holds true as nicely. An instance of this may be seen beneath, with Walmart’s sturdy earnings in Q3 2018 failing to excite market individuals.

Whereas encouraging, a quarterly report is greater than final quarter’s outcomes in comparison with expectations. Certainly, analysts are sometimes way more involved with the longer term expectations of the agency as worth is a ahead–trying metric, with future earnings being calculated in present costs.

With that in thoughts, it turns into extra cheap when buyers shrink back from a inventory with sturdy outcomes for the previous quarter, however an abysmal outlook for the longer term. A weaker outlook can severely undercut a inventory’s present valuation, no matter previous efficiency, a reality that’s realized all too typically throughout earnings season.

Learn our information on The right way to Decide Shares to decide on the correct firms on your shares portfolio.

2) Do Your Analysis

Doing all of your inventory analysis correctly will contain estimated earnings on your chosen inventory and the way they examine with analysts’ expectations. Additionally, merchants ought to be sure that they take a look at historic figures to get a really feel for a way the market has responded to releases previously.

Whereas earnings season is often considered in phrases what the outcomes imply for a single inventory, the season as an entire may also supply vital takeaways.

Data is obtainable on a company-specific foundation, however frequent themes can ring true all through. Headwinds like coronavirus, geopolitical rigidity, regulatory uncertainty or cyclicality can mix to type a wave of worries throughout a sector if cited typically sufficient.

Merchants ought to examine how such headwinds influence one sector or inventory in comparison with others. For instance, whereas an important many industries suffered through the coronavirus outbreak, March 2020 noticed Greece-based tanker vessel operator High Ships Inc (TOPS) expertise a surge in product demand in areas reminiscent of cleansing provides and paper merchandise resulting in elevated transport necessities. This in flip created larger buying and selling quantity and volatility.

The impact of headwinds has additionally been witnessed, for instance, with Brexit as firms delay capital expenditures till a post-Brexit order is established and the enterprise atmosphere is steady. Equally, frequent mentions of trade-related headwinds have labored to undermine quite a lot of sectors from semiconductors to shopper staples within the US amid the US-China commerce battle, evidenced within the chart above by the surging mentions of ‘tariff’ in earnings experiences for firms within the S&P 500.

Whereas these points could not doom a inventory to damaging returns singlehandedly (because the TOPS instance demonstrates), their look throughout a complete market can trace at their pervasiveness and the broader downward stress they will exert on outlooks and valuations. Consequently, merchants ought to monitor frequent complaints amongst firms as it could assist inform their broader macroeconomic technique as anecdotal proof builds to type a tangible menace to the broader index.

Begins in:

Stay now:

Apr 21

( 15:04 GMT )

Help your analysis with our shares webinar

Weekly Inventory Market Outlook

3. Formulate a Buying and selling Technique – and Observe It

Formulating a buying and selling technique for earnings season ought to embody methodology for entry and exits, revenue objectives, time spent buying and selling and a threat administration plan. Trading earnings experiences is troublesome and dangerous. For some, buying and selling across the occasion could not swimsuit their threat profile. As such, any place taken must be adequately hedged and embody a cease. That mentioned, volatility can create distinctive circumstances, ripe with alternative for just a few particular methods.

When formulating a method for earnings season, merchants must be conscious that quarterly earnings are able to severely uprooting an ongoing worth pattern resulting from their relative infrequency and significance. This causes merchants to place for extreme worth swings – evidenced by heightened implied volatility.

Since it’s exceedingly troublesome for the typical investor to appropriately forecast how the corporate will carry out – by no means thoughts the eventual influence on its share worth – the risk-reward of coming into a place instantly previous to a report might be skewed. If an investment automobile of selection is impacted by implied volatility, the impact on the place might be significantly acute as a result of implied volatility stays excessive till the outcomes are launched however usually collapses shortly afterward leading to what is named ‘IV Crush’.

IV Crush is, because the title would recommend, when the implied volatility of a inventory drops considerably, often as a result of the uncertainty has handed. The abrupt reversal in implied volatility is usually accompanied by realized volatility, however not at all times.

The discrepancy between implied and realized volatility permits for some distinctive buying and selling methods like straddles and strangles which search to capitalize on absolute volatility of possibility contracts or quick straddles and strangles which intention to capitalize on IV crush.

Straddles

Straddles contain shopping for each the decision (purchase) and the put (promote) possibility concurrently with the identical strike worth (the fastened worth at which the holder of an possibility should buy or promote), and the identical expiration date. When utilized to earnings, merchants may straddle earlier than the discharge and may revenue from both an increase or fall within the inventory’s worth, so long as the inventory’s worth deviates from the strike worth by an quantity greater than the full value of the premium. This might probably make a straddle a viable selection if merchants suppose absolute volatility will likely be excessive however aren’t positive of the course the transfer will take.

The chart beneath exhibits Apple’s August 2019 earnings launch immediate extra buying and selling and better absolute volatility, as proven by the Quantity and Common True Vary indicators respectively, representing an instance of a probably favorable end result for a straddle.

A brief straddle includes promoting each the decision and put choices with the identical strike worth and expiration date. This transfer is usually suited to ‘IV crush’ situations when the dealer believes the worth is not going to transfer an excessive amount of over the course of the choices contract.

Strangles

Strangles are much like straddles, and may likewise have a protracted and quick route. However whereas straddles have the identical strike worth for the decision and put choices, strangles have totally different strike costs. Strangles could probably be a viable selection if the dealer believes a inventory has extra likelihood of transferring in a single course than the opposite following an earnings report, however nonetheless seeks safety if the place takes a opposite swing.

Advisable by Peter Hanks

Obtain our equities forecast for professional shares perception

Buying and selling Earnings Season: Key takeaways

When buying and selling incomes season, there might be a interval of uncertainty and excessive volatility forward. This makes selecting the correct inventory, thorough background analysis and clever threat administration key to navigating the interval as deliberate – in addition to implementing the correct buying and selling technique. With these items in place, merchants can maximize their likelihood of success and hopefully carry some key data over to the following incomes season.

Extra on equities and inventory buying and selling

Hungry for extra details about equities? Be sure you try our inventory market part for complete steering on easy methods to navigate this asset class, together with:

aspect contained in the

aspect. That is in all probability not what you meant to do!nn Load your utility’s JavaScript bundle contained in the aspect as a substitute.www.dailyfx.com